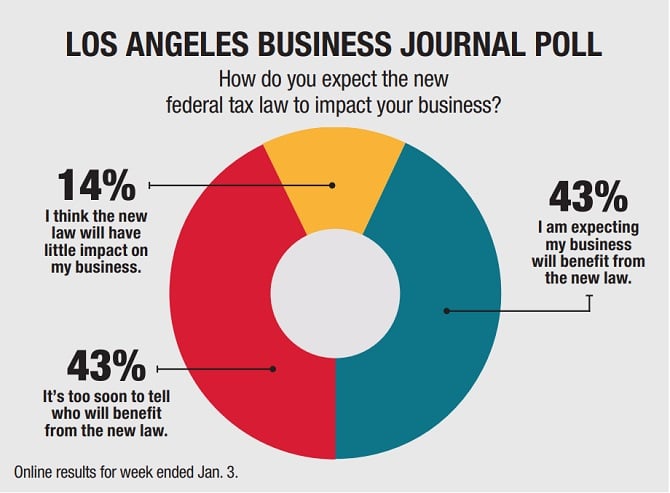

A Republican-controlled Congress passed a sweeping tax law in December that cuts corporate tax rates. So the Business Journal asks: How do you expect the new federal tax law to impact your business?

Corey Epstein, Co-Founder, Co-Chief Executive, DSTLD

We are hoping the reduced corporate tax rates will encourage more investment in apparel manufacturing in Los Angeles and the U.S., which would allow us to expand our local production capabilities.

Thor Steingraber, Executive Director, Younes and Soraya Nazarian Center for the Performing Arts

I find that our supporters are motivated foremost by our mission and programs. I expect that will ensure ongoing consistency, even in the face of the federal tax overhaul.

www.valleyperformingartscenter.org

Rich Whitney, Chairman, Chief Executive, Radiology Partners Inc.

The tax law is relatively neutral for us largely because of the interest deduction disallowance.

Business Journal readers weighed in, as well: