Digital subscriptions, like the rent many Angelenos face at the first of every month, have become expense staples in the streaming and e-commerce era. Altro, a fintech platform that powers credit building through subscription payments, has increased its availability to Angelenos and customers across the U.S.

On March 6 the downtown-based company launched the Altro Credit Builder Card, which expands customer access into 47 states through an issuing and operating partnership with the nationally chartered Hatch Bank and Discover Global Network.

The company also disclosed a $4 million bump in funding, with its latest round roping in celebrity investors including Tinashe, Chris Paul and Marshawn Lynch. Altro’s total funding now stands at $22 million.

Despite being headquartered here since its founding, Altro wasn’t available to customers in California prior to this partnership.

Bringing on Hatch Bank and Discover expands the fintech’s footprint, but Altro emphasizes customers won’t directly interact with these partners since no physical Credit Builder Cards will be issued and customers can automate monthly payments through the Altro app.

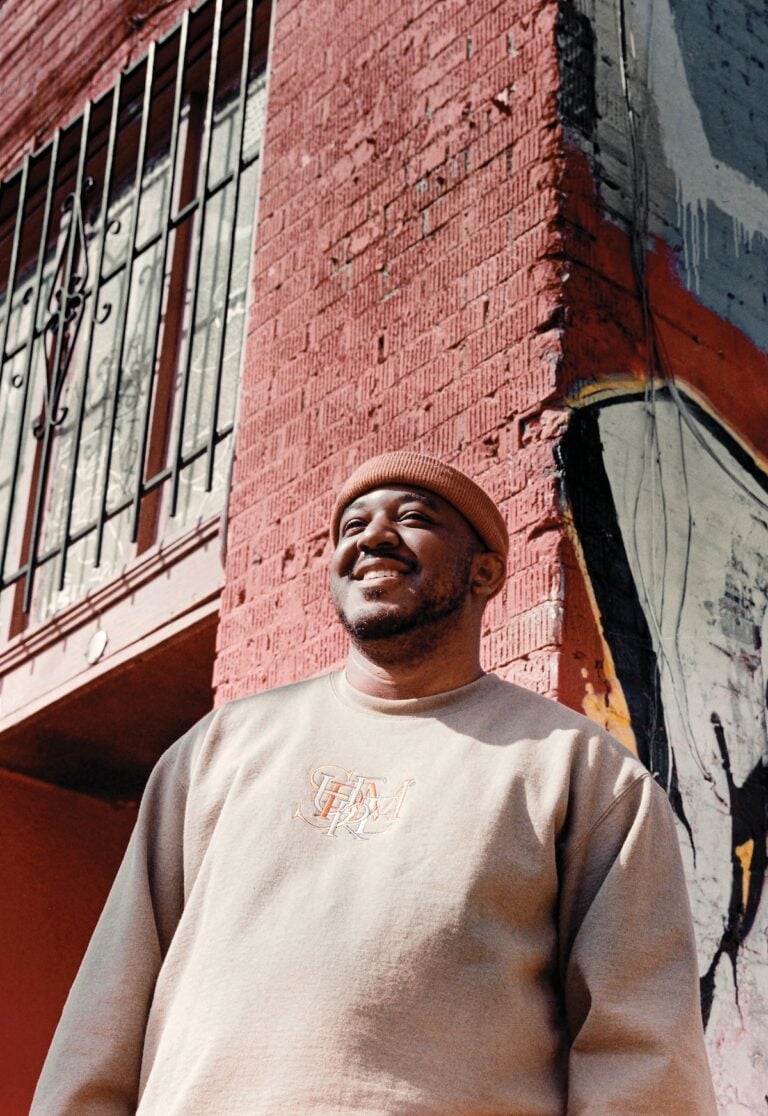

Michael Broughton, Altro’s chief executive, said Discover signed onto the deal with the hope Altro would become a core network product and driver for new-customer acquisition.

“They’ve always been seen as the third company in the credit space,” Broughton said. “They’re actually paying Altro and investing in Altro for getting our volume numbers up, and their incentive is that they get to grow their network.”

Broughton and his team expect to onboard between 20,000 and 40,000 users on its app this year. To qualify for the Altro Credit Builder Card, users must opt into Altro’s premium membership for $9.99 a month. Once subscribed, other recurring transactions from participating services such as Netflix, Spotify, and Amazon Prime can start funneling through the Altro’s trade line, which ultimately influence FICO scores. This data being shared with all three credit bureaus is key to building customers’ credit.

Altro has iterated its core business model across the company’s stages, starting in a South Central hacker house and past its incubation in the coveted Y Combinator startup accelerator program.

The platform started with free access – keeping the lights on through interchange fees and hype from an early investment by Jay Z’s Marcy Ventures. But, according to Broughton, this model didn’t provide sufficient cash flow for greater expansion.

In bringing on Discover, Altro pivoted to include some business-to-business revenue, as well as the subscription money stream.

“They forced us to have a working business model,” Broughton said. “Something that a lot of fintechs don’t have.”

Though this model is still in its early days, Altro ultimately aims for $3 to $5 million in annual revenue before looking toward a series B fundraise.

For now, with a fresh capital injection coinciding with a national expansion, Altro is focused on building an engaged user base through community events nationwide.

While Altro has set up stands in malls, in front of churches and even around payday loan centers across Los Angeles, coordinating a nationwide user-recruitment network is a whole different league.

Broughton says a community ambassador program is in the works, and the company is hoping to secure local tie-ins for those looking to improve their credit profile.

“We work with a lot of underserved communities,” Broughton said. “But the main effort is to help people go from that stage one to stage two in their credit journey.”