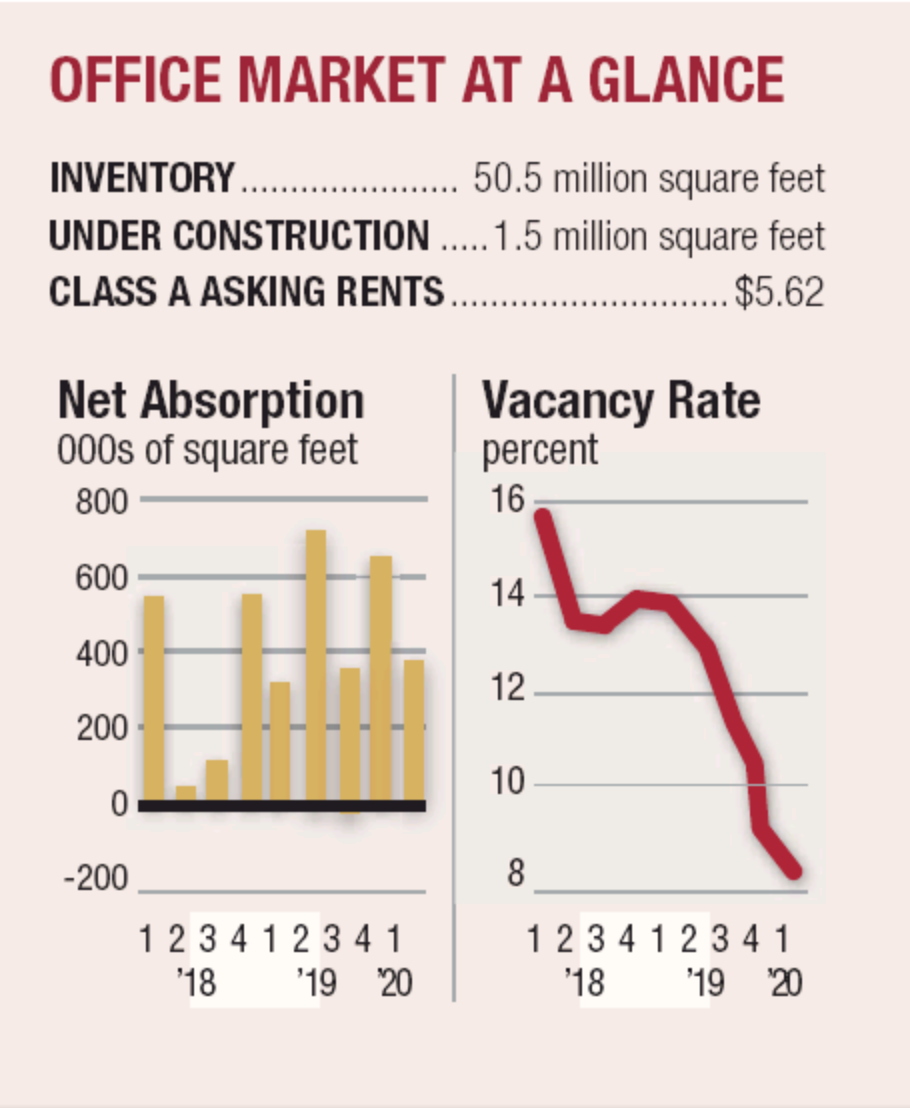

Westside

The Westside office vacancy rate fell to 8.7%, down from 9% the previous quarter and 12.5% the previous year. Marina del Rey had the highest vacancy rate at 28.1% while Century City had the lowest at 4.2%. The asking rate for Class A space on the Westside was $5.62 a square foot, up 11 cents over the previous quarter and 37 cents over the previous year. There were 1.5 million square feet under construction during the quarter, including more than 632,000 square feet under construction in Culver City alone.

Main Events

Clarion Partners and Lincoln Property Co. purchased the Jefferson Creative Campus, an office complex near Culver City, from Rader Properties Group and Rodeo Properties for $169 million.

DivcoWest Real Estate Services sold its interest in the historic Telephone Building in Santa Monica to an affiliate of Rockwood Capital.

A family trust sold a development site at the intersection of Santa Monica and La Cienega boulevards to a local development company for $22.5 million.

Coworking-meets-social-club company NeueHouse signed a lease for a Venice Beach location in a building owned by producer Tony Bill.

CIM Group sold a 147-unit multifamily site and an adjacent collection of 37 apartment complexes in West Los Angeles, including Elevate, a four-story building at 1515 Granville Ave.

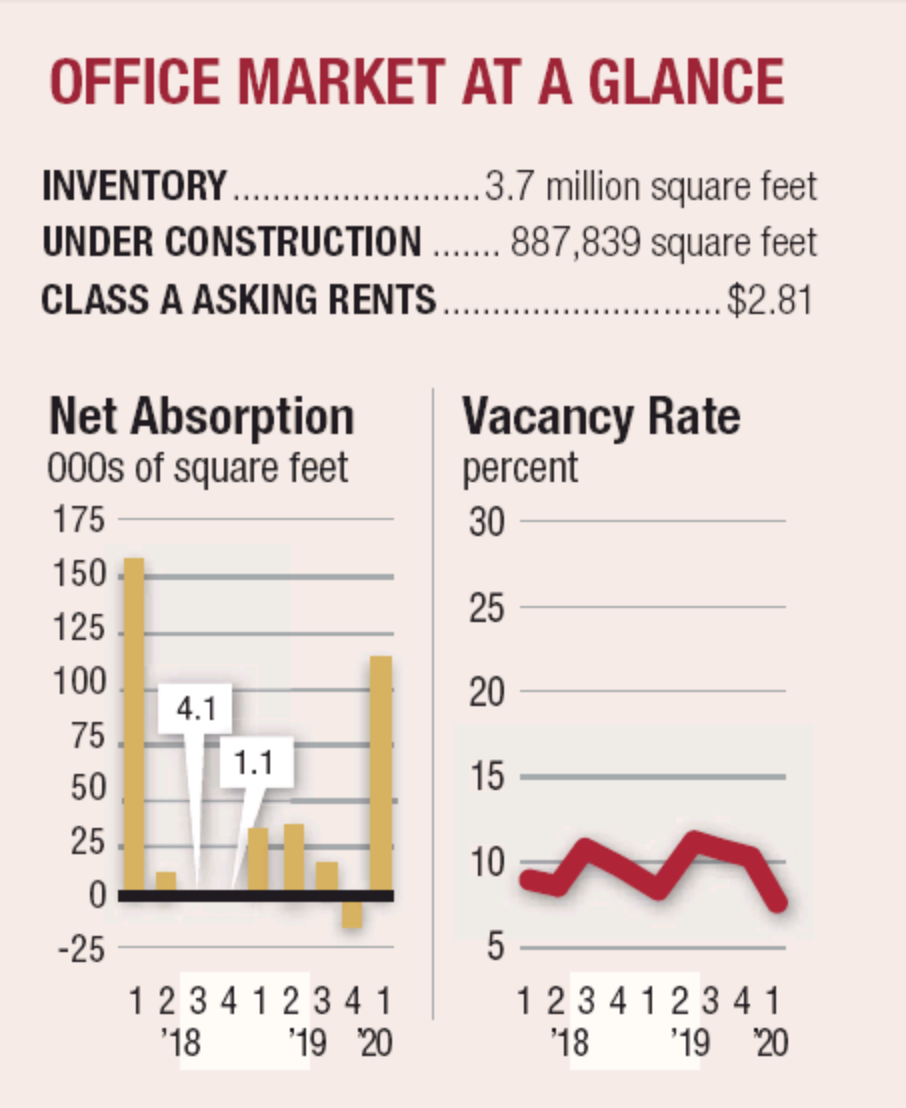

Hollywood

Hollywood’s office vacancy rate tightened to 7.1% during the first quarter, down from 10.1% the previous quarter and 8% the previous year. Rents rose to $5.42 a square foot, up 9 cents over the previous quarter but down 1 cent over the previous year. Net absorption was nearly 111,000 square feet, and close to 888,000 square feet was under construction.

Main Events

Music store Amoeba Music will be moving from its longtime location at 6400 Sunset Blvd. to 6200 Hollywood Blvd., where it is leasing the ground level of the El Centro complex.

Omninet Capital purchased a 68-unit multifamily portfolio dubbed the Chateau Mansfield at 1229 and 1318 N. Mansfield Ave. from Universe Holdings for $27.9 million.

Shamina Investments Inc. purchased the Days Inn by Wyndham Hollywood near Universal Studios from a trust for $22.9 million.

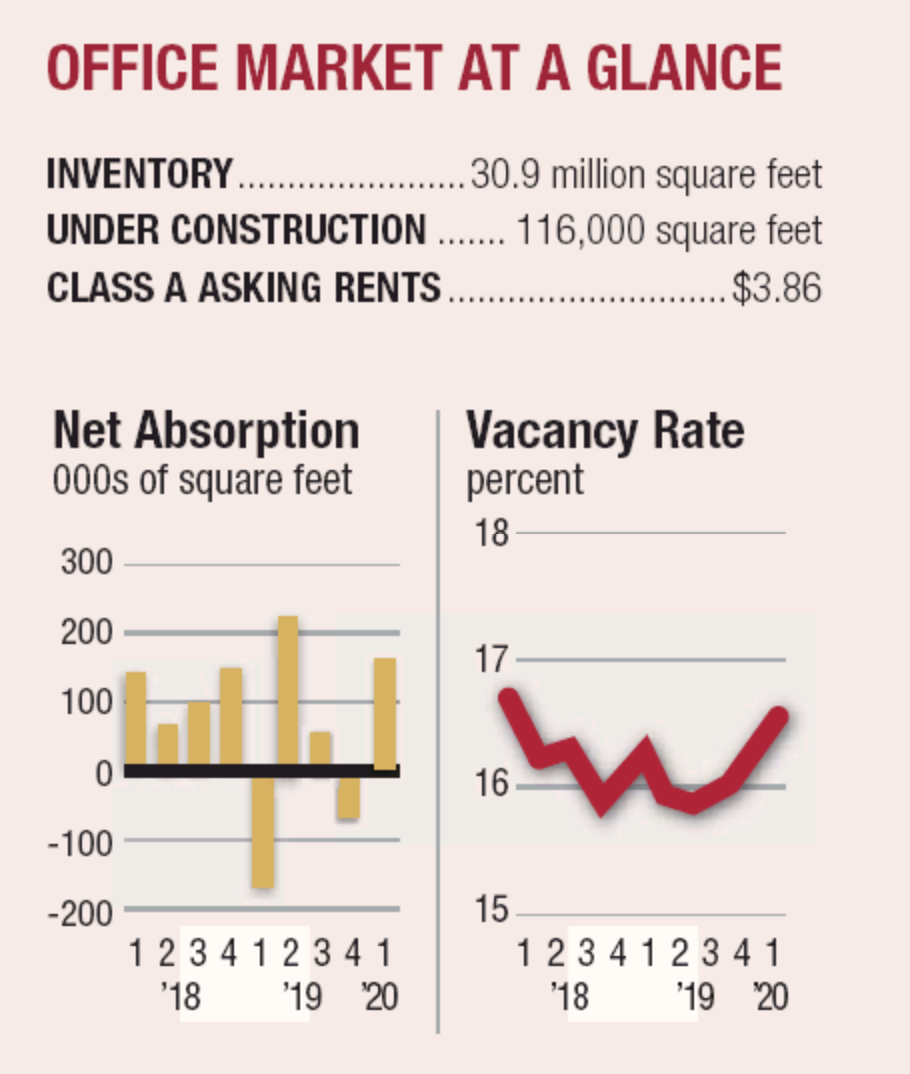

Downtown

Downtown’s first-quarter office vacancy rate rose to 16.6%, up from 16% the previous quarter. The average asking rate for Class A properties was $3.86 a square foot, steady with the previous quarter, but up 11 cents over the previous year. Net absorption was roughly negative 181,000 square feet with 116,000 square feet under construction.

Main Events

JPMorgan Chase & Co. purchased the Wakaba, a 240-unit multifamily property at 232 E. 2nd St. in Little Tokyo from Sares Regis Group for $115.8 million.

Public accounting and advisory service firm Marcum leased 22,000 square feet in the 777 Tower at 777 S. Figueroa St., which is owned by Brookfield Office Properties Inc.

Canton Food Co. purchased a nearly 35,000-square-foot warehouse at 788 Alameda St. from Atlas Capital Group for $24 million.

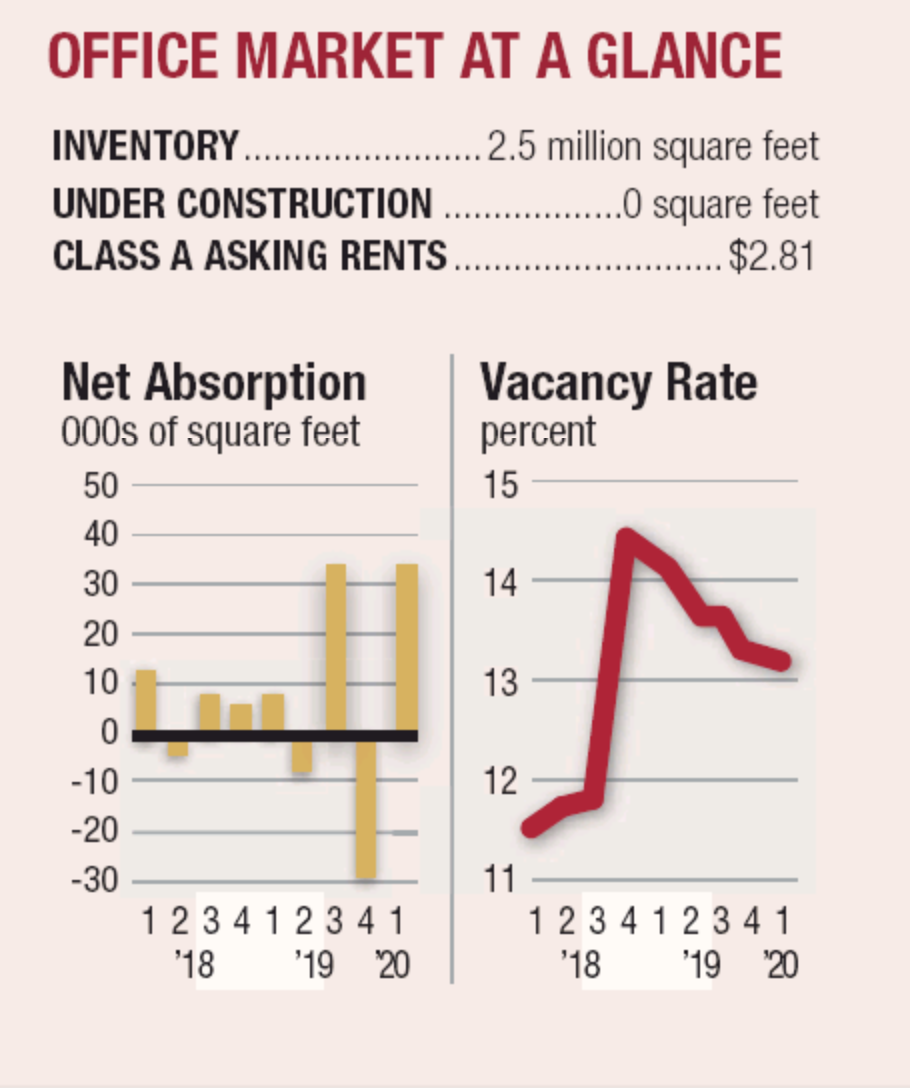

Santa Clarita Valley

Santa Clarita Valley’s office vacancy rate fell to 13.2% from 14.5% the previous quarter and 13.7% the previous year. Asking rents were steady quarter over quarter but fell 6 cents from 2019 to $2.81 a square foot. Net absorption was roughly 35,500 square feet. No new office space was under construction.

Main Events

iLEAD Education purchased the three-property Crossroads Plaza retail center in Santa Clarita from BLX for $17.3 million.

Gershman Properties purchased a shopping center with three retail buildings on Bouquet Canyon Road in Santa Clarita from Donahue Schriber Commercial Real Estate for $11.6 million.

24/7 Events Inc. leased nearly 51,000 square feet at Ground Up Properties’ Valencia Commerce Center at 27788 Hancock Parkway.

San Fernando Valley

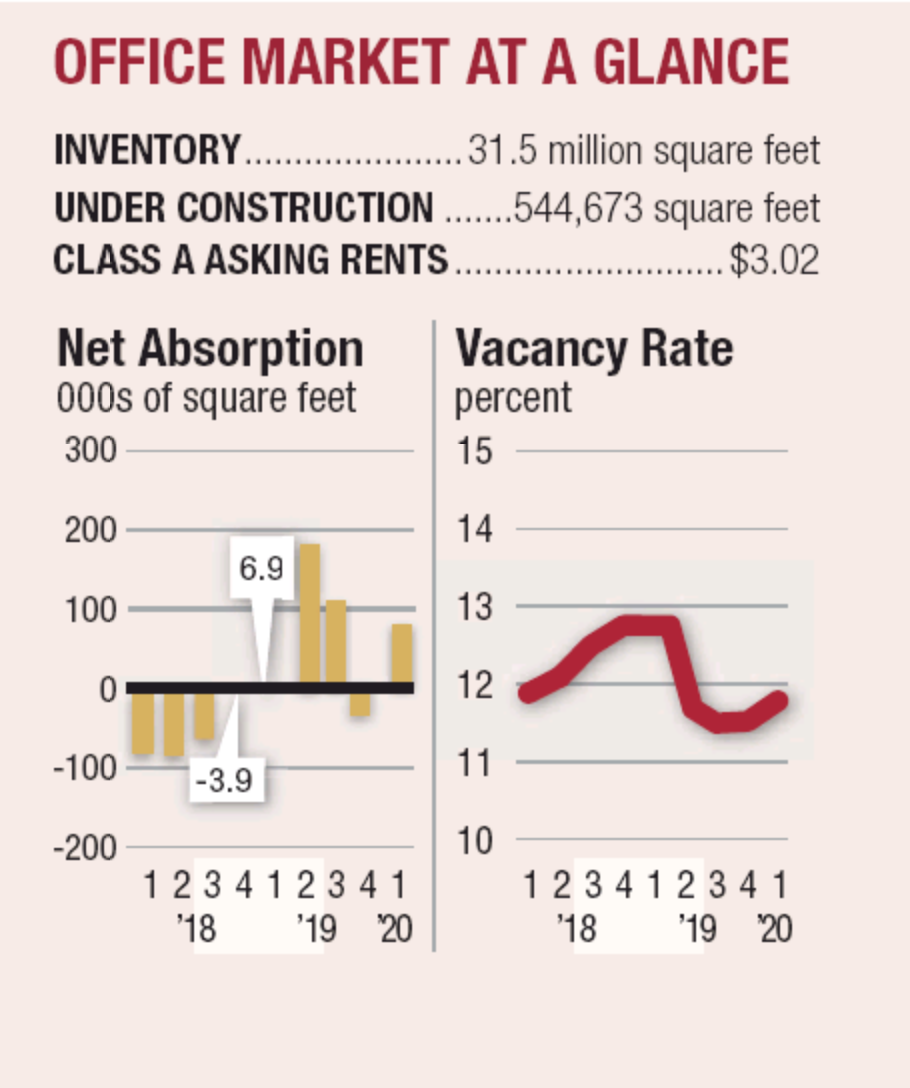

The San Fernando Valley’s office vacancy rate dropped to 11.7% from 11.8% the previous quarter and 12.7% in 2019. Rents rose 23 cents over the previous year to $3.02 a square foot. Net absorption was roughly 75,000 square feet. Nearly 545,000 square feet was under construction.

Main Events

El Segundo-based Paragon Commercial Group sold more than $100 million worth of retail redevelopment sites in California, including a portion of a Target Corp.-anchored center in Northridge.

Culver City-based Goldrich Kest sold two multifamily assets in L.A. County to Westwoodbased Xenon Investment Corp. for a combined $23.3 million, including a Tarzana property.

Blackstone Group purchased two adjoining buildings in Van Nuys from Realty Bancorp Equities for $83 million.

Tri-Cities

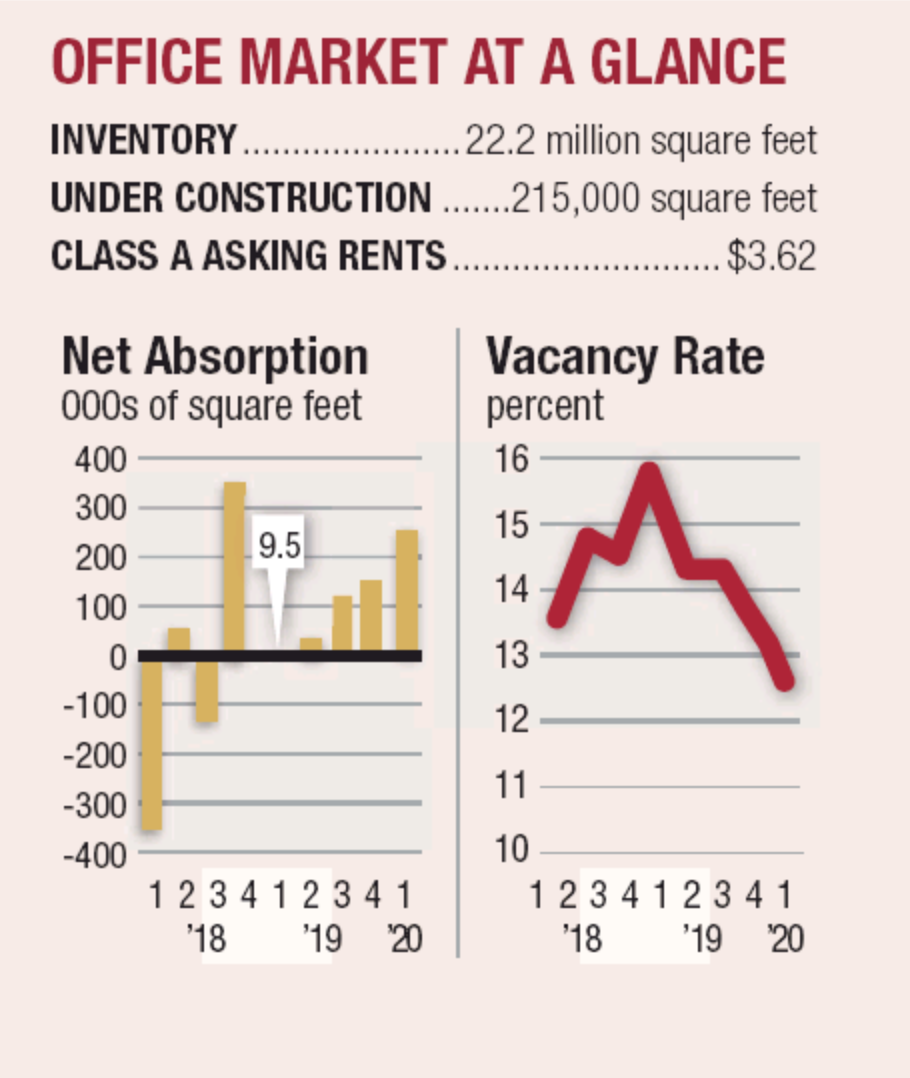

First-quarter office vacancies tightened in the Tri-Cities submarket of Burbank, Glendale and Pasadena to 11.5%, down from 12.6% the previous quarter and 14.2% in 2019. Net absorption was 246,000 square feet while 215,000 square feet were under construction. Rents increased 12 cents from the previous year to $3.62 a square foot.

Main Events

Animation company Titmouse Inc. leased a 95,000-square-foot building at 2835 N. Naomi St. in Burbank owned by Brentwood-based GPI Cos.

An undisclosed buyer purchased the three-building Pasadena Corporate Park on Foothill Boulevard from Columbia Property Trust for $78 million.

GWP Real Estate and Parviz Galdjie purchased an office building at 199 S. Los Robles Ave. in Pasadena from Laurus Corp., Ethika Investments and Miramar Capital Advisors for $55 million.

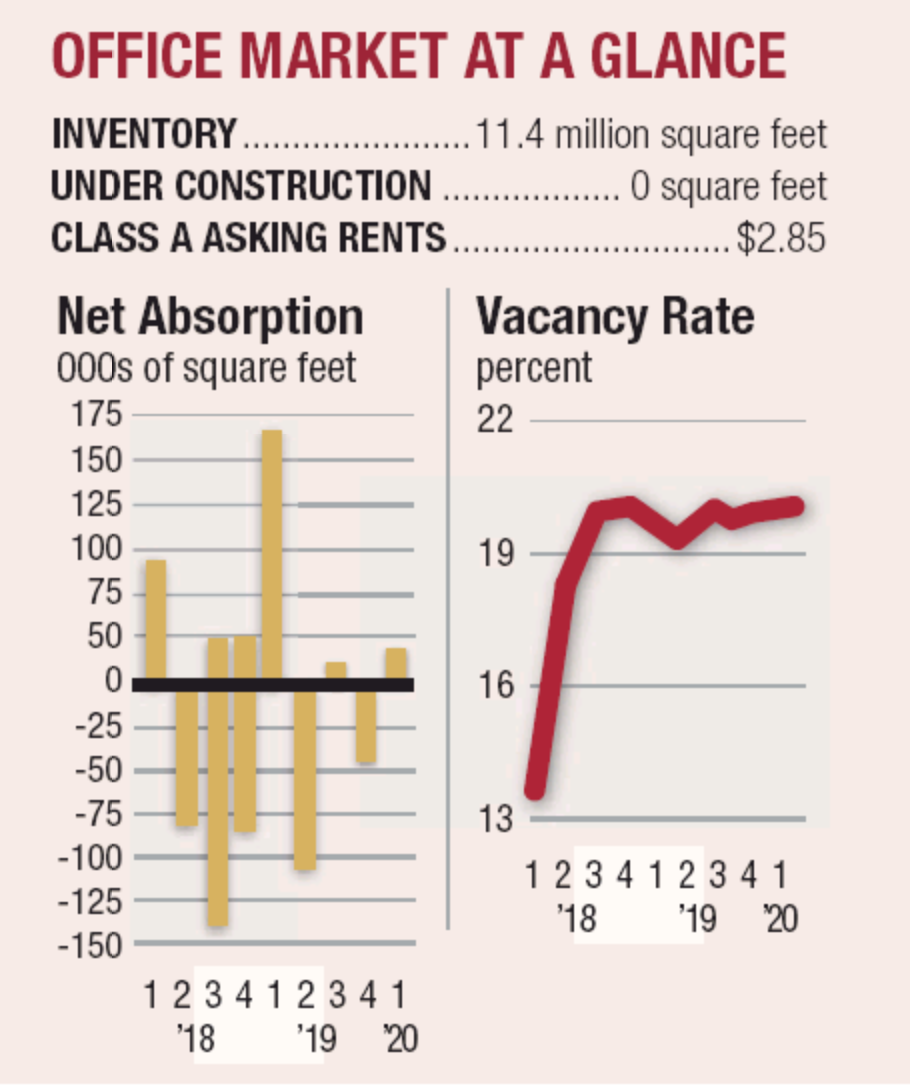

Wilshire Corridor

Wilshire Corridor’s first-quarter office vacancy rate fell to 19.6%, down 0.3% from the previous quarter but up 0.3% from 2019. Roughly 32,500 square feet were absorbed into the market. Asking rents increased 3 cents over the quarter to $2.85 a square foot but were down 34 cents over 2019. Asking rents in Miracle Mile were $4.22 a square foot.

Main Events

Rockpoint Group purchased 5900 Wilshire Blvd. in Miracle Mile from PGIM Inc., AXA Equitable Life Insurance Co. and Ratkovich Co. for $312 million.

Sares-Regis Group purchased The Preston Miracle Mile at 630 Masselin Ave., a 169-unit apartment building, from Heitman for $86.8 million.

Crescent Heights purchased the Wilshire Medical Center at 6200 Wilshire Blvd. from Wilshire Center Building for $54.3 million.

South Bay

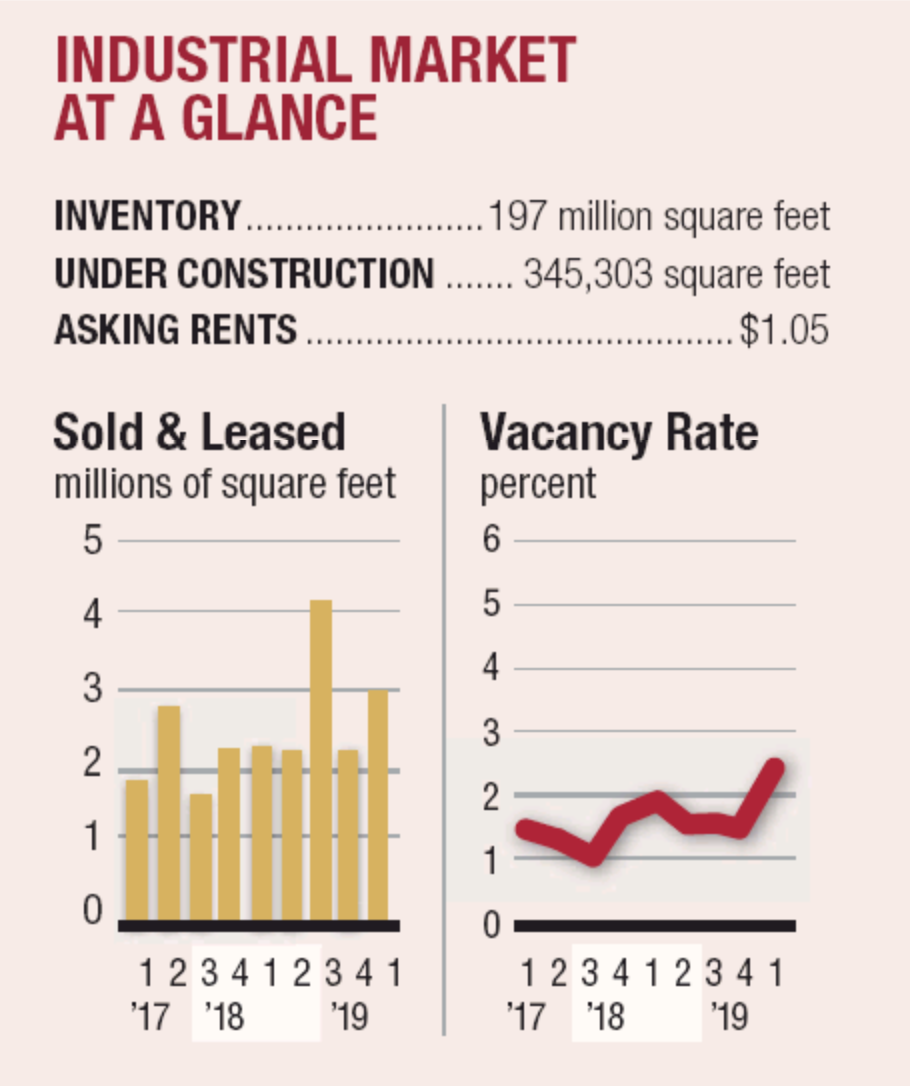

The South Bay’s industrial market vacancy rose slightly to 2.4% during the first quarter, up from 1.7% the previous quarter and 1.8% the previous year. Roughly 345,000 square feet were under construction while 3 million square feet sold or leased during the quarter. Rents rose to $1.05 a square foot, up 6 cents in a year.

Main Events

Los Angeles Clippers owner Steve Ballmer purchased The Forum in Inglewood from Madison Square Garden Co. for $400 million.

Starwood Capital Group and Artisan Realty Advisors purchased an office building with parking at 1960 E. Grand Ave. in El Segundo from Brookfield Property Group for $133 million.

Mamo Properties Inc. bought out partner Pacific Castle Management Inc.’s share of the Long Beach Marketplace for $67 million.

San Gabriel Valley

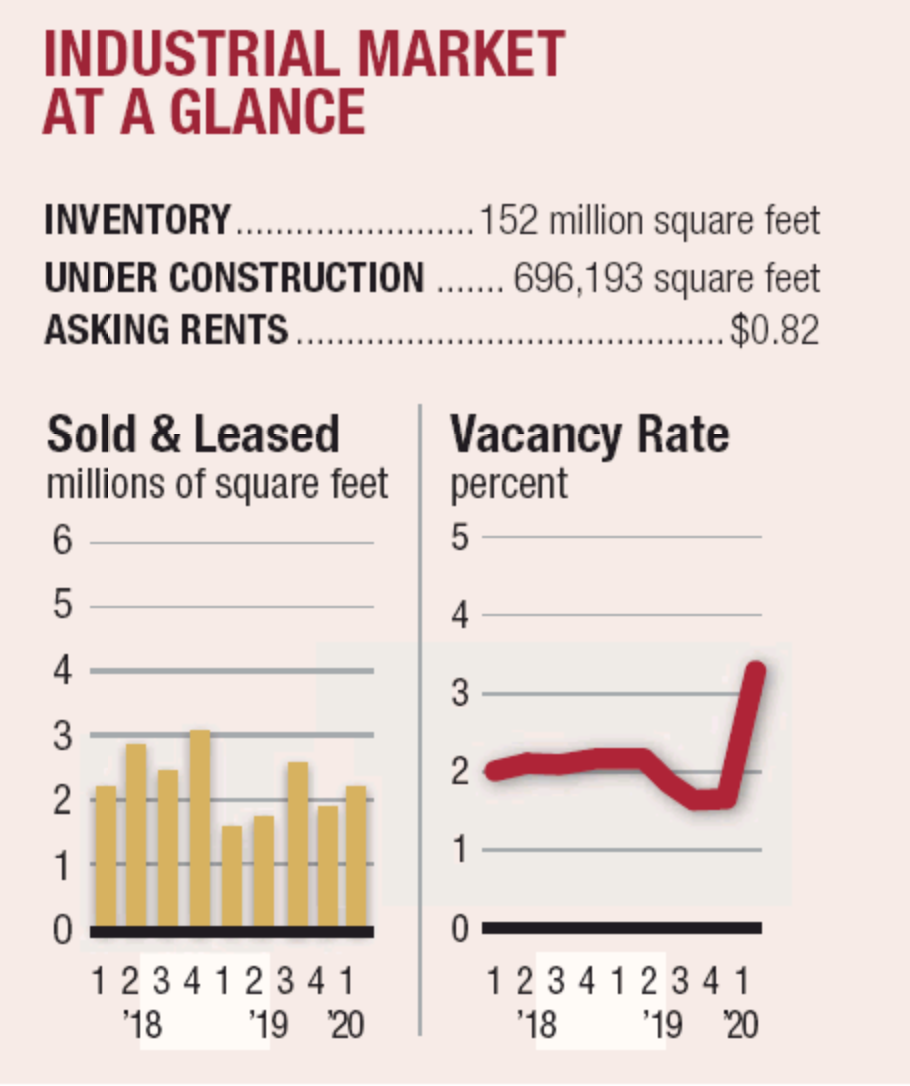

The San Gabriel Valley’s first-quarter industrial vacancy rate increased to 3.1% from 1.9% the previous quarter and 2.1% a year ago. Asking rents were $0.82 a square foot, up 6 cents over the previous year. Roughly 2.1 million square feet were sold or leased during the quarter and 696,000 square feet was under construction.

Main Events

CrossHarbor Capital Partners sold office property The Lakes at West Covina to Oaktree Capital Management for $40.9 million.

Arbor Lodging Partners and GFH Financial Group purchased a 12-hotel portfolio, including the Hilton Garden Inn in Arcadia previously owned by BRE Select Hotels Corp.

Gemdale USA Corp. purchased an 85-unit apartment complex at 2900 E. Virginia Ave. from an individual for $32 million.

Keep Reading: Real Estate Quarterly Special Report — Q1 2020