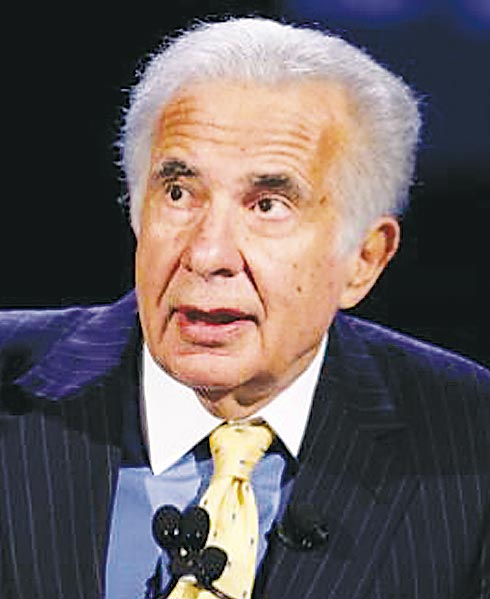

Activist investor Carl Icahn has sold a major stake in downtown-based nutritional supplement company Herbalife Nutrition Ltd.

The billionaire’s company, Icahn Enterprises, sold 14.7 million shares worth approximately $716 million, shedding about 42% of its position in the business.

Icahn remains Herbalife’s largest investor with 20.5 million shares representing 15.5% of total shares outstanding.

The sale was made as part of a modified Dutch auction in which Herbalife agreed to repurchase $750 million worth of its stock.

Modified Dutch auctions allow companies to buy back a set number of shares in a short period within a predetermined price range. Stockholders can choose to tender the number of shares they would like to sell at any price within the indicated range.

On completion of the offering, the company purchases all shares tendered at or below the lowest purchase price that allows it to fulfill the full offer value — $750 million in the case of Herbalife’s offer.

Herbalife’s final purchase price for the stock was $48.75 per share.

Because the offer was oversubscribed, Herbalife purchased only a prorated portion of the shares tendered — standard practice in a modified Dutch auction.

In total, the company accepted 15.4 million shares representing about 10% of outstanding shares as of Aug. 10.

Icahn’s 14.7 million share sale represents a sizable majority of the stock purchased in the offer.

In a statement Icahn said he continued “to strongly believe in the great future of the company” and called his investment in Herbalife a “quintessential example of our activist investment strategy.”

“We believe that all shareholders have benefited from our involvement with the company,” Icahn said. “An investment in Herbalife made on the first day we began purchasing shares would have earned a total return of approximately 200% through (Aug. 11).”