Glendale-based LegalZoom.com Inc. sees a silver lining in the pandemic.

The online legal company experienced a surge in small business filings during the past year, which prompted its decision to file for an initial public offering.

LegalZoom, which offers documents and subscription services to make it easier for individuals and businesses to accomplish basic legal tasks, is betting that its IPO will provide funds to help increase its market share.

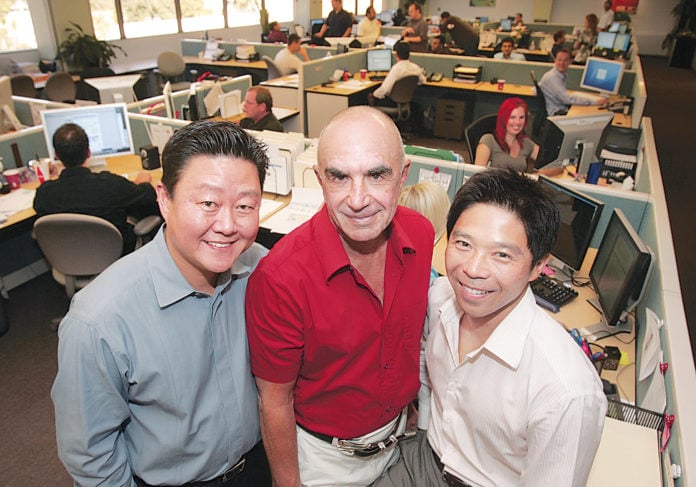

The private equity-backed company was founded in 2000 by a group of investors that included prominent Los Angeles litigator Robert Shapiro, who successfully defended O.J. Simpson against murder charges.

The prospectus filed with the Securities and Exchange Commission indicates the company wants to raise $100 million, but that is typically a placeholder amount until after the number of shares to be sold is determined. The company said it will trade on the Nasdaq under the ticker symbol LZ.

LegalZoom wants to use proceeds from the IPO to expand its marketing to attract new customers and retain existing customers. The company provides services such as tax advisory help for small businesses, wills and estates, which became popular during the pandemic.

In 2020, LegalZoom was used to help form 10% of all new limited liability companies and 5% of all new corporations in the United States, according to the company’s filing with the SEC.

In addition, 25,000 trademark applications, or 6% of all registration applications in the United States last year, were made through LegalZoom in 2020, the filing said.

As of Dec. 31, LegalZoom had more than 1 million subscriptions to help guide small-business owners through the LLC process. The company is one of the largest registered agent providers for small businesses in the United States.

During the pandemic, LegalZoom saw revenue grow 15.2% to $471 million in 2020 from $408.4 million in 2019. In the first quarter of this year, the company’s revenue increased to $134.6 million versus $105.8 million in the same year-ago period.

The company also has $141.2 million in cash on its balance sheet.

Since its founding 21 years ago, LegalZoom has attracted interest from private equity investors.

In 2018, LegalZoom completed a $500 million financing round from several private equity investors that valued the company at $2 billion.

That investment round was led by San Francisco-based Francisco Partners Management and New York’s GPI Capital, with participation from Menlo Park-based private equity firms Kleiner Perkins; Institutional Venture Partners; Franklin Templeton Investments, an investment arm of San Mateo-based Franklin Resources Inc.; and New York-based Neuberger Berman Group.

In 2012, LegalZoom was valued at $440 million and had $156 million in revenue.