Dakota Semler, the chief executive of Xos Inc., was headed south on San Fernando Road between Glendale and Atwater Village earlier this month in an electric-powered step van when he pulled up behind a Fed Ex Express delivery truck.

“You can see Fed Ex, one of our customers,” said Semler, whose company makes electric trucks. Although that delivery truck was powered by diesel, it’s one that could be electrified in the not-so-distant future.

The Atwater Village manufacturer already has sold a number of EV-powered delivery step vans to Fed Ex Ground, another division of the Memphis-based delivery services company, Semler said.

“Fed Ex Ground is one our biggest customers,” he added. “Fed Ex Express is a different division, and we are working closely with them on some vehicles.”

The step van that Semler was driving is, as he described it, a big aluminum box that rattles a lot, especially when empty. But even with the rattling it is still quieter than a diesel van, he said.

“Once a driver gets in, they don’t want to get out of it,” Semler added.

Xos, which had started out in North Hollywood as Thor Trucks before the name change in 2019, is among a number of electric vehicle manufacturers in the Los Angeles area. But it is rare among those companies in that it is actually getting vehicles into the hands of customers, including Fed Ex Ground in suburban Pittsburgh, Merchants Fleets in Hooksett, New Hampshire, and Loomis Armored US, a leading cash-handling company across North America that is a division of Loomis AB, in Stockholm, Sweden.

Nate Springer, vice president of market development at Gladstein Neandross & Associates, a Santa Monica-based consultancy that advises fleets on the transition to zero emissions, said that it’s a fact that the Los Angeles area had a high density of logistics, supportive policies at the local level and the technological expertise for electric vehicle companies to thrive.

“L.A. has the opportunity to ride what is going to be a rocky growth but eventually emerging as a leading region with an ecosystem of solutions and companies that will benefit,” Springer said.

The cost of an Xos truck depends on the configuration, the battery size and the range.

But a typical step van can cost between $130,000 and $150,000, Semler said, adding that a diesel van can cost between $80,000 and $100,000.

“When you compare that, obviously the premium on the acquisition is a bit higher for an electric vehicle,” Semler said.

But where fleets are keenly incentivized to go electric is in the operational costs. The second biggest expense in operating a fleet is fuel, with the first being maintenance.

According to Xos, the monthly cost of diesel, at $5.40 a gallon, is $2,159, compared to $792 for electricity at 22 cents a kilowatt, based on the assumption the vehicles are traveling no more than 120 miles a day.

“So, when you factor in fuel and maintenance costs what we try to achieve is pricing that gets you to a total cost of ownership that is lower than a diesel in the first five years,” Semler said. “All of our vehicles can do that without subsidies and that is what is most compelling to these fleet operators.

“Many of them will keep their trucks for 10 years, 15 years and in that case they are saving money for five, 10 years beyond that inflection point,” he added.

Xos makes its trucks at an automated factory in Tennessee. It is on track to produce 300 trucks this year with the capability of making 2,000 a year, Semler said.

The following is a status update of other electric vehicle makers in the Los Angeles area.

Faraday’s future

Carsten Breitfeld is chief executive of Faraday Future Intelligent Electric Inc., another manufacturer of electric vehicles. Unlike Xos, Faraday has not started production on any of its vehicles yet.

“The company went through a challenging and difficult time, but we are getting back on track now,” Breitfeld said in an interview with the Business Journal.

It is currently working on a new timetable for starting production on the FF91 Futurist, its first car to be made. Because of the financial difficulties the company faced this year, it had to slow down the FF91 program to preserve cash, he said.

“We are going to be announcing a new SOP (start of production) date soon and it will be next year but not too far into the year,” Breitfeld said.

The company also recently announced that it had received a new equity line of credit of up to $350 million to keep the business operating.

The cost of an FF91 will vary from the base model going for $120,000 all the way up to $250,000 for the full version of the car.

The FF81, a smaller version of the 91, but sitting on the same platform will sell for between $75,000 and $80,000, while the still smaller FF71 will start at $45,000.

The company, however is not moving ahead with the FF81 and FF71 and is instead putting all of its effort into the FF91, Breitfeld said.

To sell the cars, Faraday is relying on three different methods.

First is direct sales to customers through the company website, which Breitfeld said would take place “more and more.”

Second, was through brand stores with the first being in Beverly Hills.

The retail space will create an environment where users can experience Faraday Future; it will highlight the brand’s technology, luxury, and design. Located at 464 N. Beverly Drive, the brand experience center is a block from the famed Rodeo Drive, according to a Faraday release from May when the center was announced.

And, lastly, they will be sold through partners – other dealerships whose employees will act as sales agents for Faraday vehicles and receive commissions on the sales.

Industrial vehicles

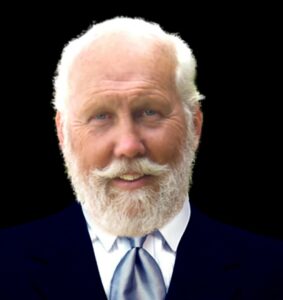

George Kettel has been in the automotive industry for more than 60 years.

The 83-year-old Kettel owns Karrior Electric Vehicles TransLectric, a manufacturer of industrial vehicles used to transport people and also used in settings such as airports to pull aircraft and in other applications.

“We are replacing all the gas-powered vehicles that are in the schools, hospitals, manufacturing facilities,” Kettel said. “The military on their aircraft carriers, we are replacing a lot of their diesel-powered vehicles with electric vehicles.”

A Karrior electric vehicle can cost in the range of $8,000 to $35,000, he added.

A dedicated sales team makes calls around the country five days a week to sell the vehicles. There are also some sales to other countries, notably Mexico and Israel, primarily to their airports, Kettel said.

The Gardena company also has a manufacturing facility in Modesto, which operates under the name Modesto Machine Works.

Between the two locations, they produce about 15 different models of electric carts and other small vehicles. Those include the double enders that were made for the San Francisco Bay Area Rapid Transit District, or BART.

Those vehicles are used in between high-powered electric lines they have in the maintenance yards. They can drive in one way, then jump in the other side of the vehicle and drive back out without turning around because there is no space. They are also used in tunnels, Kettel said.

“It is a really big industry. If you look for them, they are all over the place,” Kettel said of electric vehicles. “But if you never looked for them, you’d say you never see them.”

Busy sector

There are other electric vehicle manufacturers located in the Los Angeles area.

BYD Motors, a division of the Chinese company BYD Co. Ltd., has its U.S. office in downtown Los Angeles and factory in Lancaster in the Antelope Valley.

Frank Girardot, a spokesman for of BYD Motors, said that three weeks ago it unveiled its Type A battery electric school bus at a trade show in Texas.

“The Type A is a shorter bus and the first purpose-built vehicle of its kind in the world,” Girardot said. “Los Olivos (Elementary School District) in Central California will be the first to receive one — sometime before the 2023-24 school year begins.”

Also earlier this month, the company completed the delivery of an electric transit bus to the San Francisco Municipal Transportation Agency.

“We’re very proud of that,” Girardot said in his email. “The bus was built here in the Antelope Valley by our union workforce.”

Fisker Inc., in Manhattan Beach, is starting production at an Austrian factory on the Fisker Ocean sport utility vehicle.

Henrik Fisker, company co-founder and chief executive, said that it was an emotional day as it started production on time on what he calls the most sustainable vehicle in the world.

“We’ve challenged the old model of longer development timelines, reflecting our team’s agility and dedication to creating emotionally desirable vehicles with the newest, most unique experiences in our price range,” Fisker said in a statement. “We have the highest quality at launch, aligned with our commitment to leading the industry in sustainability.”

The Fisker Ocean’s more than 50 kilograms of recycled, biodegradable and eco-conscious materials reflect its commitment to sustainability, according to a release from Fisker.

The Ocean comes in four different models, ranging in price from $37,499 for the Ocean Sport up to $68,999 for the Ocean One and Ocean Extreme versions of the SUV.

Also located near Los Angeles, in Vernon, is Indi EV.

The car maker was recently at the Los Angeles Auto Show showing off its prototype of the INDI One car and a chassis used on the vehicle.

The company recently announced a memorandum of understanding with Hon Hai Technology Group, also known as Foxconn, to make INDI One prototypes at Foxconn’s Lordstown, Ohio factory. That is also where the Fisker Pear electric vehicle will be made.

Details of the potential collaboration, beyond the prototype build, will be disclosed later as both sides remain in negotiation, according to a release from Indi EV.

Rivian Automotive, Inc. in Irvine and Lucid Group Inc., in Newark in Northern California are other electric vehicle manufacturers located in the state. Additionally, Tesla Inc. based in Austin, Texas, has its main factory in Fremont and a new battery factory in Lathrop, just south of Stockton in the San Joaquin Valley. ElectraMeccanica Vehicles Corp., in Vancouver, Canada, has three facilities in the Los Angeles area: retail information centers at the Westfield Fashion Square in Sherman Oaks and Del Amo Torrance in Torrance for the Solo, a three-wheeled single passenger electric vehicle; and a delivery preparation and service center for the Solo in Studio City.

Bright future

Gladstein Neandross’s Springer said that he thinks the medium- and heavy-duty electric vehicle markets in Southern California have a bright future.

“Especially in the Los Angeles area,” Springer said. “There is a perfect storm of funding, new regulations and corporate sustainability goals. This is going to accelerate and fuel exponential increases in the market for EV auto makers and the other associated infrastructure.”

But if there is an impediment to the market, said Semler, of Xos, it comes from there not being enough charging stations.

“That is our biggest delay in terms of getting vehicles delivered on time,” Semler said.

To that end, the company has created Xos Hub, a mobile charging and energy storage trailer. It will begin producing the trailers next year, he said. The Hub allows the deployment of up to five chargers in one day, without any construction or need of permits, he said.

“It’s a small upgrade to your electrical subpanel; you can connect it and you have chargers for five trucks right off the bat,” Semler added.

Breitfeld, of Faraday Future, said that there will be consolidation in the electric vehicle industry, as developing, building and selling cars is one of the most difficult things to do.

“It needs a lot of experience, it needs a lot of capital, it needs the right product and the right strategy to market (a vehicle),” Breitfeld said.

Many companies get a start, but many of those companies do not make it over the line of bringing a product to market, he added.

“That is why it’s so important, and why it is our goal, to bring a product to market and move the company over the line to go from a pre-revenue to a revenue company,” Breitfeld continued.

Springer also foresees consolidation in the industry while at the same time he expects whole new industries emerging around the electrification of transportation, especially for regions that have a head start like Los Angeles.

“You can think of things like managed charging, and maintenance of charging and vehicles,” Springer said. “Innumerable products and services that we cannot even imagine yet.”