Manufacturing and real estate-related companies have declined in prominence on the Business Journal’s private companies lists over the past 20 years while architecture/engineering/construction, finance and wholesale/ distribution firms have grown their presence.

These are among the trends that emerged from a Business Journal general comparison of industry distributions of the 100 largest private companies on its 1998, 2008 and current year lists, which reflect revenue from the respective previous years (1997, 2007 and 2017).*

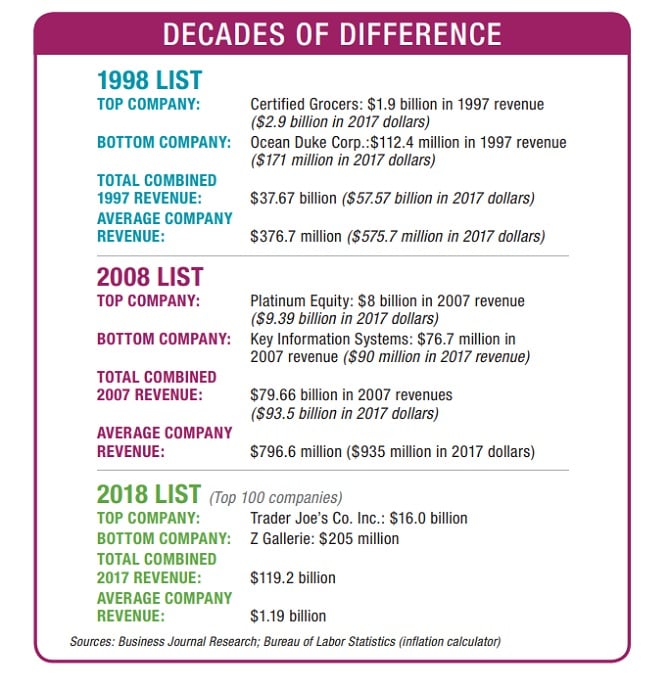

Overall, the total revenue has risen steadily on each successive list, even when adjusted for inflation. The 100 firms on the 1998 list had $37.7 billion in combined 1997 revenue, which is equivalent to $57.6 billion in 2017 dollars.

The 100 firms on the 2008 list reported a combined 2007 revenue of $79.6 billion, or $93.5 billion in 2017 dollars. And the top 100 firms on this year’s list reported a combined revenue of $119.2 billion.

This increase has been driven by much higher revenues among the top tier of companies on the lists, even when adjusted for inflation. The top five companies on the 1998 list combined for $7.6 billion in 1997 revenue ($11.6 billion in 2017 dollars) while the top five companies on this year’s list combined for $36.5 billion in 2017 revenue, more than triple the inflation-adjusted 1998 list-toppers. In other words, the largest companies have gotten much larger.

Sector declines

Manufacturing firms dominated the 1998 list, comprising 31 of the 100 companies. But that number has steadily dropped over the past two decades, first to 24 companies on the 2008 list and then to 18 companies on the current list.

“This is what we would expect from a long-term sectoral decline in our manufacturing base,” said Somjita Mitra, director of the Institute for Applied Economics at the Los Angeles County Economic Development Corp.

Mitra said the region’s high labor costs compared to other parts of the world have prompted manufacturing firms to locate production outside the region. She also cited the rise of automation and custom/specialty manufacturing.

“What all this means is that there just isn’t much mass-production here anymore,” she said.

Real estate/development and homebuilding firms formed another pillar of the 1998 lists, with 11 in all. That has dropped to four on the current list. Mitra said with the Los Angeles region largely built out and major projects often tied up for years in the land use decision-making process, there isn’t as much demand for development and homebuilding as there was 20 years ago.

Growing sectors

Instead, construction has shifted toward infrastructure, giving a boost to the architecture/engineering/construction sector. That sector has grown on the private companies lists from four in 1998 to 10 in the top 100 of this year’s list.

“We have among the highest concentrations of engineers in the nation, if not the world,” Mitra said. “So that provides the talent base for these architecture and engineering firms. And the tremendous amount of infrastructure work going on here has drawn construction firms.”

The region’s port and logistics infrastructure has also provided a boost to another sector: wholesale and distribution companies, whose ranks have grown from 13 on the 1998 list to 19 on the current list.

Another area of growth has been in finance. There were no finance companies on the 1998 list; on this year’s list, there are seven. Part of that is due to the growing financialization of the economy, according to Jim Freedman, chairman of West Los Angeles-based Intrepid Investment Bankers – which was acquired by San Francisco-based MUFG Union Bank last week (see related story, page 3).

“Finance is a growing industry as financial services are needed by almost every company,” Freedman said. “There is a lot more specialization in finance-type companies, and the whole world of financial technology is a rapidly expanding area of the economy. And private equity groups are doubling in size and quantity every few years.”

Despite Los Angeles’ reputation as the world’s entertainment capital, virtually no entertainment firms show up on any of the three private companies lists stretching back 20 years (1 each in 1998 and 2018; none in 2008). The entertainment studios are either publicly traded companies (such as Walt Disney Co. in Burbank) or are subsidiaries of conglomerates (such as Sony Studios in Culver City, which is a subsidiary of Tokyo-based Sony Corp.)

Meanwhile, many of the postproduction companies are too small to crack the eight-digit revenue threshold required to make it onto the Business Journal’s private companies lists, according to both Mitra and Freedman.

Holding their own

Surprisingly, the number of technology firms on the lists has stayed steady at around nine over the past 20 years, despite the much-hyped rise of Silicon Beach.

“We’re definitely seeing a lot of technology companies, but many are startups that are just too small to make your lists of the 100 largest private companies,” Freedman said.

Retail firms have also held up well, despite the recent decimation of marquis retailers such as Sears Holdings. There were 21 retail firms on the 1998 list, a dip to 18 for the 2008 list and a rebound to 23 on the current list. In fact, the top companies on both the 1998 and 2018 lists were both retailers: Certified Grocers of California on the 1998 list with $4 billion in 1997 revenue and Trader Joe’s Co. Inc. on the 2018 list with an estimated $16 billion in 2017 revenue.

“We have a very strong economy and increased consumer confidence, both of which are factors behind the growth in the retail sector,” Mitra said.

*(The 1998 and 2008 lists each had 100 firms; the current year list has 150, but for purposes of comparison, the Business Journal only looked at the top 100.)