Growing companies are driving up demand for office space in L.A., sending rates for short-term subleases to some of their highest levels in the most popular parts of the city.

At the same time, consolidation by larger players is making more space available for sublease in certain parts of town — creating an unusual situation where rates are going up as supply is also rising.

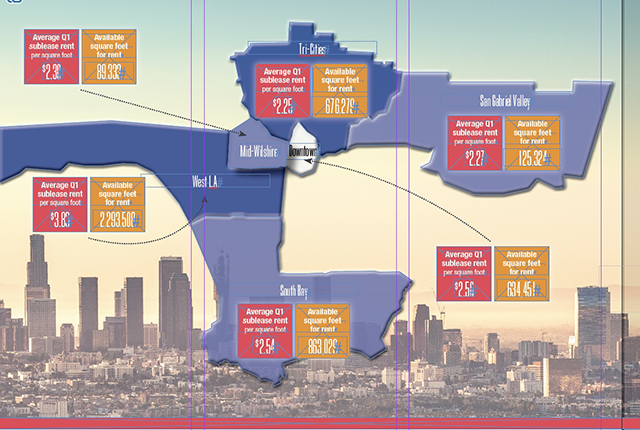

Countywide the average asking rate for sublease space rose 6.9% in the first quarter of 2019 compared to the same period in 2018, according to data from Encino-based NAI Capital. Over the same period, total square footage available for sublease in the county increased 4%.

In popular submarkets like the Westside, asking rates for sublease space rose to $4.25 per square foot in the first quarter of this year — one of the highest asking rents on record, according to NAI — while available sublease square footage rose 41% year over year.

A lot of subleasing space coming on the market is the result of consolidation. For example, Snap Inc. previously operated out of a dozen locations in Venice but recently moved to one large location in Santa Monica. And Walt Disney Co.’s purchase of 21st Century Fox’s entertainment assets will likely open office space as the companies merge operations.

Michael Arnold, an executive vice president at NAI Capital, said there are more than 400 subleases on the market in L.A. County, most for less than 5,000 square feet.

Ryan Harding, an executive managing director at Newmark Knight Frank, said some companies simply need more space. “Many sublessors are groups who have grown out of the space and moved out,” he said.

Overall, the gap between direct lease rates and sublease rates — which tend to be cheaper — has narrowed. In the first quarter of 2019, sublease asking rent increased 2.1% while rates on direct space remained flat. The difference in prices between the two is roughly 26 cents a square foot, less than the 32-cent difference seen the previous year, the group found.

Mike Catalano, a vice chairman and West L.A. office lead at Savills Inc., cautioned against reading too much into the asking rate for sublease space as companies needing to sublease space often ask a lot. “What they’re asking is not necessarily what they’re getting,” he said.

Even though the price difference is getting smaller, subleasing is still more economical for some companies. “The 26-cent difference adds up quickly,” Arnold said. The money saved can be reinvested in the business — something growing companies tend to favor.

Most companies that move into subleased locations tend to be younger, brokers said.

Lifestyle company Liv Global entered into the three-year sublease agreement in May of last year.

“We didn’t quite have our financials in place where we could get a traditional lease from a landlord, so we subleased from TW & Co.,” said Matt Fowler, senior director of operations at Liv Global. “They had the right number of workspaces that were brand new or only a year old, the office had exposed beams, and they did a really nice job renovating.”

He said they are now paying around $9,000 to $10,000 a month for the building at 600 Wilshire Blvd. He estimated that a similar lease directly from a landlord would have cost $15,000 a month.

When the sublease ends, Fowler said he’s open to subleasing again to save money.