The Los Angeles venture capital ecosystem just received its newest addition with the launch of Playa Vista-based venture studio Share Ventures.

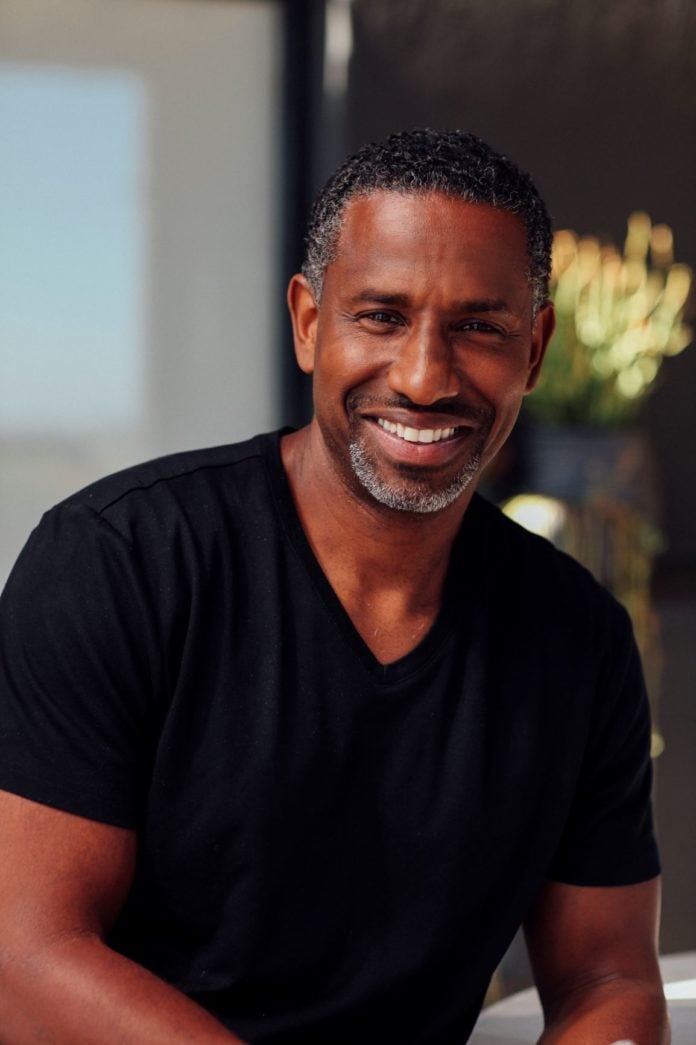

The firm is headed by serial entrepreneur and venture veteran Hamet Watt and is backed by local mainstays Westwood-based Alpha Edison Management Co. and Santa Monica-headquartered Upfront Ventures.

Watt is a board partner at Upfront, a senior adviser at BCG Digital Ventures and former entrepreneur-in-residence at Palo Alto-based True Ventures. His new firm is looking to capitalize on lifestyle changes touching on fields from neuroscience to finance.

“We focus on human performance,” Watt said. “Mental health, fitness, nutrition, micro-entrepreneurship — those are all things we put in that category.”

Watt is one of the only Black leaders in the Los Angeles venture capital space. He said he intends to take advantage of his “disproportionately diverse” professional network to bring in a broad range of talent that might otherwise be overlooked.

“We know it is a super strategic advantage to have that diversity of viewpoints,” he said.

Share Ventures is not a traditional venture capital shop. The firm fields a team of scientists, engineers and academics to build new businesses from the ground up.

Rather than searching for external startups to invest in, Watt said the studio will begin by building out concepts with its own staff.

As those ideas are tested and validated, the firm will gradually hire and grow the team around the product or service. Eventually, companies will be spun off into full-fledged businesses of their own, according to Watt.

The Share Ventures founder and chief executive began raising funds for the new firm last year. Watt closed on $10 million in total funding by the Aug. 4 launch. While there was solid initial interest, Watt said the Covid-19 pandemic has galvanized investors.

“We’re now in a place where everything is forcibly being reimagined,” he said. “It’s actually a great time for this model.”

Watt pointed to the global financial crisis a decade ago when the economic upheaval gave rise to innovators like Uber Technologies Inc. and Slack Technologies Inc.

“2008 forced a lot of behavior changes, and a lot of those changes stuck,” he said. “In our view, the opportunity is larger this time.”

Share Ventures will have a symbiotic relationship with local established VC players like Upfront, according to Watt. The founder said his new studio will act as a potential feeder, developing promising startups for later-stage investment.

“This (model) is very different from what most people do,” said Watt. “You can’t make money doing the same things that everyone else is doing.