A recent deal for a line of cooking sprays is the latest move by a Santa Monica-based holding company to become a significant supplier of private-label manufacturing and grow its own brands.

Starco Group has acquired at least seven different manufacturers since its founding under a different name nearly 20 years ago. It’s knitted together a string of product lines that range from the newly acquired cooking spray to industrial products for other companies under private labels—essentially contract manufacturing for marketers and retailers. Starco’s customers in turn sell them through various retailers, including big chains such as Wal-Mart Stores Inc. and Home Depot Inc.

Starco also has branched out with its own brand, a line of multi-purpose aerosol cleaners called “Breathe.” The line currently sells at Wegman’s Food Markets, a chain of nearly 100 stores in Massachusetts, Pennsylvania, New York, New Jersey, Maryland and Virginia.

The branded line accounts for a small fraction of Starco’s revenue, according to founder and chief executive Ross Sklar, who declined to give specific financials but said he expects to top $300 million in annual sales by 2020.

The recent acquisition from Green Bay, Wisc.-based Winona Foods Inc. – which came on undisclosed terms – bolstered Starco’s brand lineup with the addition the Winona Pure line of cooking sprays.

200 jobs

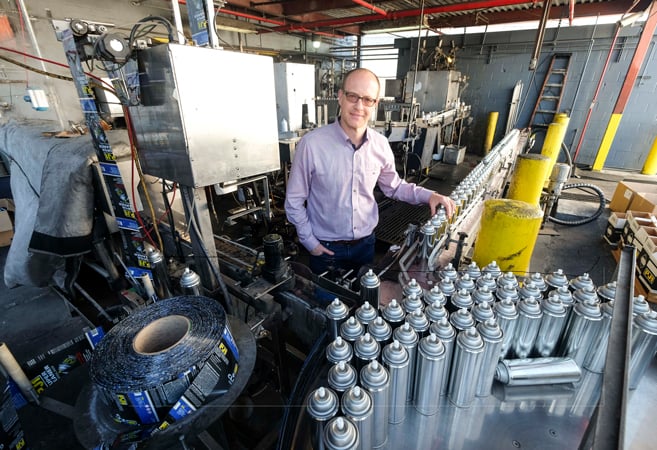

Starco counts 200 employees, and has manufacturing plants in Monrovia and Vernon, where it has a separate fulfillment center.

Sklar is a native of Canada and the sole shareholder of the company. He said he first became interested in chemical engineering and entrepreneurship while a student at the University of Manitoba – although he earned his degree in political science.

That was in 1997, and Sklar started as an entrepreneur two years later when he started SEI Chemical Inc., makers of anti-graffiti and anti-corrosion products. Sklar said that SEI landed a contract in 2000 to supply the anti-graffiti coating to the bridges, underpasses, overpasses and street improvements that make up the entire 20-mile Alameda Corridor, a cargo rail system that separates freight trains from street traffic and passenger trains. The corridor stretches from the ports of Los Angeles and Long Beach into downtown L.A. He declined to provide the contract figure but said it was “in the seven figures.”

SEI Chemical’s deal came as a subcontractor to Sylmar-based construction giant Tutor-Saliba, according to the Alameda Corridor Transportation Authority.

Sklar was still living in Canada at the time, and would make frequent trips to L.A to oversee the project.

“That contract really launched me as a manufacturer,” Sklar said. “We formulated a unique coating and finished the project in 2003. At the time, SEI and this three-year monster contract was all I had. I debated on what to do next, and in 2003, I moved to L.A.”

Sklar said he initially outsourced a lot of his manufacturing for SEI Chemicals, a set-up that brought slim margins. He started looking into acquiring distressed manufacturing operations as a way to cut costs, and picked up La Verne-based BetterBilt Chemicals in 2007, which made chemical drain openers for private labels and its own brand.

He said with the BetterBilt acquisition he was able to place the company’s products into retailers including Ace Hardware Corp., Home Depot and Wal-Mart.

Next came a deal for Cal Western Paints and Coatings prior to onset of the Great Recession in 2008.

In 2010 he started talks that eventually led to a deal for Vernon-based Four Star Chemical, his main contract manufacturer, which specialized in large-scale aerosol operations.

That took some talking – the deal with Four Star closed in 2015.

Sklar had some done groundwork before then, too. It was back in 2010 that he reorganized his growing portfolio of companies. The newly formed Starco Group oversaw its various subsidiaries as separate entities, said Sklar, who described the move as a first step toward streamlining operations and focusing on growth through acquisitions, with a longer-term goal of building his own brands.

Sklar continued with acquisitions, diversifying from his mostly aerosol-based projects so he could offer a wider range of products to large national retailers. He added Mission Labs in Elsyian Valley, makers of janitorial chemicals, and Vernon-based MX Factor, makers of automotive products.

Big names

Sklar said that he has penetrated the market deep enough to not only have his company’s products at big name retailers such as CVS Pharmacy and Walgreens Co., but also manufactures for retailer owned-brands, although he declined to name brands he was contract manufacturing for.

Yet few have heard of his Starco Group.

“I personally haven’t,” said John Anderson, director of field operations at the California Manufacturing Technology Consultants, a manufacturing consultancy. “However, it’s not uncommon for contract manufacturers to operate under the radar.”

Sklar remains undaunted and as ambitious as ever – whether or not anyone besides his customers are paying attention.

“What I’m building here is something that can take on Unilever,” he said. “I can sit in front of a Walmart and offer to make their cooking sprays, sun care lines, and personal care products, janitorial, automotive and more products, all under one vendor number.”