But the survey, conducted by the Lowe Institute of Political Economy at Claremont McKenna College as the latest surge in the Covid-19 pandemic led to another round of business closures, did reveal a glimmer of hope.

Consumers in L.A. County were more optimistic about future business conditions than they have been at any point since the pandemic began, the survey showed.

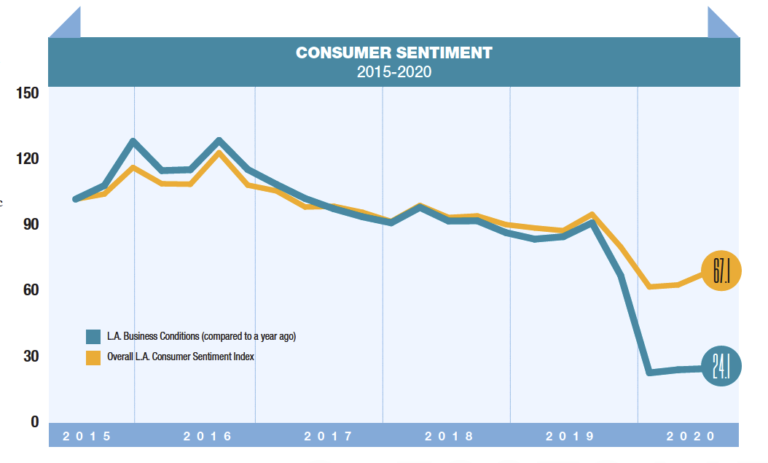

A poll of 500 residents taken throughout December showed sentiment toward current business conditions in L.A. County yielding an index of 24.1, up from 23.6 in September and a continued improvement following a record low of 22.2 in June.

To put those numbers in perspective, the survey’s consumer sentiment reading for the fourth quarter of 2019 was 89.4.

The baseline reading of 100 was set in the second quarter of 2015 as the Lowe survey program launched. A peak of 126 was reached in the third quarter of 2016. The index for the fourth quarter of 2020 was more than 100 points lower than that peak — a decline unimaginable when the survey premiered.

Stay-at-home impact

Stay-at-home impact

But, Shelton said, other questions in the survey looking at future business conditions showed a marked uptick in December from the third-quarter survey taken in September.

“When we asked whether respondents thought business conditions in the U.S. would be better over the coming year, that index reading shot up 20% (to 75.4),” Shelton said. “And when we asked whether a year from now overall business conditions in the U.S. would improve their family’s economic condition, that showed a 15% jump (to 83.7),” he said.

These jumps in future expectations led to an increase in L.A. County’s overall consumer sentiment index, which is a combination of readings for seven questions. That index rose 9% to 67.1.

Reasons for optimism

Reasons for optimism

“I’d give a bit more weight to the increased Democratic control in Washington, especially here in Los Angeles County,” he said. “We also took sentiment readings in Orange County and the Inland Empire where the political composition is more mixed than deep blue L.A. County. And in each of those two areas, the overall consumer sentiment index fell in December from the third quarter.”

In most years, the confidence boost from what respondents perceived as positive election results would be immediate. But not last month.

“Because of the renewed lockdown, the effect of the election results was shifted to future expectations,” Shelton said. “People sense we have to get the pandemic under control before business conditions can improve.”

Of course, the survey was taken before the tumultuous political events of early January, including the assault on the U.S. Capitol and the second impeachment of then-President Donald Trump.

But Shelton said that by the time of the next survey in March, he expects the degree of success in vaccine rollout will be the dominant factor.

“We will be looking closely at the pace of reopening the economy, which will depend greatly on who gets vaccinated and when,” he said. “We will also be looking at whether the benefits of reopening are spread evenly among all income groups.”