1. The economy is strong—how much will the Federal Reserve

really move?

What recession? The Q4 Gross Domestic Product (GDP) print showed the U.S. economy grew at a 3.3% annualized pace, more than economists expected. More notable is that the strength came as inflation continued its decline. As the first data reads of 2024 have trickled in, investors have pared back their expectations to a more reasonable 140 basis points from the prior 170 basis points Over the year, we expect markets and the Fed’s own forecasts to keep growing closer together.

2. Corporates are back in action — but how big is the turnaround?

The last couple of years have been weak for corporate activity — whether you look at earnings or merger and acquisition activity. Now, with less economic uncertainty and (potentially) lower interest rates, the tides seem to be turning. As the Q4 2023 earnings reports continue, we think we’ll end up seeing profit growth for the quarter.

3. While U.S. stocks notch highs, China’s are at decade lows — is there a turning point ahead?

China has announced a number of measures to support its economy and markets. Some wonder if there could be an inflection point, given all the bad news priced in: Hong Kong’s Hang Seng Index has been hovering around Global Financial Crisis levels, and India just topped Hong Kong as the world’s fourth-largest stock market. We think more forceful stimulus measures, or a comprehensive plan to rescue the property sector, is needed for a turnaround.

4. 2024 is the year of elections — what does a Trump versus Biden rematch mean?

Former President Trump has now claimed victory in both the Iowa caucus and the New Hampshire primary. Thus, it looks like we’re racing towards a Biden versus Trump rematch. We await more details on what both candidates’ policy platforms will look like. However, having this much information this early in the election cycle means there may be fewer possible outcomes for which markets need to calibrate.

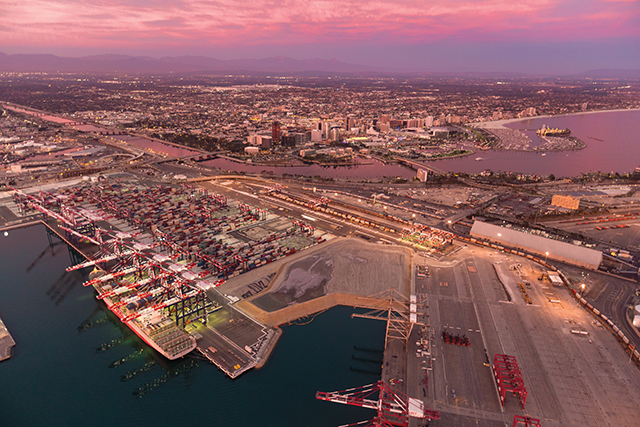

5. Geopolitical flashpoints — what’s the spillover?

After most gauges of supply chains normalized from unprecedented COVID-era disruption, the situation in the Red Sea has complicated the picture. Some question if that brings renewed inflation risks, as hundreds of giant container ships are forced to take a lengthier detour. Shipping costs have now risen for seven straight weeks. Such geopolitical tensions are concerning and warrant monitoring, but so far it appears the disruptions in the Red Sea just make trade more difficult.

Rick Barragan is the Managing Director, Los Angeles Market Manager, for

J.P. Morgan Private Bank.

[email protected] | (310) 860-3658

Source: J.P. Morgan Private Bank, January 26, 2024. “Contemplating the catalysts: 5 market movers” By Madison Faller, Global Investment Strategist, J.P. Morgan Private Bank.