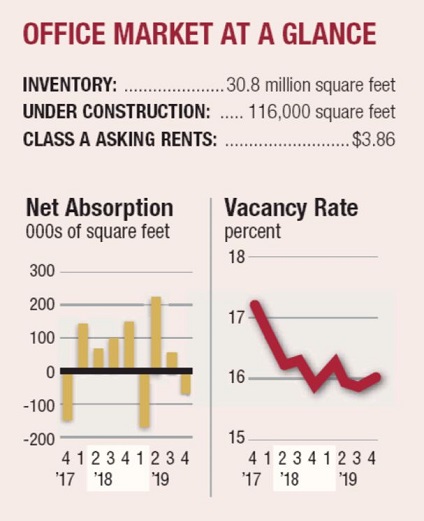

Downtown

Downtown’s fourth-quarter office vacancy rate increased slightly to 16%, up from 15.8% the previous quarter and 15.9% the previous year. Average Class A asking rents were $3.86 per square foot, down 1 cent from the previous quarter but up 16 cent from the previous year. Net absorption was -83,196 square feet while 116,000 square feet was under construction.

Main Events

Atlas Capital Group purchased the Los Angeles Times printing plant at 2000 E. 8th St. for $240 million from Harridge Development Group.

Tax and financial advisory service firm Andersen signed a lease for 46,000 square feet at CIM Group’s City National 2Cal at 350 S. Grand Ave.

An undisclosed buyer purchased Ace Hotel Downtown Los Angeles from Parks Hotels & Resorts Inc. for $117 million.

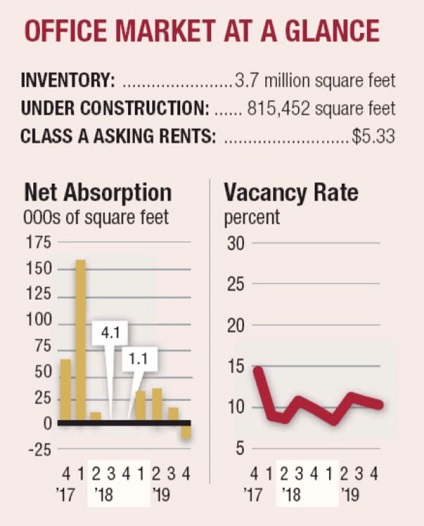

Hollywood

Hollywood’s office vacancy rate increased to 10.1%, up from 9.9% the previous quarter and 9% the previous year. Class A asking rates were $5.33 a square foot, down 4 cents over the previous quarter and 20 cents over the previous year. Net absorption was -13,006 square feet, and 815,452 square feet was under construction.

Main Events

Hanover Co. purchased a 1.24-acre site at 6200-6210 W. Sunset Blvd. from a trust for $30 million. The site is entitled for a 270-unit multifamily property.

Thomas Safran & Associates recapitalized the Hollywood El Centro Apartments at 6207-6225 De Longpre Ave., bringing in Housing Corp. of America as a joint venture partner at $24 million.

Pacific Development Partners purchased the 47-unit Vues on Gordon multifamily complex at 1558 Gordon St. from Chandler Pratt & Partners for $23.5 million.

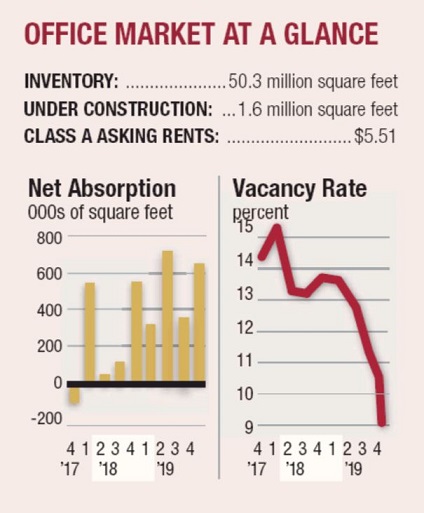

Westside

The Westside office vacancy rate decreased to 9%, down from 10.6% the previous quarter and 13.2% the previous year. Century City had the tightest vacancy rate at 3.7%. Marina del Rey had the highest at 16.9%. Westside Class A asking rents were $5.51 a square foot, up 4 cents in a quarter and 27 cents in a year. Net absorption was 623,247 square feet. More than 1.6 million square feet was under construction, with roughly 632,000 square feet of that in Culver City.

Main Events

Maybourne Hotel Group purchased the Montage Beverly Hills hotel from Ohana Real Estate Investors for $400 million, according to CoStar Group Inc.

Redcar Properties Ltd. purchased the three-building Westside Business Park in Culver City for $73.5 million from Lionstone Partners.

Pacific Reach Properties purchased the 174-unit Pico Lanai Apartments in Santa Monica from Raintree Partners for $58.6 million.

Acadia Realty Trust purchased a retail portfolio at 8436-8452 Melrose Place from VE Equities for $48 million.

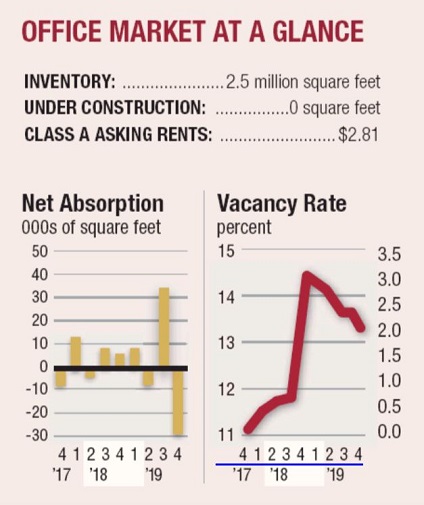

Santa Clarita Valley

Santa Clarita Valley’s office vacancy rate increased to 14.5%, up from 13.3% the previous quarter and 14.1% the previous year. Class A asking rents were $2.81 a square foot, down 1 cent from the previous month and 3 cents over the previous year. Net absorption was -29,340 square feet. There was nothing under construction during the quarter.

Main Events

Whispering Oaks Senior Apts. purchased the 65-unit Whispering Oaks complex at 22816 Market St. in Santa Clarita from MSN Associates Ltd. for $9.4 million

An individual purchased a roughly 105,000-square-foot warehouse at 27811 Hancock Parkway in Valencia for $18.2 million from AEW Capital Management.

San Fernando Valley

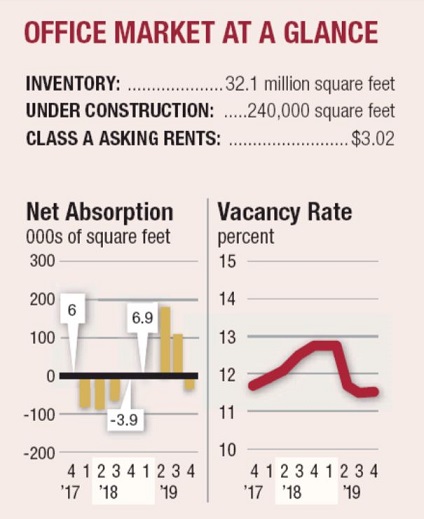

The San Fernando Valley’s office vacancy rate fell slightly to 11.6%, down from 11.7% the previous quarter and 12.7% the previous year. Class A asking rents were $3.02 a square foot, up 3 cents over the previous quarter and 24 cents over the previous year. Net absorption was 34,319 square feet, and 240,000 square feet was under construction during the quarter.

Main Events

Monster Energy Corp. purchased an industrial warehouse at 510 Park Ave. in San Fernando from Overton Moore Properties for land value for $33.7 million.

FPA Multifamily purchased the 108-unit Stonepine Apartments at 1370-1398 E. Hillcrest Drive in Thousand Oaks from a family trust for $33.8 million.

Interstate Equities Corp. purchased the 88-unit Cambridge Apartments at 14340 Addison St. in Sherman Oaks from Bailard and NNC Apartment Ventures for $29.4 million.

Tri-Cities

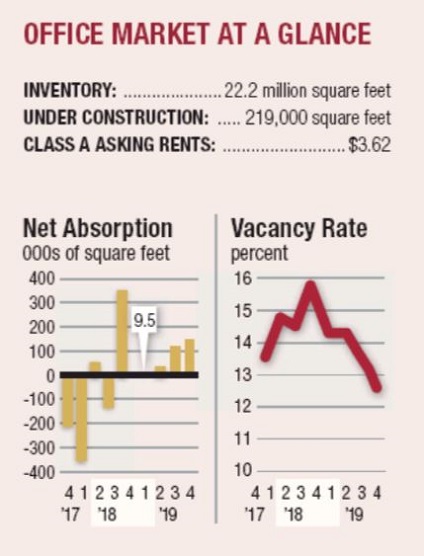

Fourth-quarter office vacancies in the Tri-Cities stood at 12.6%, down from 13.1% the previous quarter and 14.3% the previous year. Class A asking rents were $3.62 a square foot, up 1 cent over the previous quarter and 31 cents over the previous year. Net absorption was 135,125 square feet, and 219,000 square feet was under construction.

Main Events

Greystar Real Estate Partners purchased the 220-unit The Griffith at 435 W. Los Feliz Road in Glendale from AFL-CIO Investment Trust Corp. and PNC Realty Investors Inc. for $118.5 million.

Swift Real Estate Partners purchased the Pasadena Collection, a three-building office portfolio at 790 E. Colorado Blvd., 155 N. Lake Ave. and 35 N. Lake Ave. from an investment manager for $193 million.

Netflix Inc. has leased up to 60,000 square feet at Burbank Studios at 3000 W. Alameda Ave.

Wilshire Corridor

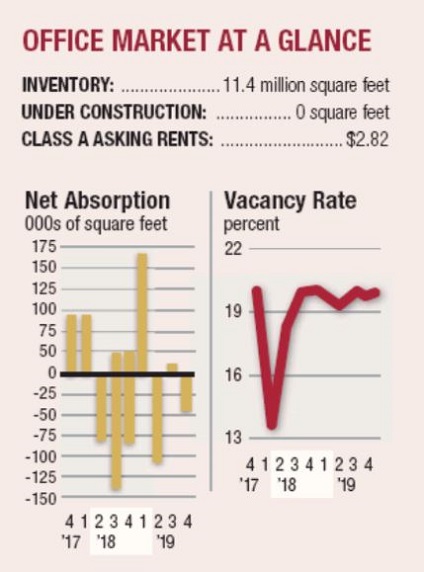

Wilshire Corridor’s office vacancy rate fell slightly to 19.9%, down from 19.7% the previous quarter and 20.9% the previous year. Class A asking rents were $2.82, up 23 cents over the previous quarter but down 35 cents over the previous year. Net absorption was -49,888 square feet. There was nothing under construction during the quarter.

Main Events

Cityview sold an equity stake in the 346-unit The Pearl on Wilshire that valued the property at roughly $171 million.

Alhambra Place Partnership purchased the 60-unit Kodo at 2867 Sunset Place in Koreatown from CGI Strategies for $29.3 million.

South Bay

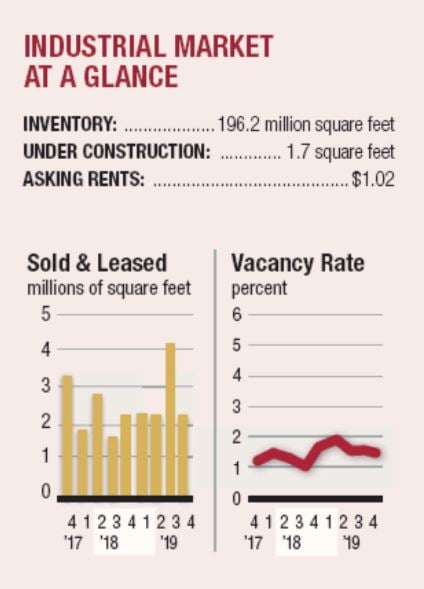

The South Bay’s industrial market vacancy rate decreased to 1.5%, down from 1.7% the previous quarter and year. Roughly 1.7 million square feet was under construction while 2.1 million square feet either sold or leased during the quarter. Asking rents were $1.02 a square foot, up 1 cent over the previous quarter and 5 cents over the previous year.

Main Events

A partnership of Nuveen Real Estate and Graymark Capital purchased a creative office building at 101 Pacific Coast Highway in El Segundo from a joint venture of AEW Capital Management and North Sea Capital Advisors for $97.2 million.

SteelWave purchased a 151,000-square-foot office building at 2160 Grand Ave. in El Segundo from Griffin Capital Essential Asset REIT Inc. for $63.5 million.

Sunstone Hotel Investors Inc. sold a leasehold interest in the Courtyard by Marriott Los Angeles near LAX for $50 million to an undisclosed party.

San Gabriel Valley

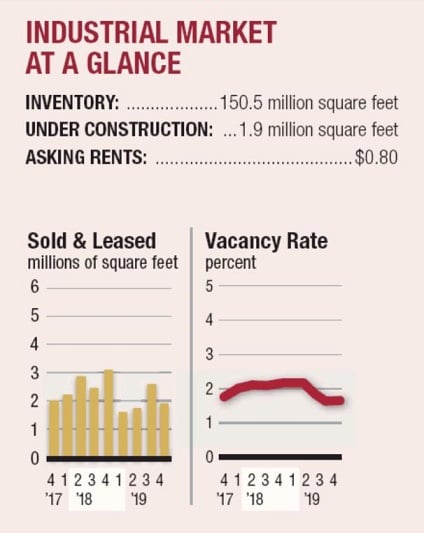

San Gabriel Valley’s fourth-quarter industrial vacancy rate rose slightly to 1.8%, up from 1.7% the previous quarter but down from 2.1% the previous year. Asking rents were $0.80 a square foot, up 2 cents over the previous quarter and 6 cents over the previous year. Roughly 1.9 million square feet was under construction during the quarter, and another 1.9 million square feet was sold or leased.

Main Events

An individual purchased the 204-unit Hills of Diamond Bar at 1020 Grand Ave. in Diamond Bar from RedHill Realty Investors and Shelter Asset Management for $72.3 million.

EverWest Real Estate Investors purchased an industrial property at 17708 Rowland St. from Newegg Inc., which leased back the property, for $38.5 million.

Keep Reading: Real Estate Quarterly Special Report — Q4 2019

For the full Fourth-Quarter Real Estate Special Report data, see the Jan. 20, 2020, print edition.