We survived a volatile 2019.

President Trump ignited the Trade War with China in July 2018 by imposing a 25% tariff on $34 billion worth of Chinese imports. Since then, many economists have argued that the Trade War could trigger a recession. Though trade uncertainty clouds have dampened growth prospects, the U.S. economy successfully survived 2019: the U.S. GDP grew by an annualized 2.1% in the third quarter; the unemployment rate stayed at 50-year lows; and CPI inflation remained anchored below the Fed’s target of 2%.

With deeper ties to Asia, Los Angeles is exposed to greater levels of economic uncertainties arising from the trade tension and slower global growth. Indeed, the ongoing Trade War has weighed on cargo volumes through the Los Angeles and Long Beach ports, the nation’s busiest ports for transpacific trade. In November 2019, total imports at the two ports dropped 11.3% year-over-year and total exports shrunk by 7.1%. While many economists have expressed concern that the slowdown of international trade might lead to strings of employment losses in the Los Angeles area, the payrolls added remained solid and the unemployment rate stayed low. Los Angeles county added 81,900 non-farm jobs from November 2018 to November 2019, an increase of 1.8%. While employment growth continued to be widespread among many sectors, we should note that the jobs involving trade and transportation grew by 6,100, keeping the falling trade volume in perspective. Due to the robust hiring demand, the unemployment rate in Los Angeles registered at 4.4% in November, down from 4.7% one year ago.

Another concern regarding the ongoing trade tension is its ripple effects on the housing market in Los Angeles, one of the top destinations for Chinese home purchasers. In 2019, Chinese retail investors purchased fewer homes in Los Angeles versus 2018 due to the weaker Chinese currency, tighter capital control from Chinese authorities, and Trade War uncertainties. Although Chinese investors have slowed their home buying activities, domestic home purchases picked up recently thanks to lower mortgage rates and solid household income growth. According to CoreLogic, 6,746 new and existing houses and condos were sold in Los Angeles county in October 2019, up 5.6% year-over-year. With the underlying demand proven to be resilient, home prices in Los Angeles has remained elevated, an increase of 4.2% year-over-year. As 2019 comes to an end, we conclude that Los Angeles successfully survived the economic headwinds from the trade tension and avoided recession.

SPIRITS TO THRIVE IN 2020 COULD BE DAMPENED AT TRUMP’S FINGERTIPS

To make it clear, in the last month of 2019, we have seen significant de-escalation of risks surrounding trade policy. One important component of the Phase One Deal is Trump’s reversion of the December tranche of tariffs on $160 billion worth of Chinese imports, which covers a wide category of consumer goods from cellphones to apparels. Second, tariffs on $120 billion of Chinese imports were reduced from 15% to 7.5%. In addition, U.S. and China are making some progress on intellectual property and technology transfer issues, which we believe are the fundamental issues that have led to the escalation of the trade tension.

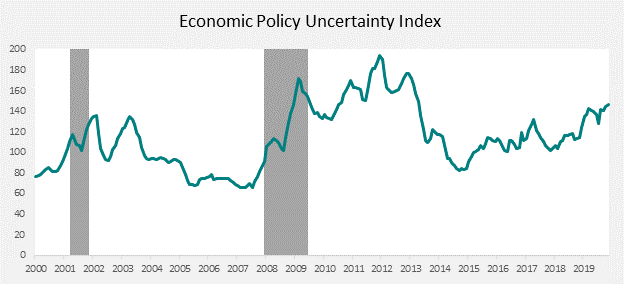

While the risk of imminent recession has diminished considerably since a Phase One Deal between the U.S. and China was reached, we are maintaining a cautious view as the calendar flips to 2020. As illustrated by the U.S. Economic Policy Uncertainty Index, it seems the only certainty is uncertainty as the index rose by an average of 17% in 2019, compared with 2018. The sharp rise of the Economic Policy Uncertainty Index augurs a murky economic outlook and generates concerns that not only fed into policymaker’s perceptions regarding their policies, but also influenced businesses and consumers’ daily economic activities. Although the narratives surrounding trade policies have improved considerably as 2019 ended, whether the economy could thrive in 2020 remains cloudy. People are still living in fear of Trump’s tweets because the economic climate could change drastically at Trump’s fingertips.

Young Cho, Ph.D. is Chief Analytic Officer at Bank of Hope. Learn more at bankofhope.com.