The trade war with China propelled near-record demand for Southern California’s freight transportation and warehouse companies as U.S. retailers and manufacturers stocked up on Chinese goods ahead of tariff deadlines.

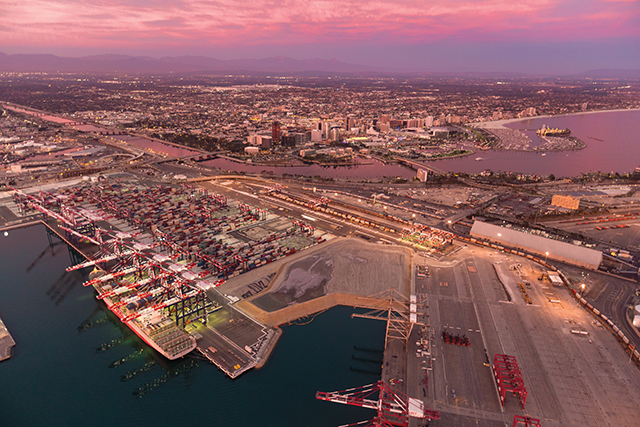

Late last year and into early 2019, storage operations were filling up quickly, and distribution networks were jammed, driving premium prices for logistics services — a boon for local operators that handle goods moving through the ports of Los Angeles and Long Beach.

But as negotiations between the two economic superpowers drag on and a widening swath of Chinese goods faces higher import levies, the specter of slowing trade in the longer term is weighing on the region’s cargo-handling businesses.

“When we get into trade wars, they have a double effect on Los Angeles,” said Michael Zimmerman, a logistics consultant with A.T. Kearney Inc. and co-author of the Council of Supply Chain Management Professionals’ Annual State of Logistics Report.

Zimmerman said Southern California’s cargo-handling businesses will feel the impacts of waning demand just as the entire economy — from retailers and manufacturers to creative businesses — faces rising tensions with its largest trading partner. “Los Angeles probably feels that disproportionately,” he said.

The State of Logistics Report found that total logistics costs for businesses grew 11.4% year over year in 2018. The logistics industry’s share of the overall economy also rose, accounting for 8% of total U.S. gross domestic product, up from 7.5% in 2017.

But so far this year, that trend appears to be slowing. A monthly index measuring nationwide freight shipment demand, published by Cass Information Systems Inc., has declined year over year for each of the last six months. And import volume at the ports of Los Angeles and Long Beach is down 2.9% through May of this year, compared to the first five months of 2018.

“We are definitely in a slowdown,” Zimmerman said.

Retailers and manufacturers are still drawing down the inventories they stocked up late last year. The national inventory-to-sales ratio rose between May and December of last year and has held mostly steady since, according to the Federal Reserve.

CBRE Group Inc.’s Kurt Strasmann, who specializes in Southern California industrial and logistics markets, said demand remains strong for warehouse space in the region.

The Inland Empire, for example, has added at least 20 million square feet of new industrial property every year for the last four to five years — all of which has been filled nearly as quickly as it’s built, he said. And there’s roughly that much currently under development. In greater Los Angeles, the large population and strong consumer spending continue to generate what Strasmann calls “heavy demand” for distribution and delivery infrastructure.

But the trade war has generated uncertainty, Strasmann said. Some retailers and manufacturers have delayed making major supply chain decisions, such as whether to source from other regions or ship along alternative routes.

“They’re trying to hedge their bets,” he said. The longer that goes on, the deeper the financial impact could be for local operators.

“If it’s long term and protracted, there’s no question that will have an effect — on not just our local economy but the greater economy,” Strasmann said.