Charlie Financial Inc., a senior-focused banking startup in Pasadena, on Oct. 31 announced $16 million in series A funding and $7 million debt financing. That’s more than double the initial funding of $7.5 million in May and comes less than six months after launching.

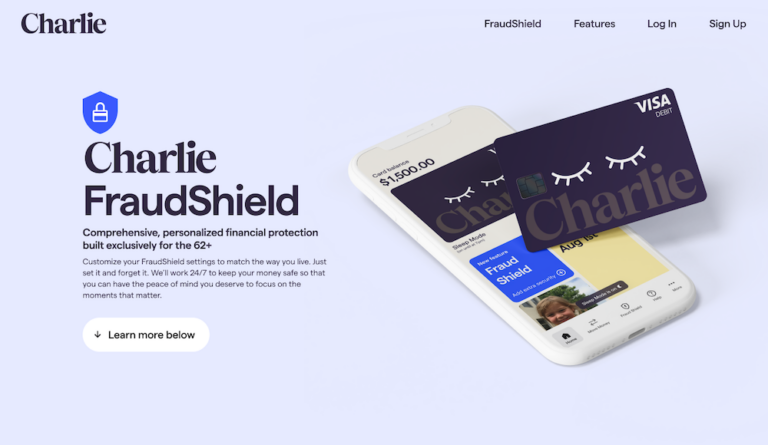

A week later the company launched FraudShield, a suite of features Charlie says addresses industry blind spots for older Americans’ spending and monitoring habits. Charlie itself is not a bank but can unlock advanced access to retirees’ social security checks on its platform without charging interest or service fees. The company partners with Sutton Bank to insure all deposits up to $250,000 and offers 3% earnings on account balances.

The latest update will be available for free for Charlie customers, a base now totaling in the thousands across all 50 states since the startup’s launch in May. According to Kevin Nazemi, Charlie’s founder and chief executive, the founding team believed targeting an older audience was a blue ocean bet for fintech but Charlie’s sizeable growth in its first months of operating raised the stakes for development acceleration.

“Whenever you launch a new company, it’s nerve wracking,” Nazemi said. “There was a collective sigh of relief when we saw so many customers signing up and we knew our approach to banking services for 62 (and up) Americans was resonating.”

Charlie markets through online channels like Facebook, where older Americans are more likely to scroll than other social media platforms, and through partnerships with Medicare brokers.

Charlie’s main source of revenue comes from interchange fees on the Charlie Visa Debit card, in which Visa Inc. pays Charlie a percentage of money earned from merchants.

With the new funding, Charlie plans to hire talent and develop new products.

Its FraudShield feature may be the most compelling sales pitch to date for aging Americans vulnerable to elder fraud and financial abuse. Beyond the standard transaction review done by most financial institutions, where algorithms parse through transaction descriptions and amounts and then cross-reference these with user data, Charlie added tools like sleep mode for debit cards and limits for online, in-person and international spending.

Sleep mode means the Charlie card will block transactions when customers set this status for times they know they won’t be using their card.

If customers don’t shop online or conduct business anywhere else in the world, Charlie can also block all online transactions as well as international transactions. If someone still wants to use their Social Security deposit on an Amazon.com Inc. Prime membership, Nazemi says certain sites can still be activated.

“Consider something as simple as online limits,” Nazemi said. “If a Charlie customer only shops online at Amazon, all other online transactions can simply be toggled off.”

Such narrow restrictions to online transacting may weed out the scammers looking for Charlie’s target customer base. The FBI estimates senior citizens lose more than $3 billion each year to financial scams, and elder financial abuse is worsening. Between 2019 and 2021, reported losses from elder fraud more than doubled.

As scammers get more creative online, Charlie aims to combat the trend by making fintech more personal. Customers can bring on family members with Fraud Alerts Co-Pilot, which allows limited access to receive alerts on spending habit changes. Users can also add photos to their account page – a unique touch acting as a digital certificate of authenticity.

When building fintech for folks who had the majority of their life defined by paper billing, Nazemi and his team aimed for an intuitive platform.

“Charlie took into account how the 62+ community utilizes technology and built transparent and controllable services and support for retirees to manage their financial future,” Nazemi said.