Culver City-based immunotherapy company ImmunityBio Inc. last week announced that it has lined up another financing package from a group of unidentified institutional investors that is expected to net $50 million towards ongoing clinical trials of several drugs.

The financing package announced Feb. 15 also includes warrants that, if exercised, could bring in another $60 million for the company.

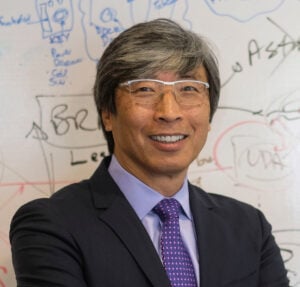

This follows a larger $157 million financing package – including a $107 million capital infusion from company founder and billionaire Patrick Soon-Shiong – announced in mid-

December.

ImmunityBio is developing an immunotherapy platform to treat a range of cancers and other diseases. During the Covid crisis, the company pivoted to developing a Covid vaccine, which is still in the clinical trial phase.

Overall, the company’s pipeline consists of drugs in 27 clinical trials –17 of which are in phase 2 or 3 development – to treat liquid and solid tumors, including bladder, pancreatic and lung cancers, as well as infectious diseases.

Existing company share investors didn’t take kindly to the latest financing package news, sending ImmunityBio shares down about 6% in trading on Feb. 15 to close at $3.50. However, it must be noted that Soon-Shiong is by far the largest investor; his approximately 323 million shares comprise a 79% stake in the company.

Over the longer haul, it’s been a rough ride for Soon-Shiong and other ImmunityBio investors since the company went public in March 2021. Soon-Shiong’s stake was worth $12.15 billion at the end of the first day of trading; last week, after the latest equity investment announcement, his stake had plunged 90% in value to $1.13 billion.

In the prospectus for the previous financing package, ImmunityBio acknowledged that the current market for biopharma stocks is difficult.

“The market price of our common stock has been and may continue to be highly volatile and could be subject to wide fluctuations,” ImmunityBio said in the risks portion of the December prospectus.

New York-based investment banking firm Jefferies is acting as the exclusive placement agent for this month’s registered direct offering.