Just when some analysts were speculating that the market for IPOs seemed poised for a comeback, the banking industry’s recent chaos has already-wary investors second-guessing the timing of the recovery.

Experts say the IPO market’s latest woes aren’t necessarily the result of any immediate liquidity issues stemming from exposure to impacted banks, such as the leading tech startup lender Silicon Valley Bank. Rather, it’s just one more sign of misfortune that the skies haven’t cleared to skittish investors.

“The markets need predictability and optimism, that’s what changes the picture and makes the demand for IPOs return,” said Chris Manderson, a partner and co-chair of the Business, Corporate and Tax department at the Beverly Hills-based Ervin Cohen & Jessup LLP. “It comes back when people feel that the markets are on a growth trend, or at least stabilizing, and capital has a greater appetite for risk.”

Manderson said private equity and venture capital clients have more recently been concerned with the overall health of the commercial banking market, in some cases with deposits at risk in failing banks, and the shrinking availability of debt, which has had an unfortunate ripple effect on IPOs.

“Debt, in general, has become a lot more expensive and underwriting standards have tightened. There was a lot of capital available in the last few years, and some not-so-great companies got funded,” said Manderson. “Investors are not going to want to take on that risk today.”

There have been 30 initial public offerings in 2023 as of the end of February, according to market researcher Statista, placing it on track for a repeat of the 181 IPOs seen over the course of 2022, which represented a 90% drop from the record-setting 1,035 debuts in 2021.

Lloyd Greif, president and chief executive of the Financial District-based investment bank Greif & Co., said the capital markets seem poised to embrace a more modest IPO market, having adjusted to the realities of a bear market and recognized 2021’s runaway record for debuts as an anomaly.

“This is a market that before any of this, before hell broke loose in the banking market specifically, you already could hear a pin drop in the IPO market,” Greif said. “It was the dual influences of 2021 being a record year for IPOs — and what must go up must come down — and the fact that most IPOs and SPAC deals have significantly underperformed the more mature, but also more stable, blue chips.”

Several L.A.-based startups that debuted via IPO post-2021 have certainly suffered in the markets compared to the blue chip alternatives. This includes professional esports organization FaZe Holdings Inc., which debuted in July 2022 via a $725 million SPAC merger. The company’s stock reached a 52-week high of $24.69 in August, but has since dropped more than 93 percent to 66 cents a share as of March 28.

The West Hollywood-based fintech and banking app company Dave Inc. debuted in January 2022, and around this time last year stood near a stock high of $323.52 per share on March 18, 2022. As of March 28, 2023, the stock has settled near $5.82 per share.

Then came the rapid fall of SVB, Credit Suisse and others in early March and the deleterious impact that rippled throughout the banking industry, said Greif, likely dimming any hopes of an imminent IPO revival.

“The sun had already gone dark on the tech-heavy startup economy, and then these banking institutions focused on serving small, early-stage companies pulled up lame. Now the sun just went into a total eclipse,” said Greif.

For as rough as the market’s been to the average company that’s debuted since 2021, Manderson said they’re still likely better positioned than most looking to IPO in the near future.

“They’ve at least achieved their public listing. They will now trade and rise and fall with the markets and the tides of their industry,” said Manderson. “IPOs are an exit for venture capital investors and a company’s founders; it’s where they eventually get liquidity. If the IPO window freezes up, they don’t get that exit. IPOs can also be a funding mechanism to provide capital for growth. The IPO market is cyclical, but investors will be waiting a lot longer to get that liquidity, and companies will have to seek alternative funding.”

Hope in the back half?

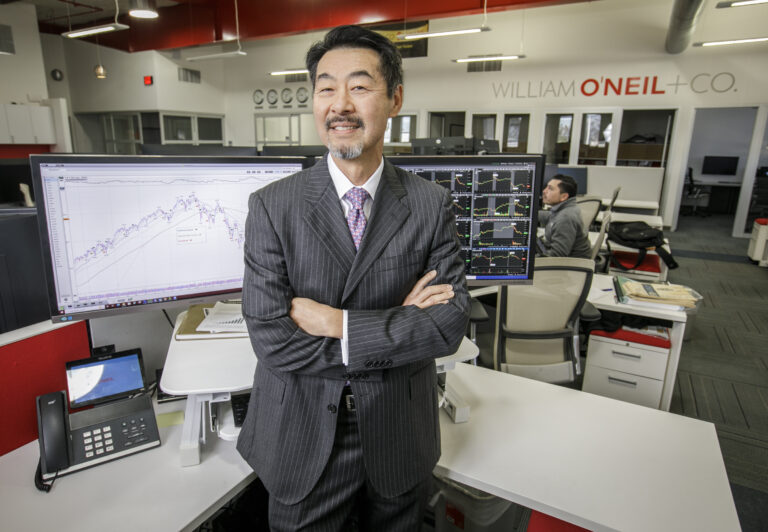

While the latest round of ill tidings certainly dims the hopes of a major IPO market recovery in the first half of the year, Dean Kim, equity researcher and head of research product at the Playa Vista-based investment advisor firm William O’Neil + Co. Inc., said there’s still hope that things get back on track in the closing months of 2023 should the Fed reverse track.

“If they were to cut going forward, which is entirely possible in the second half of the year, there’s a chance for the market to settle down,” said Kim. “If you think the market is going to bottom fairly soon, in or near the third quarter … then we may see IPOs making a comeback.”

That’s the outcome several Los Angeles-area companies that have recently announced their intentions to pursue IPOs are likely hoping for. El Segundo-based real estate investment trust Peakstone Realty Trust (formerly Griffin Realty Trust) announced in February its intention to pursue a NYSE listing.

And Beverly Hills-based agricultural tech company Opti-Harvest Inc. filed for an $8 million IPO in January, having stepped back from the $35 million public offering it had initially proposed in August 2022. Peakstone declined a request for comment, while Opti-Harvest did not respond to a request for comment.

The El Segundo-based National Veterinary Associates Inc. in late March announced that it would split its operations in two, with intent to debut both operations separately through two separate IPOs “in the next two or three years.”

“I think it’s possible for IPOs to stall through this,” said Kim. “Usually they do pre-IPO roadshow, and that’s when they get a good gauge of the interest level of the debut. And if they see people — investors — are not willing to step in and pick up the new shares they could certainly wait it out. The key thing is … will they have enough liquidity to withstand this harsh environment?”

Kim echoed Manderson’s concerns about the shrinking availability of capital, which, combined with other lingering economic factors and an uncertain commercial banking market, could make 2023 difficult for still-to-debut companies.

“The money wants to wait until it sees signs of a more robust market, which really begs the question: what is going to happen this year? Because so far, the banks are in trouble and the regional banks are having liquidity issues. And what’s more troubling is that when you look at the money supply in the market, it’s been shrinking,” said Kim. “We saw M2 (money in circulation plus checkable deposits and savings accounts in banks) and M3 (M2, plus money market funds) numbers coming down dramatically in 2022, and in February of this year that number came down again. Annualized, it was a more than 5% drop in the money supply.”

He attributed the evaporating money supply primarily to the Federal Reserve’s persistent bumps to interest rates, most recently setting a target range of 4.75% to 5.0% at its March 21-22 meeting. Kim said this latest 0.25% interest rate hike represents the best of several bad options for the economy generally and the IPO market in particular.

If they had come in and raised 50 basis points, the market would have possibly collapsed,” Kim said. “If they had come in with no rate hikes, that may have been OK. But if you look at the messaging, that’s the Fed acknowledging that we’re in trouble. It’s a sign of desperation if they don’t raise rates … their credibility would have basically gone out the window.”

Greif said the result will likely be survival of the fittest, which is already creating some great opportunities in the M&A market.

“You’ll have some companies come out healthier thanks to capturing merger synergies, but you’ll also have a major shakeout. If there’s a company that wasn’t going to make money anytime soon and can’t justify its existence on a standalone basis, it’s better to have it die a quick death than have it be a zombie company wandering aimlessly out there,” said Greif. “This market is surgically removing the horns of a lot of unicorns.”