Century City-based Ares Management has invested $1.45 billion in DuPage Medical Group, the largest independent physicians group in Illinois.

The deal continues the asset management company’s strategy in recent years of backing health care enterprises.

The latest deal gives Ares a stake in Boncura Health Solutions, a DuPage practice management subsidiary that offers billing and other services to the physicians group. The deal closed last week.

DuPage officials said the new money, including equity and debt financing, will allow for the purchase of more doctors’ practices and new outpatient clinics.

It also will allow the group to maintain its independence as physician groups across the nation, reeling from financial pressure and growing regulations, face a trend of consolidation, the company said.

“Our partnership with Ares will allow us to maintain our physician-oriented culture and clinical autonomy,” Paul Merrick, president and chairman of DuPage, said in a statement. “More importantly, we are well-positioned to expand and enhance our management service offerings and continue providing our patients the highest quality care.”

The Chicago-area medical group, founded in 1999, includes 688 doctors housed in more than 80 suburban offices. Boncura serves more than 5,500 physicians with 350,000-plus patients, and processes more than 7 million insurance claims a year.

Ares, founded in 1997, is a publicly traded global alternative asset manager of roughly $104 billion assets under management as of June 30. It focuses on leveraged buyouts, debt trading and real estate, with investments ranging from tony Neiman Marcus to discounter 99 Cents Only Stores.

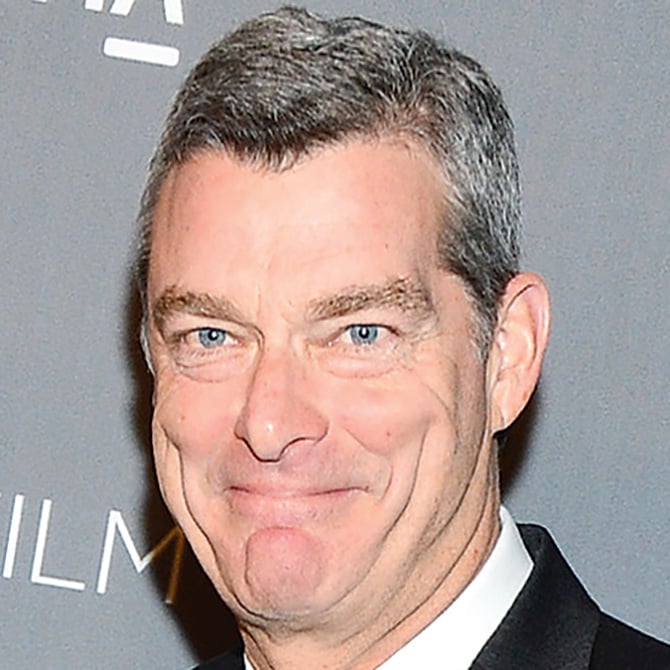

Antony Ressler, Ares chairman and chief executive, oversees an operation with 925 employees spread across 15 offices worldwide.

The company was No. 33 on the Business Journal’s list of largest public companies in Los Angeles County ranked by market cap as of June 30, with a value of $3.8 billion. It reported revenue of $1.2 billion last year – up from $814 million in 2015 – with a net income of $112 million.

Officials from Ares did not respond to a request for comment on the investment in DuPage.

Terms of the transaction call for DuPage to remain wholly physician owned and directed, with doctors retaining a “significant” stake in its practice management company.

Ares also acquired a stake in Summit Partners, a Boston private equity firm that invested $250 million in DMG Practice Management Solutions, a DuPage subsidiary.

DuPage began seeking outside investors after it generated $741 million in revenue and scooped up a number of doctors’ practices last year, according to Crain’s Chicago Business.

Company executives have said they hope to expand its medical services outside Chicago and add 300 more doctors in the next two years.

The company chose Ares out of 20 prospects, a DuPage official told the Chicago business paper, because of the firm’s knowledge of the health care industry, a similar company culture and “strong health vertical” that includes investments in Aspen Dental Management; CHG Healthcare Services; and Ob Hospitalist Group, the nation’s largest OB-GYN specialty provider.

Analysts were bullish on Ares’ prospects compared with other public asset management firms prior to the deal.

“We see Ares Management as still an emerging participant in alternative asset management,” Kenneth B. Worthington, an analyst with J.P. Morgan, said in a report this month, “but with a more stable and fast-growing business than its listed peers.”

Ares closed at $17.90 a share Aug. 16, down less than a percent from one week and a year earlier.