The price of FAT Brands Inc. stock experienced a 128% surge in the days following news that the company had agreed to buy Johnny Rockets from a private equity firm.

The deal allows the Beverly Hills-based fast-casual restaurant franchise operator to add Johnny Rockets to a roster of restaurant brands that includes Fatburger, Buffalo’s Cafe, Buffalo’s Express, Hurricane Grill & Wings, Ponderosa and Bonanza steakhouses, Elevation Burger and Yalla Mediterranean,

The company acquired the Wilbraham, Mass.-based burger chain for $25 million from Sun Capital Partners Inc., a private equity firm in Boca Raton, Fla.

Investors deemed the move a positive one, pushing FAT Brands’ shares from $3.30 to nearly $10 on Aug. 13. The run-up tapered off the following day, and the stock has settled in at about $6, but FAT Brands’ market cap as of Aug. 18 was still nearly double its value from before the announcement.

So, what’s so good about the deal?

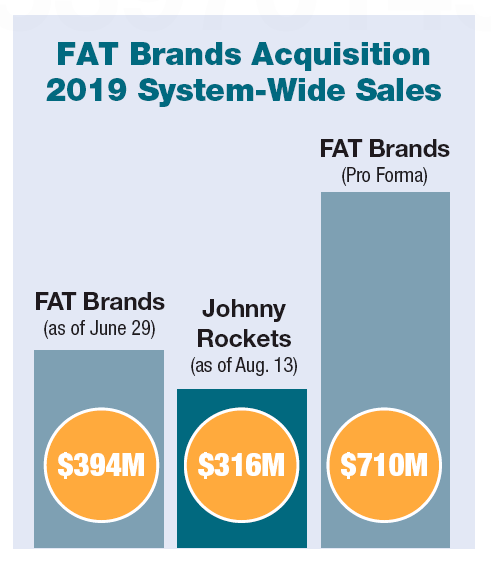

“This is a transformative event for us, which doubled our unit count to more than 700 restaurants around the globe and brings annual systemwide sales to north of $700 million,” FAT Brands Chief Executive Andy Wiederhorn said in a statement.

“The Johnny Rockets footprint immediately delivers FAT Brands’ a more diverse and robust geographic presence, including in markets where we have a little preexisting or no overlap and many of which are in high-growth new markets.”

Wiederhorn also said that, based on 2019 sales at both companies, he expects the integration of Johnny Rockets will “double” FAT Brands’ gross earnings, which hit $7.7 million last year.

He also said the company will “realize immediate cash flow benefits” from eliminating corporate redundancies and increasing its purchasing volume for food, beverages and paper “to more than $250 million a year,” which will “result in lower food costs and higher profitability for our franchisees.”

FAT Brands, which generates revenue by charging franchisees an initial fee as well as ongoing royalties, reported a net loss of $6.6 million for the first six months of 2020, compared to a net loss of $1.2 million it posted for the same period in 2019.

Its revenue was also down for the first half of the year, adding up to $7.5 million. The 30% decrease “reflects the negative effects of the Covid-19 pandemic on royalties from restaurant sales,” according to the company.