Safety, as much as effectiveness, will be a key marketing message this month for Amgen Inc. as it launches Prolia, a much anticipated osteoporosis drug.

That’s no surprise, given the trauma that the Thousand Oaks biotech suffered a few years ago after serious safety concerns dampened sales of its blockbuster anemia drug Aranesp.

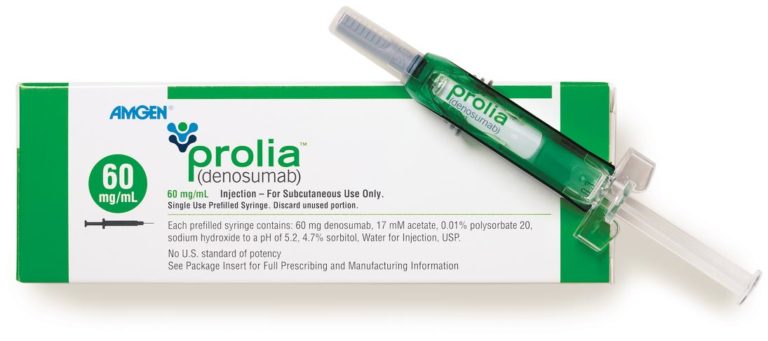

The U.S. Food and Drug Administration last week granted Amgen approval to start selling Prolia as a treatment for osteoporosis in postmenopausal women at high risk for fractures. The drug, which only has to be injected once every six months, inhibits proteins that feed bone-destroying cells.

Amgen’s June 1 press release devoted significant space to the size and length of the clinical trials the company completed over the past decade and others that are ongoing. At least 18,000 male and female patients so far have taken Prolia in the trials.

“The company has been committed to fully understanding the safety and efficacy profiles of its drugs. There’s also been an evolution in how we assess drugs after approval,” said Dr. Catherine Stehman-Breen, Amgen’s vice president of global development.

The company told the FDA it will launch extensive educational efforts to doctors and patients to help them better determine who would be the best candidates for the drug. It also committed to what Amgen calls an unprecedented patient-monitoring program to detect any previously undetected problems that might come from long-term use.

“This is both the right thing to do for patients and a smart financial move for any drug company to do in this age,” said Chris Raymond, an analyst at Milwaukee-based Robert W. Baird & Co. analyst who noted that the first studies questioning Aranesp’s safety came from outside the company. “If you don’t do it yourself, someone else will and then you can’t control the message.”

Analysts believe Prolia will be a key growth driver for the company over the next several years. Raymond estimates annual sales could reach $2.4 billion by 2013 if the company receives expected additional approvals to expand the drug’s use.

Amgen is seeking also to market the drug to treat prostate cancer patients whose treatments leave them at risk for bone loss. European regulators approved that use in May. The company also has submitted data to the FDA to show Prolia’s usefulness when a cancer has spread to a patient’s bones.

Prolia’s wholesale price will be $825 per 60-mg injection. That is somewhat higher than other branded osteoporosis therapies but still competitive, said Michael Yee, an analyst at Toronto-based RBC Capital Markets. He believes Prolia could take away market share from drugs in pill form that treat female osteoporosis.

Doctors are often frustrated by patients who don’t take the pills properly, so they have an added incentive to try Prolia because it has to be injected at the doctor’s office.

“This is a drug that can justify premium pricing because it has shown superior efficacy, is more convenient, and has a clean label – no major warnings,” Yee said.

IPC Growth

IPC the Hospitalist Co. Inc., a North Hollywood company that has been buying up hospital-based physician practices around the country, has announced a trio of acquisitions.

The company last week said it acquired LH Self Medical Services PC of Las Vegas, and the hospitalist operations of Mountain Empire Medical & Surgical Associates PLLC, which is based in Elizabethton, Tenn. The two groups combined have an annualized volume of about 18,000 patient visits.

A week earlier, the company bought Continuum Geriatric Services PLLC, which is based in Livonia, Mich., and has doctors at more than 60 nursing and assisted living facilities. The acquisition is part of a push to expand outside its usual acute care market into related business segments, said Chief Executive Adam Singer. IPC has affiliated “hospitalists” at more than 500 hospitals and other inpatient facilities in 21 states.

Local Buys

U.S. HealthWorks, a Valencia company that, like IPC, has been on a growth tear, has acquired Technimed Occupational Medicine health care centers in Vernon and Commerce.

The operator of occupational health care centers said the two centers, founded by Dr. David B. Landers, expand the number of U.S. HealthWorks facilities to 66 in California and 134 nationwide.

“We are continuing our expansion in the important California market,” said Therese Hernandez, senior vice president of operations, in a statement.

Staff reporter Deborah Crowe can be reached at [email protected] or at (323) 549-5225, ext. 232.