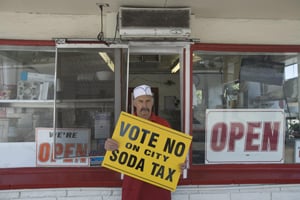

Hamburger joint owner Art Meier is mad.

The proprietor of Art’s Burgers in El Monte, Meier fears losing sales if the city’s voters approve a tax on sugary drinks that would add 12 cents to the cost of a can of Coke.

The emergency move last month by the El Monte City Council to put the measure on the November ballot was unexpected.

If it passes, Meier believes it could result in a nightmare for businesses like his, what with keeping track of how many ounces of taxable Coca-Cola, as opposed to nontaxable Diet Coke, customers get from an open fountain, for example.

“I don’t see this as right, declaring a fiscal emergency just so they can tax us,” Meier said.

He is not alone in his feelings, nor is El Monte the only city taking this tack. Retailers and business owners in Culver City and La Mirada also are facing the prospect of unexpected sales tax hikes if voters approve ballot measures in November. Emergency tax-hike proposals in two other cities – Duarte and Baldwin Park – fell short of making the ballot.

Business reaction to the tax proposals has been surprisingly mixed. Some business owners say they would rather face a higher tax than watch their cities cut more in services. Others oppose the tax hikes, saying they would drive away customers and scare off businesses from opening or locating in their cities.

The slew of proposed tax hikes was brought on by the increasingly dire financial straits cities face. After several years of budget and staff cutbacks as revenues sagged during the long economic slowdown, cities were slammed earlier this year when the state ordered the dissolution of local redevelopment agencies, forcing most cities to turn over millions of dollars each to the state.

In the last two months, three California cities have declared bankruptcy: Stockton, Mammoth Lakes and San Bernardino. In Los Angeles County, some officials in Compton have threatened a bankruptcy filing in coming months, claiming the city will no longer be able to pay its bills. But so far, there’s been no official action toward bankruptcy.

“The redevelopment kill was the accelerant for many of these cities, like a bank calling in a line of credit,” said Larry Kosmont, an economic development consultant in Los Angeles.

Tax pressures

The tax hikes have generated the most controversy in El Monte, where the City Council took a double-barrel approach. The council first voted to ask voters to extend an existing temporary half-cent sales tax hike for another five years to mid-2019.

Then, in a controversial move that grabbed national headlines, it voted to put on the ballot a five-year, one-cent-per-ounce tax on sugary drinks, including sodas, and power and fruit drinks. The measure is modeled on a proposal in the Northern California city of Richmond that’s also on the November ballot.

El Monte officials estimate the sugary drinks tax will bring in up to $7 million a year, which would more than close a budget gap estimated at just more than $1 million. The sugary drinks tax is also aimed at reducing residents’ consumption of them; advocates say this would represent a major step in reducing obesity and related health problems among the city’s majority Latino population.

The decision to ask for tax came after the council declared a state of fiscal emergency, which allowed the measure to be rushed to voters in November instead of waiting for the regularly scheduled municipal election next year.

But Meier, the burger restaurant owner, said the tax would be a huge hit, raising the cost of the largest drink he sells – a 44-ounce size – from the current $2.02 to $2.46.

“People aren’t going to pay $2.46 for a soda at my restaurant,” he said. “They will either order a smaller size, bring in their own drinks or go to another restaurant a couple miles up the street that’s in another city.”

Meier said he would also have to track the amount of soda sold to customers, which would require having his accountant spend hours recalibrating his books and eliminating free refills for his customers, among other things.

“That alone is going to be a huge burden, never mind the actual tax amount,” he said.

Meier fears that customers might order fewer or smaller drinks or even skip his eatery altogether. For Meier’s small, nondescript shop, even a slight drop in customers or sales could hit his bottom line hard.

Another issue is that not all drinks would be taxed – which might result in different prices for the same-size can from a vending machine, for example.

El Monte Mayor Andre Quintero, who authored the tax proposal, said the tax would apply to drinks with sugar or caloric sweeteners, such as “regular” Coke or Gatorade. But the tax would not apply to many diet drinks – including Diet Coke, Coke Zero and Diet Pepsi – and 100 percent fruit juice drinks.

Quintero said that tracking the sale and taxation of drinks from vending machines and soda fountains has not been worked out. So-called implementing regulations should clarify the process; they would be written if voters approve the tax.

But Blanca Gonzales, owner of Pinata World in El Monte’s Valley Mall, echoes Meier’s concerns.

“I don’t know how I’m going to keep separate accounts for the sodas and other drinks,” she said.

Gonzales also fears this is just the first step.

“If they can get away with taxing sugary drinks, then won’t sugary candy be next? Then what am I going to do? You know what goes inside pinatas. I’m essentially a candy store. That’s why I have to fight this,” she said.

Late last week, the El Monte/South El Monte Chamber of Commerce voted to oppose the tax, calling it a tremendous burden on business.

Mixed reaction

However, in other cities, businesses reaction hasn’t been as negative.

As the redevelopment losses started to hit home, La Mirada was first out of the gate, declaring a fiscal emergency in February. Last month, its council placed a one-cent sales tax measure on the November ballot. If voters approve the measure, the sales tax rate would jump from 8.75 percent to 9.75 percent for five years, starting early next year.

The tax hike would generate an estimated $7 million a year in revenue, most of which would go toward repairing the city’s streets, sewers and other infrastructure.

Jeff Irvin, principal with audiovisual equipment company Spinitar, served on a city task force set up to explore revenue options. Irvin describes himself as an anti-tax fiscal conservative.

“When I first got on to the task force, I was very skeptical about the need for a tax hike and pushed back hard,” he said. “But the city has been extremely responsible about making cuts and the more we looked into it, the more I was convinced more revenue was the only way forward.”

And a move last month by the Culver City Council to place a half-cent sales tax increase on the November ballot also has generated some support. It would help close an estimated $8 million annual budget deficit.

“Look, no one wants a tax increase. But we also don’t want services here in Culver City cut more than they already have been,” said Bill Reider, general manager of the Doubletree by Hilton hotel and a board member of the Culver City Chamber of Commerce.

Still there is opposition from some Culver City business owners who say a tax hike would cause more harm than good for local businesses, especially for those that sell more expensive items.

“When you buy larger-ticket items, that’s when you really feel it,” said Earl Daniel Trusty, who owns two businesses in the city: Ferrufino Interiors and Budget Blinds. “Believe it or not, when a customer is looking at plunking down $5,000 for a furniture set, if they can get that same product for $25 less at a business in a neighboring city, they will do it. And then I lose the entire sale.”

Trusty said that instead of increasing the sales tax, the city should be looking for ways to expand the tax base by becoming a more attractive place to do business.

The Culver City chamber is having second thoughts about supporting the tax hike. Last month, it approved a resolution supporting a sales tax hike, but only one that lasts five years. Then the council turned around and put a 10-year hike on the November ballot.

“We believe 10 years locks this in for too long a time,” said chamber President Steven Rose, who added that the board will soon take another vote to see whether the chamber will support the measure in its current form.

More battles ahead

Indeed, the position businesses take on these measures could play a large role in whether the tax measures pass.

Under state law, the cities cannot finance campaigns for the tax proposals and city staff is limited to providing factual information about the taxes’ effect on municipal finances. What’s more, anti-tax advocates will be fighting this latest round of hike initiatives.

“These city officials don’t get it,” said Kris Vosburgh, executive director for the Sacramento-based Howard Jarvis Taxpayers Association. “Average citizens are already suffering from tax overload and will not take kindly to further efforts to invade their wallets.”

Kosmont said proponents have one key advantage: The tax hikes will be on the ballot with the presidential election, which has a high voter turnout. That is expected to bring out more voters who might favor the tax initiatives.

“These cities were getting advice from pollsters that the chances for passage of the taxes are better in a broad general election as opposed to narrow municipal election that accentuates the anti-tax vote,” he said.

But whether the measures pass or fail, they’re not likely to be the last time business groups wrestle with the issue. Chris McKenzie, executive director of the California League of Cities, said he sees more sales tax measures headed for subsequent local ballots.

“We see this tax pressure continuing, given the slow rate of economic recovery and the continual demand for basic city services,” he said.