The Beachbody Co. Inc., a subscription health and wellness service, is working on a turnaround after receiving notice its stock could be delisted by the New York Stock Exchange due to an “abnormally low” price.

In October, the El Segundo-based company announced several initiatives that its leadership hopes will restore growth and generate positive cash flow. In addition to a rebrand, the company added a C-level performance advisor, new price points and altered the payment structure for its fitness partners who produce content and sell products for the brand.

Whether the initiatives make a difference remains to be seen. The company released its third-quarter earnings on Nov. 7, with revenue at $128 million, down from $166 million in the same period last year. Digital revenue was $64.3 million compared to $72.2 million in the prior year period and digital subscriptions totaled 1.38 million in the third quarter, down from 1.53 million in the second quarter.

The company’s stock dropped from 19 cents to 17 cents in after-hours trading following the third-quarter earnings report. The company’s stock has been under 50 cents since late March after peaking earlier that month at 85 cents.

Delisting risk?

In November last year, the NYSE issued a deficiency letter to the company notifying it that it was not in compliance with applicable price criteria in the NYSE’s continued listing standards. The company’s class A common stock was less than $1.00 per share over a consecutive 30 trading-day period.

A company spokesperson told the Business Journal that the company’s stock is not being delisted from the NYSE and the company will have a “shareholder vote on Nov. 20 to ratify a reverse stock split which will resolve delisting concerns.”

Despite its downturn, company executives say they believe in the company’s plan to become profitable.

Going public

Beachbody was cofounded in 1998 by Daikeler and Jon Congdon as a distributor of home exercise DVDs. Since then, the company has gone digital with workouts and diet products. It went public in January 2021 in a deal valued at $2.9 billion, with a revenue forecast of $1 billion.

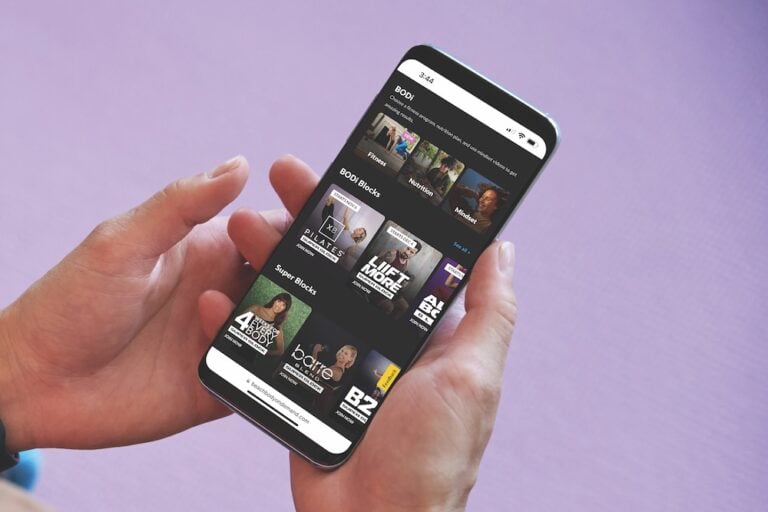

In the last two years, however, its market cap dropped to $64 million. In an effort to combat its plummeting numbers, the company rebranded in March as BODi, which stands for Beachbody on Demand Interactive. The rebrand was in part to focus more on consumers’ fitness goals rather than pursuing the goal of the chiseled “beach body.”

Then in May, the company was hit with a class action lawsuit from its network of fitness coaches, who alleged they were underpaid.

According to the Los Angeles Times, Beachbody uses a network of more than 300,000 coaches who encourage followers to engage with Beachbody exercise regimens and buy Beachbody products. Those coaches are also responsible for recruiting more clients and coaches.

According to the report, the coaches are supposed to earn commissions from product sales to new customers and earn additional income from the sales of the entire downline organization. In 2021, however, nearly 26% of coaches claim they did not receive a single commission check.

While the company initially classified its coaches as independent contractors, a 2019 California law went into effect that no longer allowed Beachbody to place its coaches in this category.

The lawsuit aims to require that Beachbody pay coaches four years’ worth of unpaid wages and business expenses. Per the Times, the company could also be liable for thousands of dollars of statutory penalties under the California labor code.

“The independent contractor status of direct sellers is well recognized on a federal and state level, including California, as part of a well-established legal framework that allows distributors to remain independent to allow them to work as much or as little as they want, controlling their own schedule,” said a Beachbody spokesperson. “We will vigorously defend ourselves against these allegations.”

As part of the revamp, in October, the firm updated its compensation structure for its independent distributors. Beachbody announced that its “partners” – the name it calls its coaches who distribute BODi products and services – would now receive an adjusted compensation plan to “more closely align with industry norms to incentivize both newer partners and BODi’s most productive partners with a sustainable, scalable, results-driven structure.”

A company spokesperson said “the changes were designed to provide a more compelling and rewarding business opportunity.”

New hire

In addition, last month, the company appointed performance coach and author Brendon Burchard as its chief growth and performance advisor. Burchard is also founder and chief executive of Napa-based GrowthDay, a subscription-based “self-improvement” app. Select content from Burchard and the GrowthDay will be available to the BODi network this month.

“Brendon is a world-renowned high-performance coach who will be working directly with our partner network to drive their productivity,” said Beachbody’s spokesperson. “Starting Nov. 9, content from his GrowthDay personal development app will be sampled on the BODi app, and subscriptions to the full GrowthDay will be offered by our partner network to prospective customers along with our existing deep portfolio of fitness, nutrition products and healthy eating programs.”

Beachbody has also issued a simplified monthly digital and nutrition subscription package called the “$99 Rebel” to provide new subscribers an option to offset inflation concerns. In addition, the company will streamline the release of new content into its digital fitness library, creating a fully integrated database of digital fitness, nutritional products and healthy eating programs.

“In this economic environment, this option makes our total solution of fitness, health and mindset more affordable on a monthly basis and gives our partners a lower out-of-pocket entry point to bring in more new customers,” said the company spokesperson.

“All of these initiatives are based on strengthening the business model and creating a strong foundation for the future. The changes are consistent with what we have shared on previous earnings calls and recent IR webcasts. We continue to innovate and stay true to our vision.”