Online jeans seller DSTLD is “testing the waters” for a $10 million public offering of its stock thanks to new Securities and Exchange Commission rules.

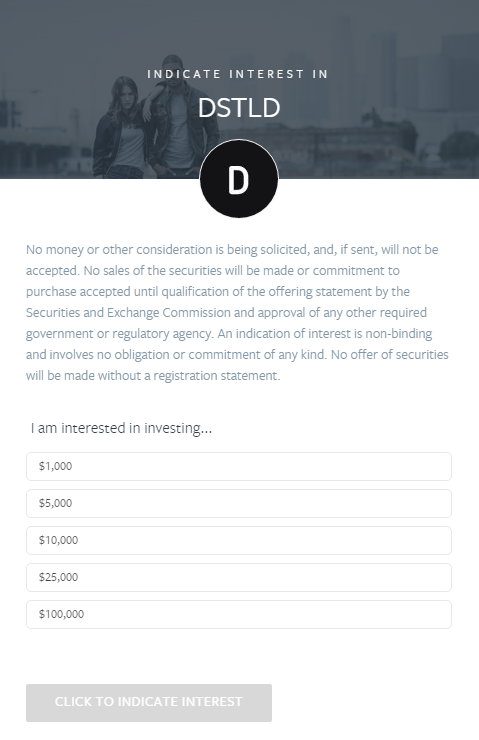

DSTLD floated the idea in an email blast to 25,000 of its customers and on equity crowdfunding platform SeedInvest Saturday. So far, prospective investors have indicated they would be willing to buy close to $8 million of the company’s stock.

Founded in 2012, DSTLD of Beverly Grove directly sells premium jeans online to consumers for $65 and $85. The prospect of cutting retailers out of luxury clothing sales initially helped the startup raise $4.4 million last November from prominent venture capital backers such as CAA Ventures and Venice accelerator Amplifiy.LA.

But now DSTLD says venture capital is a poor fit after an analysis of its long-term growth prospects.

Venture capitalists, said Co-Chief Executive Mark Lynn, are focused on startups capable of achieving quick billion-dollar valuations, known as unicorns. That’s left companies with more moderate growth rates stuck between a rock and a hard place. They can either accept onerous terms that push breakneck growth or risk stalling without financing, Lynn explained.

“We are building this business for the long term and we want to take as much market share as possible, but we also want to make really sound business decisions and grow sustainably,” he said. “The venture model doesn’t generally support a model likes ours.”

DSTLD sees a small public offering as a viable middle ground.

“I don’t necessarily think it is about getting better terms as much as it is having more alignment between the investor base and the management of the company,” said Lynn. “Someone putting $1,000 into the company isn’t looking to have an outcome in the next 26 months.”

DSTLD can do this under a new provision of the JOBS Act called Regulation A+. The rules, finalized in June, allow startups to raise a maximum of $50 million worth of securities in a 12-month period, with less-expensive oversight than a typical initial public offering.

And though a public offering will crowd out some future venture capital investment, Lynn said DSTLD’s early institutional investors are warming to the idea.

“Some of them were a little skeptical on the onset, but now I think they’ve seen there’s been so much interest. Everybody is coming around,” said Lynn.

Before DSTLD moves forward with a public offering of its stock it will need to have SEC-required legal reviews of its terms and audits of its business. That will not be cheap. DSTLD has set aside $250,000 to cover those costs and Lynn said anything less than $2 million in equity sales won’t make the effort worthwhile.

Technology reporter Garrett Reim can be reached at [email protected]. Follow him on Twitter @garrettreim for the latest in L.A. tech news.