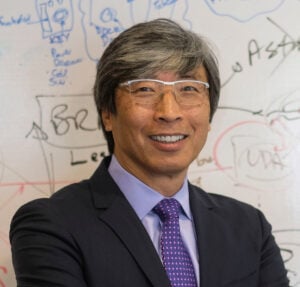

Culver City-based immunotherapy company ImmunityBio Inc. last month received yet another capital infusion from founder and billionaire Patrick Soon-Shiong – this one as part of a $157 million financing package.

In a Dec. 12 announcement, ImmunityBio said Soon-Shiong’s personal investment company, Nant Capital, had agreed to provide $50 million in debt financing. Soon-Shiong also agreed to convert approximately $56.6 million in debt held by his company NantWorks into shares of ImmunityBio, essentially freeing ImmunityBio of those debt payments.

The remaining $50 million was in the form of equity financing from a single, unidentified institutional investor. That same investor also has been issued warrants that can be used to purchase up to $60 million worth of additional shares at a later date.

This financing package comes almost exactly a year after ImmunityBio announced that Soon-Shiong’s Nant Capital had loaned it $300 million.

Soon-Shiong is also by far ImmunityBio’s largest shareholder. With the addition of nearly 9.1 million shares from the debt-to-equity conversion, his stake is now 323 million shares, or 79% of all common shares.

But it’s been a rough ride for Soon-Shiong and ImmunityBio since it went public in March 2021, when his stake was worth nearly $12.2 billion at the end of the first day of trading. As of Dec. 19, Soon Shiong’s stake in ImmunityBio was $1.85 billion, a drop of $10.3 billion, or roughly 85%.

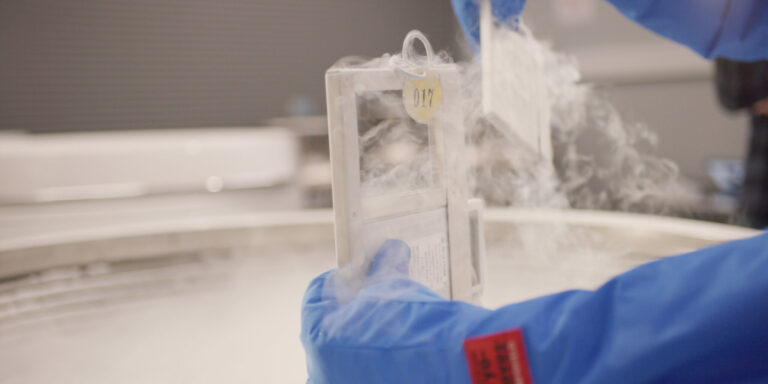

ImmunityBio is developing an immunotherapy platform with the goal of treating a broad range of cancers and other diseases. During the Covid crisis, the company pivoted to developing a Covid vaccine, which is still in the clinical trial phase.

Overall, the company’s pipeline consists of drugs in 27 clinical trials –17 of which are in phase 2 or 3 development – to treat liquid and solid tumors, including bladder, pancreatic and lung cancers, as well as infectious diseases.

Proceeds from this latest financing package are intended to support Immunity Bio’s clinical development programs and pre-commercialization efforts and other capital expenditures.

Investors initially greeted the financing package favorably, sending ImmunityBio shares up 10% on Dec. 12 to $6.77 a share. But a week later, on Dec. 19, the share price plunged 11% to close at $5.72; the drop far outpaced the 1.5% drop in the Nasdaq composite index for that date.

The company did not provide direct comment for this financing package.

But in the prospectus for the share-offering package, the company did offer this observation on the current state of the market for biotechnology and pharmaceutical stocks:

“The stock market in general and the market for biopharmaceutical companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies,” ImmunityBio said in the risks portion of the prospectus. “The market price of our common stock has been and may continue to be highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control.”