Founded in response to a famous bet offered by Warren Buffett, and rebuffed by Charlie Munger over a game of bridge, Anacapa Advisors Inc. is starting a public campaign to promote its hedge funds did what Buffett and Munger said couldn’t be done: beat the markets.

After five years in operation the Pacific Palisades investment management company was awarded best quantitative strategy under $1 billion in assets at the Hedge Fund Manager Performance Awards gala this November, and says several large investors are now interested in adding to its asset base.

According to its third-quarter results, the Anacapa Alpha and Quantum funds continue to outperform the S&P 500 Index and Nasdaq 100 Index respectively despite the macroeconomic turbulence experienced on the public markets.

Since Anacapa’s inception five years ago, the Alpha fund is up almost 139% compared to the S&P’s 67%, while Quantum has returned nearly 145% compared to Nasdaq’s 76%.

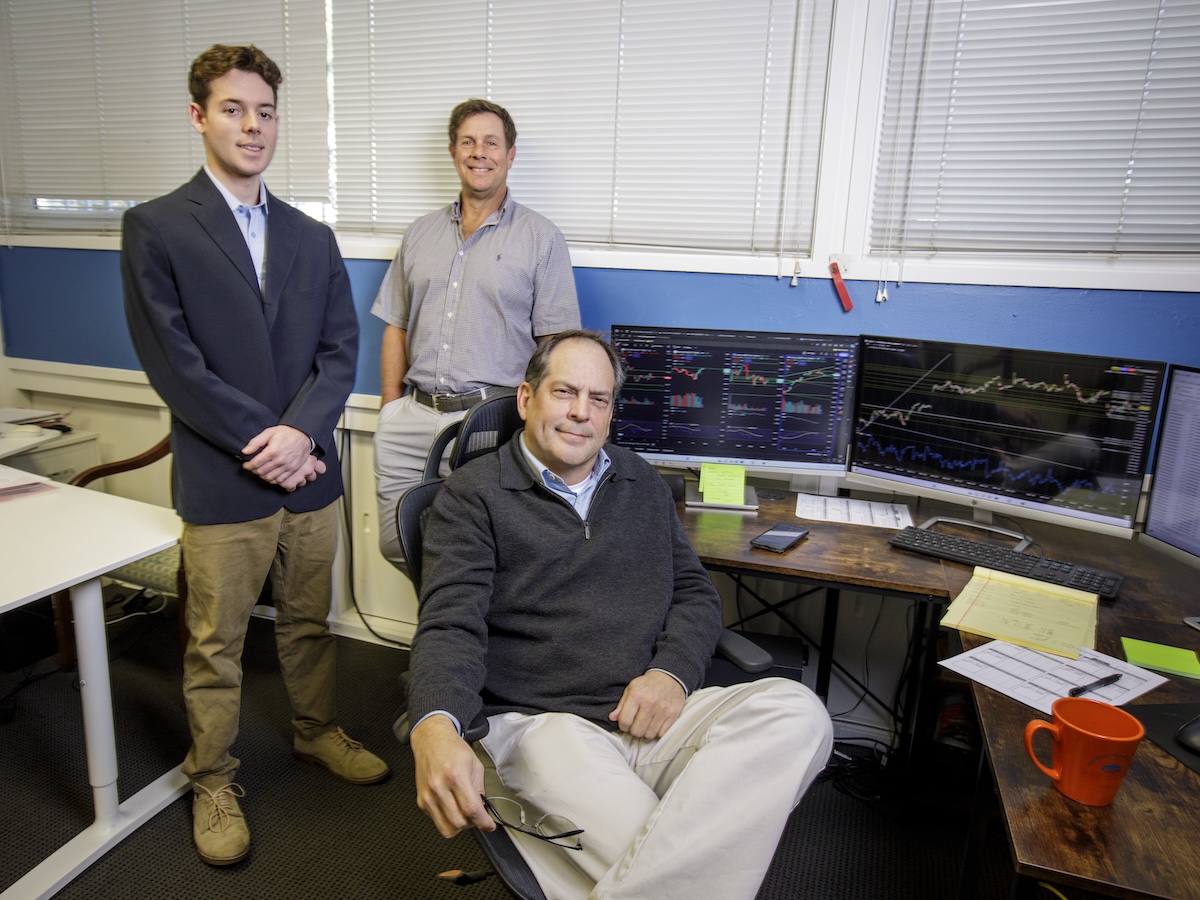

After lying low for its first building years, Phil Pecsok, Anacapa’s founder and chief executive, wants to put his firm on the map and bring in more assets.

“Our strategy should be able to handle at least a billion, maybe up to five (billion),” Pecsok said. “We’ve established five years of consistent growth in up and down markets, we outperform in both.”

Pecsok first launched the Alpha fund in 2018 to compete with the S&P 500. It came two years after he, while playing bridge with Berkshire Hathaway’s late vice chair Munger, decided to take on Buffett’s bet that hedge funds were unable to beat the market. Pecsok, who played bridge on and off with Munger for 15 years before the pandemic, told Munger it was possible.

Over the next two years, Pecsok hired a team of PhDs and a computer scientist to test a strategy which harvests stocks’ short-term growth then balances through hedge-purchasing risk management. Back-testing on 13 years of historical stock data, the results beat market gains. Pecsok brought on general partners for the initial Alpha fund, then in 2020 launched the Quantum fund against the Nasdaq 100.

The company now has 30 to 40 investors.

Several financial veterans joined Anacapa this year to grow its investor base. In September he hired Sam Rosenberg, who formerly helmed billion-dollar hedge funds at Natixis and Société Générale, as head of business development, and Mark Wayner as a senior fund manager with 30 years of experience of trading from prior stints at Citadel, Bank of America and BNP-Paribas.

Pecscok, who admitted he is not an experienced salesman after a career as a trader and risk manager, must market a product in a saturated and well-established hedge fund market in Los Angeles.

Legacy investment managers like Century City-based Ares Capital Management and Brentwood-based Oaktree Capital Management have billions in assets with some of the largest pension and sovereign fund clients in the world.

By charging a relatively small management fee compared to larger firms and publicizing his firm’s outsized performance in its founding years, Pecsok hopes larger institutional investors will take a chance on his younger strategy.

“You want to invest in an emerging manager,” Pecscok said. “You want to invest in a small, nimble fund. They get better performance.”