New York City-based JPMorgan Chase announced earlier this year that it had dedicated more than $40 million to support Minority Depository Institutions as part of a multibillion-

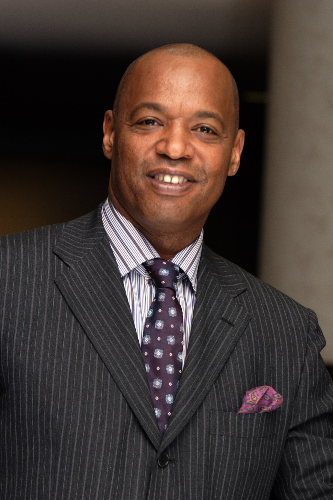

Protests in the wake of the killings of George Floyd and Breonna Taylor in 2020 have been regularly cited in media reports as a primary motivator for initiatives like these. Kevin Cohee, chief executive of the MDI OneUnited Bank, which has dual corporate offices in Baldwin Hills/Crenshaw and Boston, said the progress is owed in equal parts to societal and technological advancements.

He pointed to artificial intelligence as a chief example of technology’s role as a great equalizer in the finance sector.

“It’s moving us past the traditional ways of determining credit,” Cohee said. “Historically, the factors in credit decisions were very narrow, very limited. We didn’t have the technology to consider thousands, if not tens of thousands, of different factors that change the way we do business.”

For “the new Black Wall Street,” Cohee said the internet has provided minority lenders and borrowers with a venue similar to the one Tulsa, Okla., provided the original.

“Why would Tulsa, of all places, be where you’d have found a place called Black Wall Street?” Cohee said. “You’d think places like New York, Philadelphia or some big Southern city like Atlanta would be where you’d fine that source of entrepreneurship and ingenuity. But it was in Tulsa this community called Greenwood developed, it being the only place I’m aware of where actual reparations were given,” said Cohee, whose great-great-grandfather Charles Cohee Jr. was as part of the group that in 1894 successfully lobbied Congress for reparations for freedmen in Oklahoma.

Tom Nida, executive vice president of CityFirstBroadway, which is dual-headquartered downtown and in Washington, D.C., said MDIs focused on community development have been addressing the generational nature of the wealth gap.

“Many African Americans don’t own their own home and can’t benefit from appreciating home values, building equity that could fund education, retirement or a small business,” Nida said.

As real estate prices continue to skyrocket, the dream of homeownership has only grown more unattainable absent additional assistance. This is where MDIs can play a pivotal role, he added.

“We can’t address such issues by ourselves, but we can forge private sector partnerships and private-public partnerships to leverage available resources,” Nida said.

Here are examples of how such partnerships and efforts are taking shape in regional and national banks in the form of various outreach initiatives and offers to customers.

OneUnited Bank

OneUnited Bank

Honoring Cohee’s ancestor and other early pioneers in minority financing — and to celebrate the emergence of a “new Black Wall Street” — OneUnited recently launched the Greenwood Visa Debit Card, a fee-free option for low-to-moderate income customers.

With a physical presence in California, Massachusetts and Florida, the company’s operations have been becoming increasingly digital, Cohee said.

“It’s unique to have this sort of service on a nationwide basis — it’s the only Black-owned business that has the capacity to serve several hundred million people across the country,” Cohee said.

JPMorgan Chase

JPMorgan Chase

In February, the bank launched Empowering Change, a program backed by Google in partnership with MDIs and CDFIs to provide economic opportunity to underserved communities. The program is designed to allow MDIs and CDFIs to offer new investment products to their customers, boost their technological capabilities and develop new revenues through fund distribution.

Citigroup

Citigroup

In addition to supporting area MDIs, Citi will provide college savings accounts for local public school students as part of its partnership with the city while also working with the National Urban League to offer no-fee options throughout its national network.

Citi said its Action for Racial Equity plan offers a comprehensive approach to providing greater access to banking in communities of color and increasing Black home ownership and investment in Black-owned businesses.

Bank of America

Bank of America

The company continues to provide capital investments and grants to Pacific Coast Regional Small Business Development Corp. and the Greater Los Angeles African American Chamber of Commerce to support resources, microlending and technical assistance to local Black-owned businesses.

Last year, the bank launched a jobs initiative dedicating $25 million to 21 higher education institutions, including historically Black colleges and universities, Hispanic-serving institutions and community colleges in support of job skills and placement.

Comerica Bank

Comerica Bank

In 2020, Comerica directed $10 million to MDIs, including $2.5 million each allotted to the downtown-based Broadway Federal Bank and Commercial Bank of California of Irvine