California is consistently at the forefront of lifestyle trends in the U.S. from music, art, and film to fashion and beauty. Our state continues to lead the way in the apparel, beauty, and lifestyle brands space with both traditional wholesale operators and digitally native brands. Not only have these sectors been performing well, but they have attracted interest from investors in both the private and public markets.

California-based companies like The RealReal and Kopari Beauty have developed into category leaders driving a significant brand following. Based in San Francisco, The RealReal provides an online marketplace for consigned luxury goods. The company has cemented its leader status by becoming the first consignment business to issue an Initial Public Offering (IPO) in recent history and quickly became a stock market darling with its trading price increasing by nearly 50% since its first day of trading in June 2019. Similarly, San Diego-based, Kopari Beauty has become an industry leader in the beauty space. Kopari creates a wide range of beauty products that are a natural extension of coconut oil, which is free from sulfates, silicone, parabens, and other harmful ingredients. With its attractive strategic positioning, the company received $20 million of development capital from Unilever Ventures, Mistral Equity Partners, University Growth Fund, and L Catterton in July 2019. Ultimately, interest in the company was driven by its sustained category dominance and successful marketing integration to reach a wide and growing consumer set.

TRENDSETTERS AND DIRECT TO CONSUMER BRANDS ARE AT THE FOREFRONT OF DEAL ACTIVITY

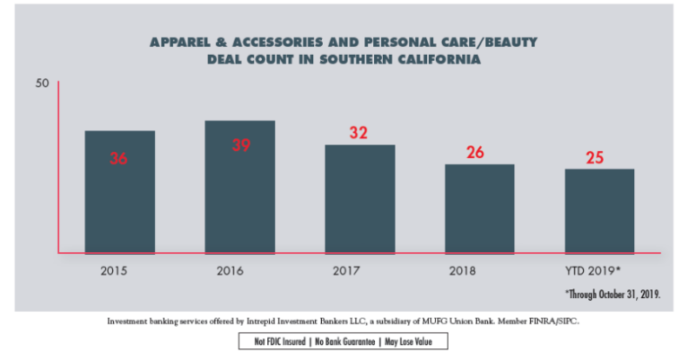

On the heels of successful trend-setting companies based in California, M&A and investment activity continues to surge. While M&A markets continue to be highly active, Southern California and Los Angeles have been a hotbed for capital investments in the fashion and beauty categories. Globally, M&A in the fashion and beauty & personal care industries has shown consistent results over the past 24 months. In 2018, more than 500 M&A transactions were recorded in the space, and through October of 2019, the industry notched nearly 400 M&A transactions globally. Various factors have influenced the M&A landscape for these sectors in the past few years, including an evolving retail environment, breakthrough technologies, and sustainability trends. Perhaps the most notable element for strong M&A underpinnings is the rise of digitally native consumer brands, and it is no surprise that California has been leading the way in seeing investment activity in these industries.

Southern California M&A has been consistent over the past five years, with more than 25 M&A transactions in the space each year—we have already seen 25 M&A transactions through October of 2019. The high-profile deal of 2016 in which Marina Del Rey-based Dollar Shave Club sold for $1 billion to Unilever, set the stage for various lifestyle-focused consumer transactions in the years to follow. In 2017, Intrepid client San Francisco-based direct-to-consumer provider of natural deodorant, Native was sold to Procter & Gamble for $100 million. Certain parties were interested in growing the brand beyond the direct-to-consumer channel, while other groups were interested in leveraging the company as a platform for further expansion into new product categories focusing on the company’s natural positioning. In 2019, a leading designer and distributor of branded planners, crafting and paper accessories, and an Intrepid client, me & my BIG ideas (mambi) sold a majority interest to Main Post Partners. Parties were interested in mambi’s unique voice with consumers and strategically guiding the company into new channels and product categories. Both mambi and Native had strong consumer followings and either a proven eCommerce platform or clear pathway for eCommerce opportunity.

CONTINUED INTEREST IN MATURE MARKETS

Southern California continues to be a hotbed for not only M&A but also other forms of minority and outside investment for brands in what some consider to be mature markets. Just this past August, Encinitas-based Vuori, an online lifestyle platform selling performance apparel, raised $45 million of Series B venture funding from Norwest Venture Partners. Vuori has been able to create a positive brand experience for devoted customers by developing products with a unique perspective on athletic apparel that transitions from physical activity to leisure and beyond. Other categories have continued to succeed in what people felt were mature markets. Huntington Beach-based Jolyn Clothing, the designer and retailer of women’s swimwear, received development capital, also from Norwest Venture Partners to continue serving the aquatic lifestyle marketplace. Further, in August 2018, Gardena-based Next Level Apparel, the eighth largest supplier in the apparel promotional products industry, received a growth investment to further expand its differentiated, innovative offering from Blue Point Capital.

PREMIUM DENIM…HERE TO STAY?

After the financial crisis, the industry thought the Los Angeles premium denim market was dying. Contradicting the skeptics, we’ve continued to see LA-based premium denim brands like Mother Denim, FRAME, and Amiri continue to set trends. In June, luxury brand Amiri known for its rock-n-roll inspired apparel received an investment from Renzo Rosso, the founder of Diesel, to support its continued growth. Furthermore, we saw heritage brand Levi Strauss go public earlier this year with an impressive debut on the New York Stock Exchange.

MARKETPLACES AND RETAIL

While edgy, trend-setting brands have been at the forefront of investment activity, eCommerce marketplaces and traditional retail have also received interest from investment capital. In June of this year, LA-based online fashion retailer Revolve Group Inc. raised $212 million in its IPO, and in 2017, Sun Capital invested in Windsor Fashions, a leading specialty retailer of events-driven, fast fashion women’s apparel, footwear, and accessories.

LOS ANGELES LEADING THE WAY

With Los Angeles continuously exporting its style to the rest of the world, we expect our city to continue to be a target for investment capital. Our backyard continues to breed the fashion and beauty leaders of tomorrow while attracting talent away from Silicon Valley to create a vibrant Silicon Beach. We are confident Los Angeles will continue to lead the way in the fashion and beauty industries for years to come.

Marvin Padilla is Managing Director and Head of Apparel & Lifestyle Brands at Intrepid Investment Bankers, a subsidiary of MUFG Union Bank. He can be contacted via [email protected]

Sources: Intrepid proprietary Apparel & Lifestyle Brands and Beauty & Personal Care transaction database, S&P Capital IQ, public company filings, and industry research sources.