Westwood-based Fintech company Sunbit is venturing into the payment card industry with the introduction of its own no-fee credit card that will primarily compete with buy now, pay later firms such as Klarna, Affirm and Sezzle.

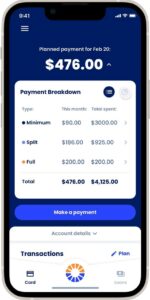

In addition to standard credit card features, the Sunbit Card offers personalized APR for approved users and allows them to pay individual transactions in full or in three-, six- or 12-month payment plans. There are no annual fees, application fees, late fees or penalty fees — nor are there fees to add or remove a transaction from a payment plan at any time. The card is managed through the company’s MySunbit app.

“I think what we’re trying to accomplish is having the best of all these different (payment solutions) all together in one card with no fees and a mobile app that does all the heavy lifting for you,” Bill Walsh, Sunbit’s chief customer officer, said. The card is issued by Utah-based TAB Bank pursuant to a license from VISA.

So far, the Sunbit Card has clocked in more than 65,000 early-access cardholders and has 400,000 additional consumers on its invitation list.

Expansion

Sunbit also has a point-of-sale lending option available at about 14,000 locations across the country that includes businesses such as auto dealership service centers, optical practices, dentist offices, veterinary clinics and specialty healthcare services.

However, there is a lot of ground for the company to cover, according to Chief Executive Arad Levertov, who said that Sunbit’s goal is to expand the adoption of its card. According to a report by finance analysis website pymnts.com, the United States’ business market was made up of nearly 29 million small and medium-sized merchants in 2020.

“There’s a large merchant base out there and Sunbit has a small market share,” said Dave Maddox, a payments industry consultant with independent payment consulting firm Thinkpayments and retired business development leader at IBM. “They’re targeting the subprime marketplace, which is an underserved marketplace, no doubt.”

Maddox added that buy-now-pay-later (BNPL) services and companies gained significant traction during the pandemic, when card users in the subprime category were most likely out of work and not able to qualify for a credit card. Since then, BNPL transaction volumes have come down, with companies such as Affirm losing more than 75% of its value as of this February. Affirm’s stock trades at about $35 nowadays, a far cry from late last year, when its stock was trading at more than $160 per share.

“The way (Sunbit is) targeting looks good to me, at least in the fact that they’re focused on individual segments where subprime consumers would get in trouble and need to finance something,” Maddox said, using auto shops as an example of a place where consumers might run into unexpected financial trouble that could be helped by Sunbit’s offerings.

Filling in gaps

The Sunbit Card took more than two years to develop, according to Walsh, who said that the company spent a significant amount of time researching what gaps in personal finance its card could fill.

One issue found in Sunbit’s research was that more than half the customers in the study had multiple checking accounts used to handle different purchases.

“I think when we started to see these common themes with personal finance life hacks that customers were doing in order to make it all work, it inspired us to kind of go down that road and feel like we were onto something,” Walsh said.

However, Walsh added, there awaits a big challenge for Sunbit if it is to grow its card user base: reimagining how a card works in an industry in which there is card-based legacy technology that consumers are familiar with.

“They’ve got to get consumer demand, educate consumers and make sure people are comfortable with the application,” Maddox said. “And they’re competing against PayPal, they’re competing against some (firms) that have real name recognition, like Klarna.”

Convincing consumers is just one piece of a larger puzzle, according to Maddox. He said that successfully pushing the product to merchants over competitors will be a challenge, as it is likely that merchants will stick with one finance solution over juggling multiple platforms from different companies.

The way Sunbit structures its merchant agreements, which are extensive and detailed documents, will also be a determinant in how successful the company is in convincing merchants to adopt its services, according to Maddox.

Maddox said if he was to invest in the company, he would want to better understand Sunbit’s projected loan losses, current loan losses and how it plans to get more merchants on board. “They’re going after the subprime marketplace with a credit card, which makes it even more challenging to understand what (their) potential loan losses could be,” Maddox said.

Levertov said that the advantage Sunbit has is that it has collected a lot of data in the last six years of business. “There is always a challenge when you provide credit, but we are confident in our ability to measure it and to overcome it, because that’s what we’ve been doing over the years,” Levertov said.