Local firms featured on the Business Journal’s list of Fastest Growing Private Companies faced several common challenges. Over the past three years the group contended with supply chain delays, hiring skilled workers in a hot labor market and adapting to fast growth. Some now are bracing for what’s beyond 2022.

Vegamour Inc. topped the list with a 1,900% increase in revenue from 2019 to 2021. (The list of L.A.’s Fastest Growing Private Companies begins on page 20.)

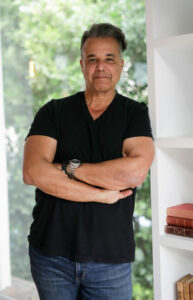

“One of the biggest issues was scaling, going from a six-person company to an 80-person company,” said Vegamour founder and Chief Executive Daniel Hodgdon. “We had to learn how to think as a midsize company rather than as a bootstrap startup. This year we’re going to do $140 million (in revenue, up from $100 million last year). We’re not a start-up anymore, but we still had that mentality. It was so amazing when we finally were able to bring in a professional HR person.”

Recruiting “during a time that was defined as the great resignation” was also a challenge, Hodgdon said. “It was such a competitive job market and not everyone wanted to work full time and hardly anyone wanted to show up at the office.”

He founded the downtown-based maker of hair-wellness products for women in 2016 with $250,000 in savings and help from family and friends. The company posted $3 million in revenue in 2019, but also figured out how to convert at least 30% of its occasional customers into monthly subscribers.

“From that moment on we started seeing 15% to 20% month-over-month growth,”

Hodgdon said. “When you’re a digital native brand as we are, strictly D2C, the acquisition costs to get a new customer are pretty expensive, especially if you’re a brand that doesn’t have any recognition. But we were able to identify who our cohort was, and explain to her that with regard to wellness, our products take roughly three months for you to start seeing visible results, and there’s no reason to buy just one (month supply) … When we figured out how to message that correctly, that was the game-changer.”

Funding didn’t come easy to Vegamour until last year when Hodgdon sold a minority stake to a private equity company, General Atlantic, for $80 million to launch additional products and expand into new channels and geographies.

“We just did it all ourselves, and then we get to the point where we were profitable, that’s when all the investment banks and PE firms started circling around,” he said. “Actually, if you can hold off long enough to where you don’t need the money, that’s the best time to raise it, because that’s going to be the cheapest money you can get. It’s always expensive when you need it.”

Vernon-based Lawrence Wholesale, tied for No. 57 on the list of fastest growing companies, also reported challenges with finding affordable financing to support its food drop-shipping operations, especially after the Federal Reserve began raising interest rates in March.

“We borrow a lot of money, and when the cost of money goes up, it hurts us,” said Chief Executive Mark Liszt, who founded the company in 2001 with $300,000 he inherited from his father. Last year the company posted $1.04 billion in revenue, a 39% increase from 2019. Liszt said the growth was partly due to an increase in the number of accounts the company serves, but also in a jump in the costs of goods it sold to grocery store chains, restaurants and distributors.

Cost increases

“The cost of manufacturing for a producer went up, the cost of labor went up, the cost of transportation went up, so the cost of food went up dramatically for 2021,” he said, adding the company also sold more goods “because many retailers that we sell to were having difficulty getting their supply from their regular suppliers, so they reached out to new people and we were able to capitalize on that.”

Liszt said Lawrence Wholesale will surpass $1 billion in revenue this year as well, but he anticipates the profitability will be cut in half, as retailers his company works with contend with overstock issues.

Doug Lodder, president of downtown-based TruConnect, is also tempering his expectations after two years of sizable growth in revenue. The internet service provider posted $265 million in sales last year, up nearly 200% compared to its 2019 top line. That put the firm at No. 13 on the list.

While the company’s co-founders, Matthew and Nathan Johnson, have been focusing on providing connectivity to underserved communities since 2010, Lodder said the pandemic validated the fact that the gap exists and that something needed to be done about it.

The influx of business from homebound students and workers, while welcome, created several challenges TruConnect’s management team had to contend with. One of them was scaling — the company needed more systems, additional customer agents and greater distribution. Some of the challenges were easy to foresee, while others were not.

“We had to adapt a lot of our systems to exist in the new world and in a new size, and that’s been really painful, as it always is with most companies who grow (at a pace) that we’ve grown,” he said.

Staffing up

The other challenge was scaling up the employee count in a way that was sustainable.

“It’s very easy to look at monthly growth in the double digits and say, ‘Oh, we need to hire 50 people to account for the growth,’ but as someone who’s managed a growing business before, you realize that’s not going to be the way forever,” Lodder said. “We have to be smart about who we hire … We are very much such a people- and purpose-driven company, and the last thing you want to do to people in a purpose-driven company is to lay off because the leadership team didn’t anticipate what should have been able to be anticipated, which is decelerating of growth as you get bigger. And so we’ve just been very disciplined. We haven’t had to lay anybody off. We are still hiring, which is good.”

Curtis Jang, chief financial officer for Long Beach-based SCS Engineers, is also looking to hire people.

“With the federal infrastructure bill that came out a couple of years ago, and then the Inflation Reduction Act, there has been a tremendous amount of money being pushed into our industry, in engineering, and we are all struggling to find staffing,” Jang said. “We have 70 to 90 open requisitions right now, and for a company of 1,100 or 1,200 people, that’s a lot. Any engineer is hard to get right now. In my opinion, the smart kids are selecting computer science over infrastructure engineering. I think that that’s been going on for several years now, and it continues to create a shortfall of infrastructure-type of engineering – civil, mechanical, chemical.”

To remedy the situation, several years ago SCS Engineers staff started getting involved with STEM programs at high schools.

“We know that that alone isn’t going to correct everything, but as a national engineering company, we’re trying to do our part to excite these kids and show them what we’re doing as opposed to what the computer sciences are doing,” he said. “I think that there’s a certain number of individuals who come into infrastructure engineering, because they want to build things, with their hands rather than with a keyboard. So we’re just trying to recapture those individuals and get them into our industry.”

The environmental consulting and engineering company closed 2021 with $349 million in revenue, up 46% from 2019, and anticipates it will wrap up this year with $430 million. It is No. 48 on the list.

“We focus on air, water, soil, remediation and monitoring,” Jang said. “And then the big thing that kind of hit us over the last couple of years, and as well as here in 2022, is (converting) biogas to renewable natural gas. What that means is, we’ll collect methane that’s coming off of a landfill, dairy, lagoons, or treatment plants for wastewater, and we clean up that gas and convert it to renewable natural gas … That market has exploded because of the carbon credits and renewable natural gas credits that are offered.”

Supply chain issues

Other challenges SCS Engineers faced include supply chain issues.

“We do see it easing up here in 2022, but prior to that, it was difficult to get a lot of our materials, a lot of our equipment. We procure most things out of the U.S., but inevitably some component on a large piece of machinery that we were purchasing is made in China and it was stuck on a ship,” Jang said. “And the other thing is inflation. Our clients and we are dealing with huge inflationary pressures, particularly as it relates to salaries and cost of materials.”

Joe Derhake’s Partner Engineering and Science Inc., based in Torrance, provides environmental and other consulting services for commercial real estate transactions — about 70,000 a year. The robust market in 2021 pushed the company’s year-over-year revenue up 68% to about $300 million. It is No. 34 on the list.

Derhake has added some 400 employees since 2019, and expanded the firm’s services, including asset management. The move is proving beneficial now that interest rates have gone up and the real estate market is cooling.

“We can say, ‘Hey, look, you bought this last year. Can we come by and tell you how to make your building energy efficient? Can we come by and talk about your strategy on solar? Can we come by and talk about ways to make your roof last longer?,” he said. “When everybody is buying, they don’t have time to think about how to actually manage it … We are thankful to have these asset management-centric businesses to pivot into.”

In addition to hiring hundreds of people, Derhake had another problem.

“We rent 45 offices, and so we very much want people to be back in the office,” he said. “However, during Covid we worked remote, and that created habits that have been hard to break, so we have become a bit of a hybrid.”