The impact of new development and of the ongoing operations of existing commercial real estate buildings in the United States – office, industrial, warehouse and retail – has grown to support 9.2 million American jobs and contribute $1.14 trillion to the U.S. GDP in 2019, an increase from 8.3 million jobs and a contribution of $1.0 trillion to GDP in 2018.

Based on the existing stock of commercial buildings — totaling 49.6 billion square feet at the end of the third quarter of 2019 — direct spending on building operations totaled an estimated $173.0 billion and contributed $464.0 billion to GDP.

In addition, 563.3 million square feet of new office, industrial, warehouse and retail space newly constructed in 2019 has the capacity to house 1.4 million new workers with a total estimated annual payroll of $83.5 billion.

The findings were presented in the annual study, “Economic Impacts of Commercial Real Estate, 2020 U.S. Edition,” released by the NAIOP Research Foundation. The study measures the contributions to GDP, salaries and wages generated, and jobs created and supported from the development and operations of commercial real estate.

The study broke out several key measures by commercial real estate industry sector:

• Office construction expenditures totaled $50.8 billion in 2019, up 5.4% from 2018, building on its 12.3% gain the previous year.

• Retail construction expenditures totaled $14.4 billion in 2019, a decrease of 15.1% from 2018. That marks four straight years of decline; expenditures fell 9.5% in 2018, 0.8% in 2017 and 7.0%in 2016. The last time retail construction spending increased was in 2015.

• Warehouse construction outlays rose in 2019, gaining 12.6% from 2018. Construction spending had declined slightly in 2018 (0.7%) after increasing in each of the preceding seven years.

• Industrial construction spending, which fell sharply in 2015 and 2016 before increasing in 2017 and 2018, declined 31.7% in 2019. This reflects the manufacturing sector’s weaker performance during the year, caused in part by tariffs that have disrupted foreign trade.

Combined, commercial, residential, institutional and infrastructure development and operations contributes $3.9 trillion in construction spending and accounted for 18.1% of all U.S. economic activity in 2019.

“The U.S. economy is in nearing 11 years of expansion, growing consistently since July 2009 and making it the longest in American history,” said Thomas Bisacquino, NAIOP President and CEO. “Commercial real estate remains as a significant economic driver, facilitating growth and creating valuable jobs. Despite slowing global and U.S. fiscal growth, the economy’s expansion is expected to extend beyond 2020. This is good news for our industry, as steady demand will drive new construction and development.”

The study cites projections that GDP will increase 2.1% in 2020 followed by some additional slowing in 2021, when it will fall to 2.0%. Slower growth is expected during 2021 through 2024 as the stimulus effects of the Tax Cuts and Jobs Act of 2017 diminish and increased deficit spending moderates.

The survey cited several economic trends that will support above-trend growth in 2020. These include:

• Continuing spending stimuli flowing from the Tax Cuts and Jobs Act of 2017

• Fiscal benefits resulting from higher federal spending under the Bipartisan Budget Act of 2019

• Continuing low interest rates

• Personal income growth resulting from job growth and higher wages supporting strong consumer spending

• Improved global economic activity that will support U.S. export sales

• Stronger domestic crude oil production

Three additional factors will contribute to GDP growth in 2020 that were not present during 2019: the six-week GM strike has been resolved, production of the Boeing 737 Max airliner could possibly resume in the second quarter of 2020, and there will be a one-time increase in hiring and spending to support the 2020 Census.

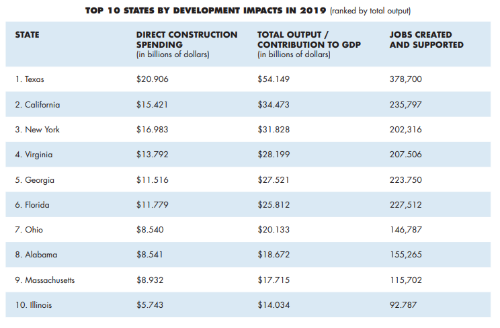

The full report includes detailed data on commercial real estate development activity in all 50 states and the District of Columbia, including direct spending; total output; salaries and wages; and jobs supported.

The report is authored annually by economist Stephen S. Fuller, Ph.D., Dwight Schar Faculty Chair, university professor and director, Stephen S. Fuller Institute, Schar School of Policy and Government at George Mason University, Arlington, Virginia. Data was provided by Dodge Data & Analytics.

Since 2008, NAIOP has conducted this study for purposes of estimating the annual economic contribution of commercial real estate development to the U.S. economy. This study is used by real estate professionals and municipal, state and federal officials and employees, to understand and quantify the key economic benefits of commercial real estate development.

NAIOP, the Commercial Real Estate Development Association, is the leading organization for developers, owners and related professionals in office, industrial, retail and mixed-use real estate. NAIOP comprises 20,000 members in North America. NAIOP advances responsible commercial real estate development and advocates for effective public policy. For more information, visit naiop.org.