Celebrities and sports brands are more eager than ever to lend their legitimacy and likeness to new ventures, and private equity firms are more than happy to oblige.

One of the most high-profile partnerships among these has taken things even a step further, putting the celebrity behind the wheel to direct private equity funding. In September 2022, reality megastar Kim Kardashian co-founded SKKY Partners alongside Jay Sammons, who formerly headed the global consumer, retail and media division for The Carlyle Group.

The company, which has target sectors including consumer products, digital and e-commerce, consumer media, hospitality and luxury brands, began fundraising in March 2023, according to a company press release. SKKY Partners has dual headquarters in Boston and Calabasas; Sammons resides in the former, while Kardashian is a resident of Calabasas.

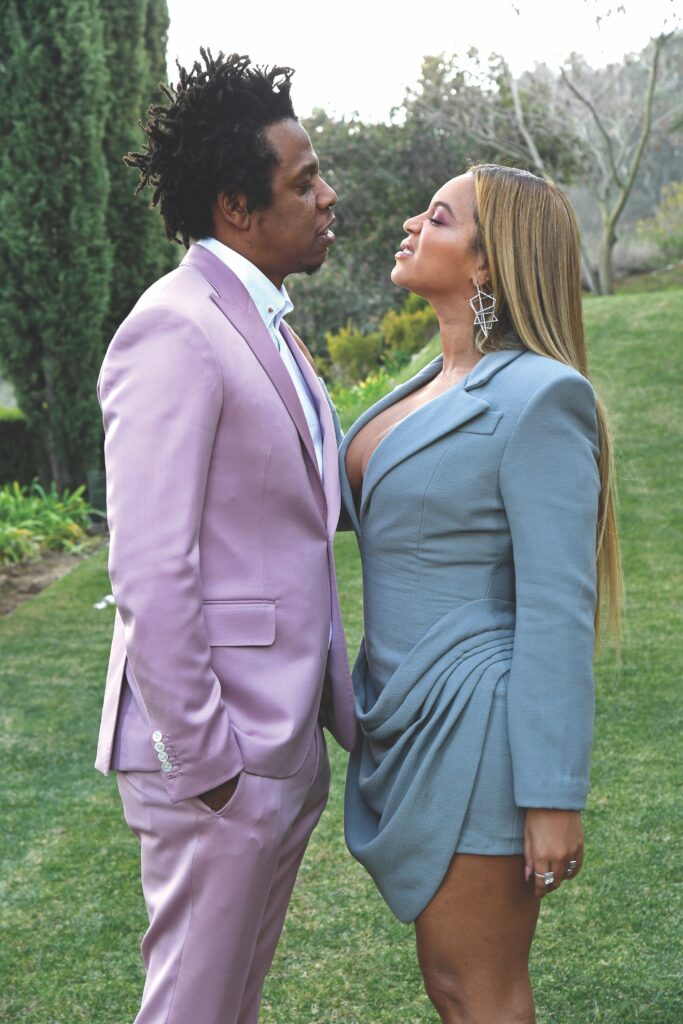

Joining the ranks of entertainers-turned-angel investors such as Jay-Z and Ashton Kutcher, Kardashian is leading a new wave of big names looking to make fortunes outside of Hollywood. Mehdi Khodadad, a Century City-based partner at Sidley Austin LLP focusing on technology and life sciences companies and their private equity sponsors, said the hype has been driven in no small part by the recent Hollywood strikes.

“Branding like this has been around for a while now – think back to Vitaminwater and 50 Cent – but you’re really seeing celebrities are jumping on the bandwagon (after) the Screen Actors Guild strike,” said Khodadad. “It had a profound effect on just about everyone in the celebrity realm, and suddenly, the idea of finding some alternative source of income suddenly held a lot of appeal. They’re looking for different verticals and jumping into branding opportunities.”

‘Words carry substance’

Chris Manderson, chair of the corporate practice at the Beverly Hills-based law firm Ervin Cohen & Jessup LLP specializing in mergers and acquisitions and private equity, said the significant downturn in leverage deal value post-2021 has made equity firms eager to get the best bang for their buck with the deals they do make.

“Leveraged deal value has fallen off much harder on average than overall deal value, which makes the difficulty of obtaining financing all that much worse,” Manderson said. “Given that, it makes great sense that private equity firms would look to alternative strategies to get those funds raised, deploy their capital, and close deals.”

Manderson said celebrities with mainstream appeal can be significant needle-movers for fundraising, and in that regard, the Kardashians have among the most dependable brands.

“Their words carry substance. When the Kardashians back a consumer-facing business, it’s something that has genuine value, especially in categories like consumer cosmetics and fashion,” said Manderson. “They’re not out there investing in aerospace and defense contractors, but when it comes to things like beauty products, health and wellness and the like, their name carries weight in the same way that Tom Cruise’s name means something when you’re trying to sell a movie.”

Private equity affiliated with a big name combined with “the right kind of business brings something to the table that no one else really can,” Manderson said.

“You can have a guy with an MBA from Harvard, but chances are all of that know-how won’t help them deploy capital nearly as effectively as the Kardashians could. It is the rare, very rare case where a big-name celebrity that actually brings business value outside of the realm of entertainment.”

Top Hollywood influencers like Kardashian have enough clout and cash to direct investment, but Manderson noted that it’s much more common to find high-profile names in sports and entertainment on the side of the companies benefitting from the funding.

“Los Angeles is overwhelmingly a middle-market city, and the companies here tend to be privately owned and driven by private equity transactions,” Manderson said. “And with the heart of the entertainment industry a few miles down the road, that creates some obvious opportunities for synergy between the two.”

Khodadad highlighted Maximum Effort, a film production company and digital marketing consultancy owned by Ryan Reynolds, as an example of a middle-market celebrity-branded company powered by private equity.

Sports and private equity

If private equity funds are interested in partnering in the entertainment industry, they’re positively champing at the bit to expand their presence in the sports world, particularly the local ones.

“I think it helps a lot that we have two NFL teams, two basketball teams, a presence in the MLB and the NHL – teams in just about anything,” said Eric Geffner, a Sidley Austin LLP partner focusing on entertainment, sports and media. “We’re all long for Los Angeles, and soon we’ll have the World Cup and the Olympics here, and benefit from all the infrastructure that comes with it.”

Private equity’s presence in Los Angeles sports is growing rapidly, Geffner said, highlighting the investment activity of firm client Arctos Sports Partners. While Arctos’ investments aren’t publicly disclosed, it was reported in March 2022 that it had upped its equity stake in the Los Angeles Dodgers, a franchise recently valued by sports data tracker Sportskeeda at $4.8 billion.

Even leagues with less mainstream appeal have found wild success – and private equity interest – in Los Angeles, Geffner said. It’s also home to some of the world’s most profitable teams in women’s’ sports.

“The valuations for men’s teams are obviously high, but particularly when you look at women’s soccer in the city, where you’ve got a team that’s had success on an international level for 20 years, a team that’s dominated the World Cup. That one was really a case where the values were recognized as being too low, and investors believe there’s really money in these teams now.”

Lloyd Greif, founder, president and chief executive of downtown-based middle-market investment bank Greif & Co., noted that private equity’s presence in sports has provided symbiotic benefits for Los Angeles Football Club.

The franchise is owned by Bennett Rosenthal, co-founder and director at the Culver City-based Ares Management Corp., with co-ownership held by the New York-based Apollo Global Management’s Larry Berg and Brandon Beck, founder of the Santa Monica-based Riot Games Inc.

“Angel City has been a winning franchise, and that huge success was backed by private equity and local entrepreneurs.” said Greif.

Access to a huge amount of capital for NFL owners would be unlocked if private equity were allowed allowed to purchase stakes in NFL franchises, Geffner said.