High Times magazine has vowed to capitalize on the legal sale of marijuana in California and other states, but the 45-year-old monthly may have hit a snag.

HighTimes Holding Corp. said in a May 31 Securities and Exchange Commission filing that after an 18-month initial public offering period, the company has not met the requirements to be listed on Nasdaq or another major securities exchange.

High Times will instead look to be listed on an over the counter market operated by OTC Markets Group Inc., after its stock offering winds down June 30. It is a decided step down from the company’s earlier aspirations, financial observers say.

“The difference between Nasdaq or the New York Stock Exchange or one of the big public exchanges and an OTC market is like General Motors going public versus Charlie’s Pizza Parlor,” said John Fitzgibbon, founder of the tip sheet IPO Scoop.

Fitzgibbon said OTC markets are filled with “very minor companies” that few investors follow.

Adam Levin, whose Oreva Capital bought the Westwood-based publication in 2017, wasn’t available for an interview.

New Chief Executive Kraig Fox, a former executive at Live Nation Entertainment Inc. and Guggenheim Partners who was named CEO in April, said in an email exchange that High Times is still pursuing an eventual Nasdaq listing while it looks at over the counter markets. Fox also disputed the characterization of OTC markets as a backwater.

“We’ve seen a lot of success with other companies listed on the OTC that have raised hundreds of millions of dollars,” Fox stated over email. “We understand that a stigma exists; however, the current regulatory environment in the cannabis space is likely to result in several anomalies in the cannabis markets.”

Observers are taking a wait and see approach, due to the company’s operating expenses and debt load.

“Some of these numbers seem upside down,” said Chris Krogh, an auditor at Squar Milner.

Initial public odyssey

High Times has sought various ways to go public since Levin bought the company in a deal valued at $70 million for the company in July 2017.

“Two years is a long time to have a round of financing open,” Krogh said.

Levin first sought to merge High Times with a special purpose acquisition company, but the deal was scotched after the blank-check outfit in question dissolved.

High Times next pressed forward with a Regulation A offering, an investment tool created under federal securities law in 2013 through which companies sell shares to accredited and unaccredited shareholders alike.

Under the Reg A offering, Levin set out to raise $50 million starting in January 2018. Shares were set at $11 each, a stock price the company set arbitrarily, according to the SEC filing.

High Times raised $10.2 million in net proceeds through the Regulation A offering through the end of May.

The company needs at least $15 million in private equity capital to trade on Nasdaq and for now is setting its sights on over the counter markets after failing to meet that minimum over the last 18 months.

Dramatized in the 2013 movie “The Wolf of Wall Street,” over the counter markets come with their own lore and lingo – “pink sheets,” the color paper brokers list stocks on, and “penny stocks,” named because of the low stock prices.

The financing weeds

High Times’ investor presentation suggests the current IPO struggles may be a hiccup in the company’s march to profitability.

The company is betting that the global cannabis market will grow sevenfold from this year to 2025, reaching $146 billion in revenue, according to a report High Times cites from Grand View Research Inc.

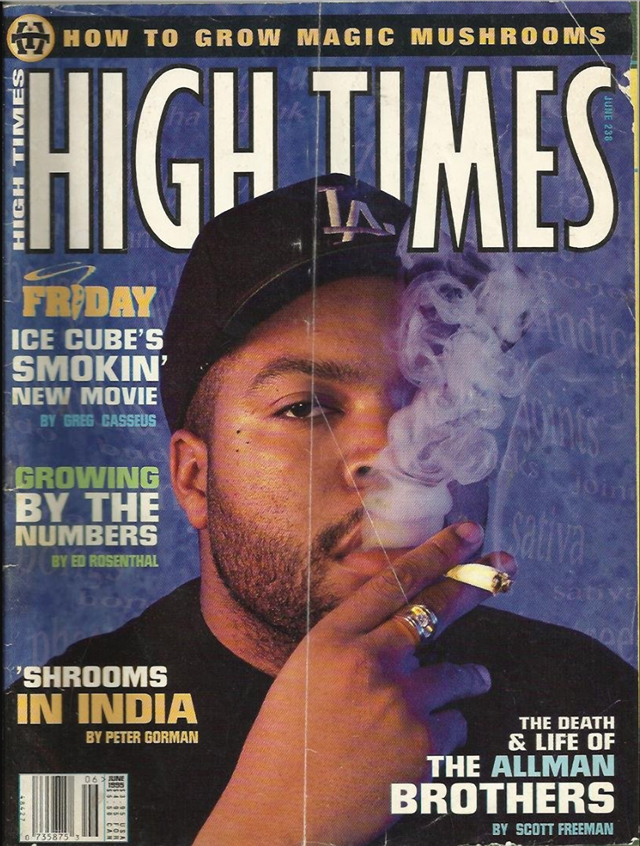

High Times plans to piggybank on the growing acceptance of legal marijuana through events, including its Cannabis Cup series — a festival circuit that often features veteran rappers and competitions such as best marijuana strain or pot-infused edible.

Ticket sales and sponsorships from these events will make up the vast majority of the company’s revenue, High Times’ pitch deck claims.

So far, the strategy has yet to pay off.

High Times’ 2018 revenue was $14.7 million, or 2% more than 2017, but operating costs are $28.5 million or 70% more, compared to last year.

The extra expenses come from advertising the Regulation A offering and acquisitions — including the purchase of online cannabis news outlet Dope Media Inc.

The company also has debt obligations, including $17.4 million owed to ExWorks Capital, debt that matures in February.

Fox said High Times’ debt does not pose an existential threat to the company.

“We’ve received indications of interests from strategic partners,” he said via email. “The company’s current debt load is limited to an asset backed loan similar to that of other companies in the space.”

Fox also claimed high times are ahead, including an event schedule that will make the company profitable by 2020.

“We remain bullish on the opportunity to create events where cannabis consumers can safely interact with cannabis and non-cannabis brands,” Fox emailed. He added that municipalities will perhaps become more accepting of marijuana events, allowing the company more leeway in holding its Cannabis Cups.

Any loosening of municipal attitudes toward marijuana would be a boon for High Times, which has struggled to get event permits in certain jurisdictions.

In 2018, for example, the city of San Bernardino voted against giving High Times a permit for the Southern California Cannabis Cup, but this year city officials approved a Memorial Day weekend event hosted by Ice Cube.

The 2020 profitability target is perhaps overly ambitious, said Mark Washburn, an economics professor at Cal State Long Beach.

Burns says the reimagined High Times is an interesting gambit to “find a federally legal way to get into the marijuana industry,” but added, “festivals and online web magazines do not typically generate high valuations.”