A portfolio of six multifamily and co-living properties in L.A. has received a $53.7 million loan.

The non-recourse bridge financing was given to New York-based Six Peak Capital. The company is a private real estate asset management firm and developer. Its multifamily portfolio in L.A. has more than 2,000 beds and 900 units.

MF1, a partnership between Berkshire Residential Investments and Limekiln Real Estate, provided the financing. The company provides capital to multifamily properties.

Century City-based George Smith Partners’ Malcolm Davies, Zack Streit, Drew Sandler, Alexander Rossinsky, Aiden Moran, Brandon Asherian and Ben Tracy arranged the financing.

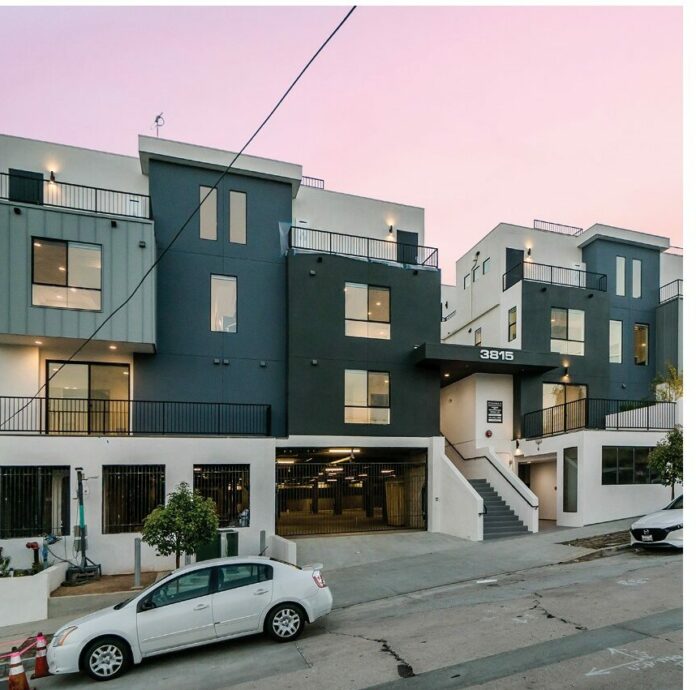

The six properties are located in Eagle Rock, North Hollywood, East Hollywood and Koreatown.

Three of the assets are traditional multifamily buildings and three are co-living properties. Combined, the portfolio includes 118 units and 278 beds.

“The financing represents another milestone for the co-living asset class,” Chris Aiello, a partner at Six Peak Capital, said in a statement. “As Los Angeles continues to recover from the pandemic, it will become apparent that this product type serves a missing middle renter and the backbone of L.A.’s dynamic workforce. It will become clearer that investors in equity and debt need to add exposure to co-living as a subset of their multifamily investment portfolio, especially in the L.A. market.”

The exact setup of co-living properties varies but in general tenants have some private space, such as a bedroom and bathroom, but share other common spaces.

These units are usually cheaper than other studio or one-bedroom apartments and often come with amenities and community events.

Also, the price of co-living units is usually inclusive of everything including furniture, electricity and internet.