Centenarian Power

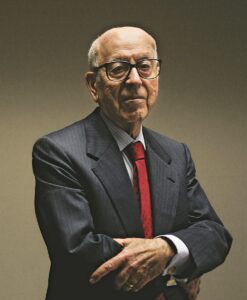

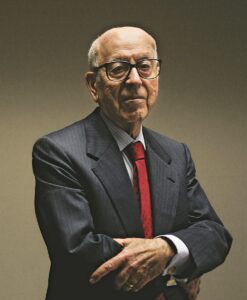

Of the four oldest billionaires in the world, three appear on this year’s list of Wealthiest Angelenos. Mercury General founder George Joseph (with $2.2 billion in net worth) is the oldest billionaire in the world at 101. (His birthday was Sept. 11.) Former Dole Foods Co. chief David Murdock (with $2.3 billion) is 99 and is the second oldest billionaire. Berkshire Hathaway co-chairman Charles Munger ($2.6 billion) is 98 and is the fourth oldest. The third oldest, according to Forbes’ list of 10 oldest billionaires, is Robert Kuok of Malaysia at 98; he is about three months older than Munger. He is not on the Business Journal’s list of Angelenos, of course, but, with $11.7 billion in net worth from palm oil, hotels and real estate, Kuok is richer than the three others put together.

Also on the Business Journal’s list is another nonagenarian, homebuilder John Shea, 96, with $2.3 billion. He is not on the Forbes list of 10 oldest billionaires because there are several others a little older. The Wealthiest Angelenos section begins on page 31.

• • •

In case you missed it, the story in last week’s Business Journal about Latino GDP in Los Angeles had some startling numbers that are worth repeating. Los Angeles has the largest population of Latinos in America, about 6 million in all, making up about 45% of the area’s population. The number of local Latinos getting bachelors’ degrees or higher was increasing much faster than among non-Latinos, and the Hispanic labor participation rate was growing faster, too.

Put it all together and the Latino GDP in Los Angeles was $285 billion – bigger than the entire states of Louisiana and Oregon. That was according to the first Los Angeles Metro Latino GDP report, which was carried out by research organizations affiliated with UCLA and California Lutheran University.

• • •

A poll out last week said small businesses have suddenly shifted from hiring to hiring freezes. In fact, 63% of small businesses have now halted hiring and 10% even plan layoffs. That’s a big jump, and a record, according to Alignable, an online referral network for small businesses. It conducted the poll of more than 5,600 employers that ended Sept. 6 – so it’s a good-sized pool of respondents and the numbers are fresh.

The reason for the sudden shift: Drooping revenue plus higher costs from inflation and especially from wages. Labor costs are at least 50% higher than they were prior to the pandemic, according to 58% of poll participants. Alignable put it this way: High Labor Costs + Decreasing Revenue = Hiring Freezes. Small businesses in California mirrored the nation: 60% are no longer hiring and 10% now plan layoffs.

So, are all those complaints by companies that they can’t fill open positions now a thing of the past?

The Insider column is compiled by Editor- in-Chief Charles Crumpley. Submit items to [email protected].