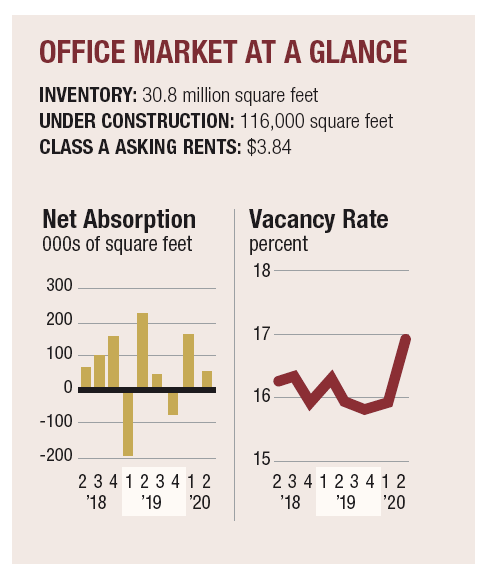

Downtown

Downtown’s second-quarter office vacancy rate fell to 16.9%, down from the previous quarter’s 17%. The average asking rates for Class A properties was $3.84 a square foot, down 2 cents from the previous quarter but up 1 cent over the previous year. Net absorption was 50,292 square feet, and 116,000 square feet was under construction.

Main Events

The Los Angeles Department of Water and Power signed a lease for 132,459 square feet at 233 S. Beaudry Ave.

The Army Corps of Engineers renewed its 100,000-square-foot lease at 915 Wilshire Blvd.

An individual purchased a retail and office building at 1045-1051 S. Los Angeles St. for $6.4 million from another individual.

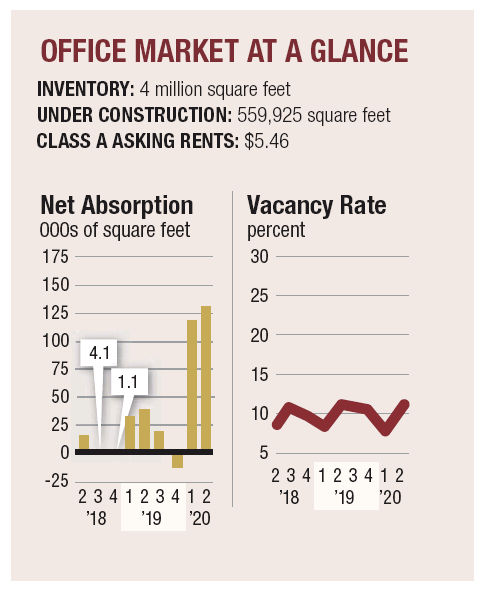

Hollywood

Hollywood’s office vacancy rate rose to 11.1% during the second quarter, up from 7.1% the previous quarter but down from 11.2% the previous year. Rents rose to $5.46 a square foot, up 4 cents over the previous quarter and 15 cents over the previous year. Net absorption was roughly negative 125,000 square feet, and close to 560,000 square feet was under construction.

Main Events

Netflix Inc. paid $14.4 million for the famed Egyptian Theatre, purchasing it from American Cinematheque.

An individual purchased a hospitality property at 1624 Schrader Blvd. from USA Hostels Inc. for $4.7 million.

Appa Real Estate purchased multifamily properties at 5926 and 5932 Carlton Way from an individual for $3.9 million with plans to develop a 26-unit coliving community.

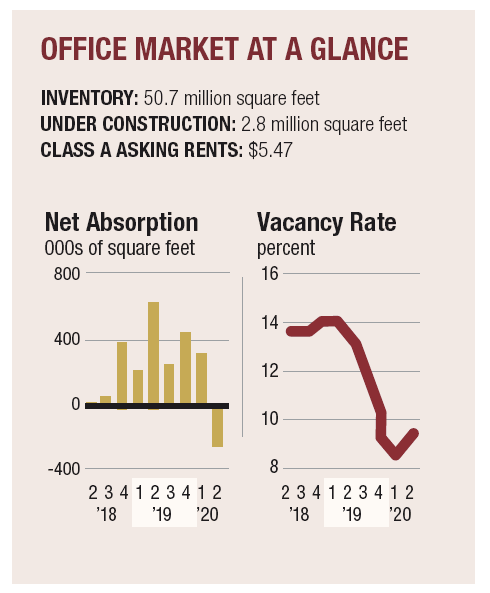

Westside

The Westside office vacancy rate increased to 9.4%, up from 8.7% the previous quarter but down from 11.1% the previous year. Marina del Rey had the highest vacancy rate at 29.8%; Century City had the lowest at 4.9%. Asking rates for Class A space on the Westside was $5.47 a square foot, down 15 cents over the previous quarter but up 11 cents over the previous year. There was 2.9 million square feet under construction during the quarter, including more 1.6 million square feet in West L.A. and roughly 983,000 square feet in Culver City.

Main Events

Aspen Skilled Healthcare purchased a 48,000-square-foot convalescent hospital at 5240 Sepulveda Blvd. in Culver City with 116 beds from Sierra Land Group Inc. for $6.75 million.

Facebook Inc. signed a lease expansion of 84,616 square feet at 12105 W. Waterfront Drive in Playa Vista.

LVMH Moet Hennessy Louis Vuitton Inc. acquired a 6,000-square-foot property at 449-453 N. Beverly Drive in Beverly Hills for $30 million from B & A Management Corp.

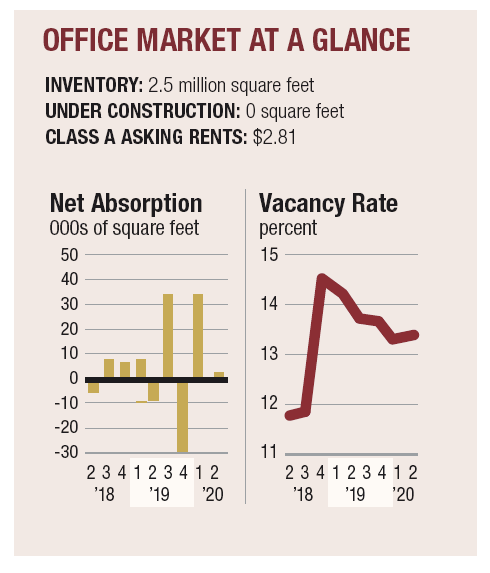

Santa Clarita Valley

Santa Clarita Valley’s office vacancy rose to 13.3%, up from 13.2% the previous quarter and down from 13.7% the previous year. Asking rents held steady with the previous quarter at $2.81 a square foot, down 3 cents over the previous year. Net absorption was negative 3,000 square feet. There was no new office product under construction.

Main Events

Trammell Crow Co. purchased 97 acres of land in Santa Clarita from Needham Ranch Land Co. for $9 million. Nearly 49 acres is usable for building.

Amazon.com Inc. will occupy a roughly 97,000-square-foot building at The Center at Needham Ranch in Santa Clarita.

MegaGoods purchased the Valencia Commerce Center at 28650 Braxton Ave. from Trigg Laboratories for $7.5 million.

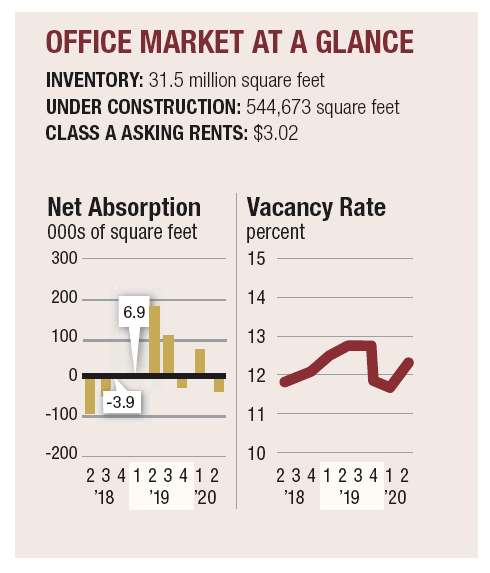

San Fernando Valley

San Fernando Valley’s office vacancy rate rose to 12.1%, up from 11.7% the previous quarter and year. Rents rose 2 cents over the previous year to $3.02 a square foot. Net absorption was roughly negative 25,000 square feet, and nearly 545,000 square feet was under construction.

Main Events

Refrigerator food transportation company True Star Transit Inc. and entertainment industry vehicle provider Moviemachines signed leases for a combined 73,000 square feet at 13571 Vaughn St. in San Fernando.

MC Investment Partners purchased a 96-unit apartment building at 14420-14432 Valerio St. in Van Nuys for $19.2 million from Ridan Inc.

DNA Prep Academy purchased a building at 21523 Rinaldi St. in Chatsworth from Chatsworth Hills Academy Inc. for $9 million.

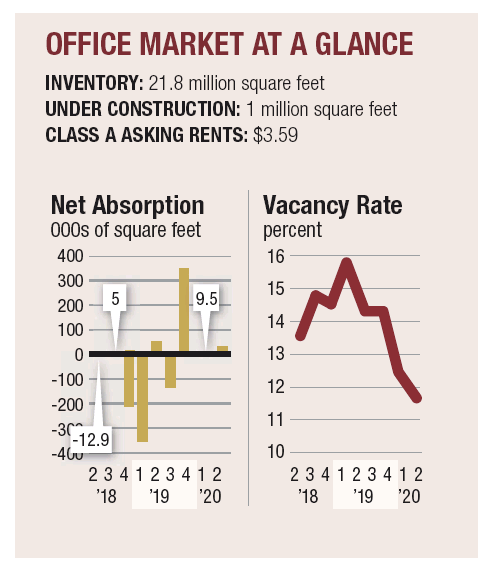

Tri-Cities

Second-quarter office vacancies tightened in the Tri-Cities submarket of Burbank, Glendale and Pasadena to 11.9%, down from 12% last quarter and 13.7% the previous year. There was roughly 24,000 square feet of net absorption. Rents decreased 3 cents from the first quarter and 1 cent from last year to $3.62 a square foot.

Main Events

Columbia Property Trust Inc. sold the 260,000-square-foot Pasadena Corporate Park for $78 million to an unnamed buyer.

Atlas Capital Group purchased a 315,000-square-foot building at 101 S. Marengo Ave. in Pasadena from Woodbridge Capital Partners for $72 million.

An individual purchased the Pottery Barn building in Old Pasadena from Federal Realty Investment Trust for $16.1 million.

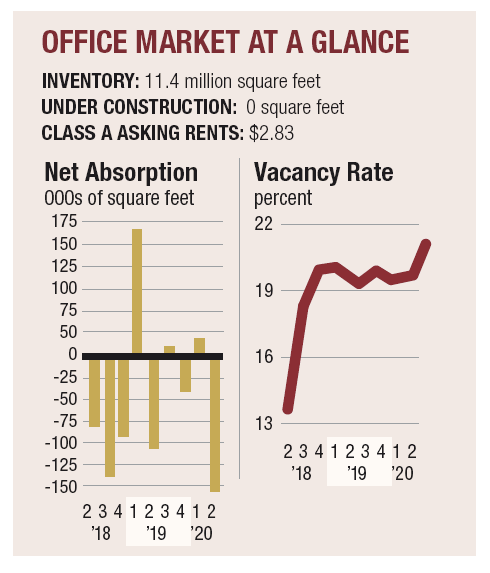

Wilshire Corridor

Wilshire Corridor’s second-quarter office vacancy rate rose to 21.5%, up from 19.6% the previous quarter and 20.2% the previous year. Negative 157,000 square feet was absorbed into the market. Asking rents decreased to $2.83 a square foot, down 2 cents in a quarter and 29 cents year over year. Asking rents in Miracle Mile were higher at $4.24 a square foot.

Main Events

Klein Financial Corp. recapitalized the Wilshire Vermont property in Koreatown at 3183 Wilshire Blvd., valuing the 449-unit building at $135 million.

Penske Media Corp. purchased a warehouse at 5111 W. Washington Blvd. in Mid-City from an individual for $6 million.

An individual purchased a 42-unit multifamily property at 970 Menlo Ave. in Koreatown for $9.3 million.

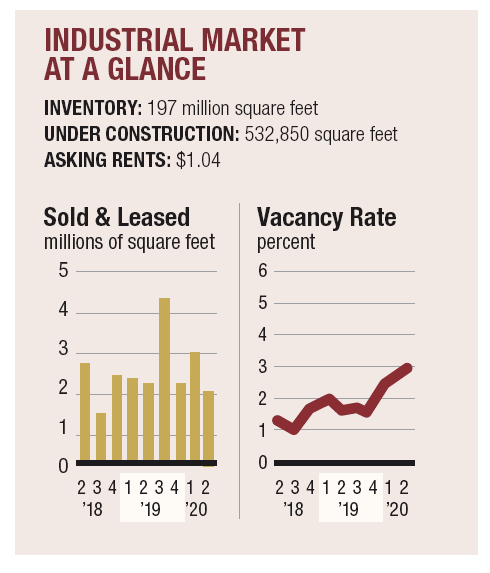

South Bay

South Bay’s industrial market vacancy rose slightly to 3% during the second quarter, up from 2.4% the previous quarter and 1.6% the previous year. Roughly 533,000 square feet was under construction while 2 million square feet sold or leased during the quarter. Rents rose to $1.04 a square foot, up 5 cents in a year.

Main Events

Brookfield Asset Management Inc. purchased two industrial buildings at 2001 E. Dominguez St. and 20740-20750 S. Wilmington Ave. in Carson for $63.6 million.

Denver-based Black Creek Group purchased a Torrance warehouse at 538 Crenshaw Blvd. from a family trust for just under $50 million.

Omninet Capital purchased office campuses in Commerce and Torrance for a combined $78 million.

San Gabriel Valley

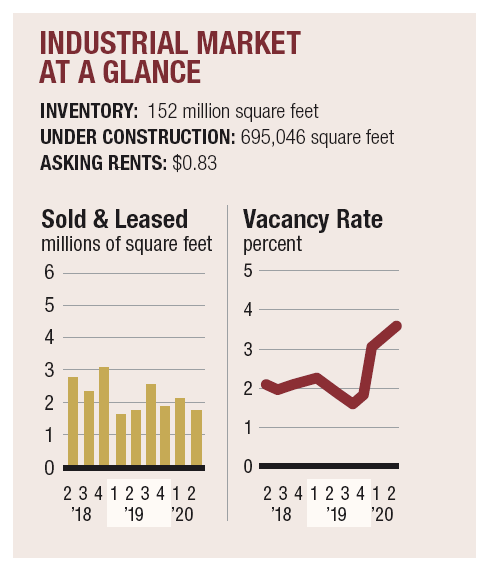

The San Gabriel Valley’s second-quarter industrial vacancy rate increased to 3.6% from 3.1% the previous quarter and 1.8% from the previous year. Asking rents were $0.83 a square foot, up 4 cents over the previous year and 1 cent over the previous quarter. Roughly 1.7 million square feet was sold or leased during the quarter.

Main Events

RA Capital purchased a 64,000-square-foot medical office building in Covina from DaVita Inc. for $40 million. It is fully leased to Magan Medical Clinic Inc.

T&L Stone Supply Inc. purchased a 61,715- square-foot former grocery store at 10775 Lower Azusa Road in El Monte for $14 million.

Dairy Farmers of America purchased a $433 million portfolio from Dean Foods Co. including City of Industry properties.

Keep reading the Q2 2020 Real Estate Quarterly Special Report.