Jason Roth

Senior Vice President, Debt, Equity & Structured Finance

Colliers

It’s compressing returns, shrinking commercial real estate valuations, and making life more challenging for investors and brokers. It’s the elephant in the room.

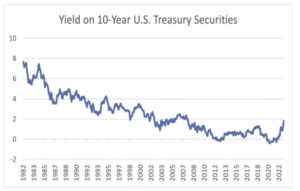

The elephant is the current federal funding rate which, as I write chis, sits at 3.75-4%, the highest it’s been since 2008. However, it’s not just the cost of capital creating heartburn for dealmakers; it’s the fear of another rate increase coming around the corner. In an industry where a sales cycle can take an average of four to six months, the frequency of rate increases over the past several months has made dealmakers feel as though they’re running in place. Weekday tee times are more of an appeal than re-submitting lower purchase offers to sellers. Particularly as many sellers and their advisors are reluctant to accept the quantifiable erosion of value that increased borrowing costs are having on the market value of their property.

In 2020, during the most uncertain days of the COVID-19 pandemic, a multifamily developer explained, “People get all worked up about the Fed, Republicans vs. Democrats, this tax rate vs. that rate, but at the end of the day, I only want long term clarity. I want to know what the rules of the game are going to be so I can play the game accordingly.”

Just as COVID-19 resulted in immediate changes and an uncertain future for many businesses, the pause in our economy allowed many executives to re-examine how they conduct business. That pause resulted in many discovering new efficiencies and work trends that stayed with us even as infection numbers decreased and restrictions lifted. As commercial real estate investors pivot from tracking infection rates to interest rates, the savvy ones will make similar adjustments in how they underwrite and secure investment financing.

Here are some of the adjustments I recommend people make:

Hire a qualified commercial mortgage broker on an exclusive basis to help you secure financing for a transaction.

Approximately 95% of all commercial real estate sale and lease transactions have a broker representing them on one or both sides of the transaction. Yet it’s estimated that only 50% of all commercial real estate financing transactions involve an intermediary.

The mortgage broker’s role is to:

• Identify all potential lending options in the market for the client’s deal

• Create a detailed loan request package that proactively addresses concerns regarding the deal – this should be of comparable depth and quality to that of an investment sales offering memorandum. Hiring a broker at a major full-service brokerage firm will ensure they have access to the highest quality market data and research tools.

• Illustrate the qualitative and quantitative differences between the available lending options to the client.

• Negotiate the best business terms for the client through a structured and competitive process.

• Lead the clients’ legal counsel and third parties through a quick closing process by anticipating and remedying potential issues chat could cause the lender to re-trade or back out of the financing. In today’s current rate environment, speed can often save a client more interest costs than a long negotiation process.

When interest rates were low, borrowers often sourced financing from a handful of “relationship” lenders and, in many cases, would consult mortgage brokers as a last resort. In most cases, the mortgage broker would source more attractive busi

ness terms from other lenders in the market.

You can only control the process, not the outcome. Focus on the process.

When discussing prospective financing with a mortgage broker, focus more on their process than trying to solidify a defined outcome. The broker’s job is to represent you and your financing request in the market exclusively.

Once a client selects a lender and is under application, the broker takes charge of the process all the way through to loan closing: from application to submission and through funding. Mortgage brokers ensure the process is smooth and that the lender holds all of their initial terms, even as surprises may come up during the lender’s diligence process.

Valuation is an art, not a science.

Underwriting assumptions are just that – assumptions. Lenders, buyers, and sellers all underwrite differently and inevitably come to different valuations. Lenders underwrite risk and downside, whereas buyers and sellers underwrite returns and upside. Inevitably, lenders will come co the lowest valuation of the three parties.

As mortgage brokers, we are responsible for educating lenders on the nuances of a deal and a submarket. Though helpful in gathering diversified perspectives, high-level market data from common research platforms such as CoStar is insufficient to support a lender’s underwriting. Utilizing Colliers’ best-in-class research capabilities, our team provides in-depth calculations and predictions on market vacancy, rent growth, tenant demand, and access to extensive market data from other commercial real estate data platforms.

Minor tweaks to underwriting assumptions can swing millions of dollars in loan proceeds in or out of a borrower’s favor. Walking lenders through the differences in asset subclasses and asset sub markets is crucial.

Approximately 95% of all commercial real estate sale and lease transactions have a broker representing them on one or both sides of the transaction. Yet it’s estimated that only 50% of all commercial real estate financing transactions involve an intermediary.

A good example is a difference between high-bay and low-bay industrial or metal and non-metal industrial buildings, similarly, with office buildings outlining the significant differences in vacancies and tenant improvement allow ances between a full-amenities Class A tower vs. a standard Class A/B office building vs. a single-story flex office building.

Document your process.

A mortgage broker is also responsible for educating the seller’s broker (and, by proxy, the seller) on the current financing market and how it impacts the buyer’s offer price. In a volatile market where re-trades are common, the buyer must provide a quantifiable justification for a revised (lower) offer.

Having a mortgage broker who has covered the market and has quotes and term sheets from multiple lenders provides buyers and borrowers with ammunition and actionable data points to justify any changes in the offer price. A prepared and experienced mortgage broker bolsters the buyer’s credibility and further justifies their offer as marker driven. While real estate investors cannot control interest races, they can control their approach to financing measures by hiring a qualified professional to ensure they are getting the best deal in the market.