Car leasing and financing provider Fair closed on a $50 million credit line from Silicon Valley Bank to buy cars for its users.

This is the latest in a series of transactions the Santa Monica-based company has made with lenders as it scales globally.

The credit line with Santa Clara, Calif.-based Silicon Valley Bank complements credit lines Fair is already accessing with Credit Suisse and Goldman Sachs.

It also follows Fair’s closing in December of a Softbank Group Corp.-led $385 million Series B round. Following this round, Fair now has access to nearly a $1 billion in debt capital since its 2016 founding and has raised more than $500 million in equity to date.

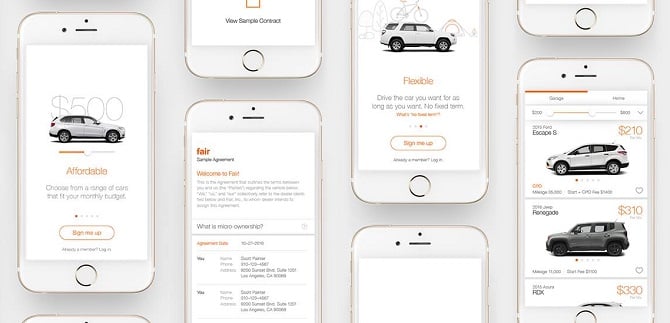

Fair provides a smartphone app that lets users choose and lease a car Fair owns and provides financing options for the lease. Users pay a monthly fee for a Fair car, which comes equipped with roadside assistance and a limited warranty. Fair drivers have the option to purchase insurance from Fair, up to a $500 deductible for an additional $115 per month.

Its existing investors include Moonshots Capital, based in Marina del Rey, and San Francisco-based investors Sherpa Capital and G Squared Capital; Mountain View, Calif.-based BMW i Ventures; Bloomfield Hills, Mich.-based Penske Automotive Group; Exponential Ventures, a unit of MMI Holdings in South Africa; Germany’s Munich Re Venture’s Ergo Fund; and, Beijing-based CreditEase Corp.

Finance reporter Pat Maio can be reached at [email protected] or (323) 556-8329.