The largest banks headquartered in L.A. County saw modest growth through mid-2017, which analysts said signaled a healthy banking climate.

The top 50 entries on the Business Journal’s list of largest banks as ranked by assets saw a cumulative 3 percent growth in assets as of June 30, climbing to $224 billion compared to $217 billion over the same period a year earlier. Bank assets are anything the banks own, including cash, government securities and interest-earning loans.

The top five regional banks accounted for 40 percent of the assets, or $160 billion of the total. The top five also employed 13,699 people in Los Angeles County, almost half of the total 27,693 bank employees counted on the list.

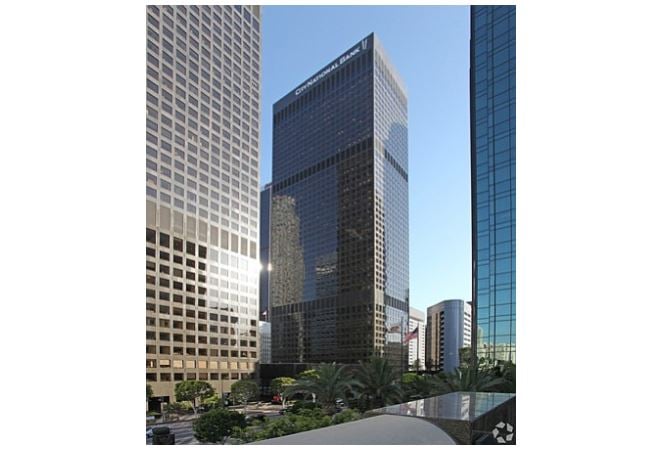

No. 1 this year is downtown’s City National Bank, which overtook Pasadena-based CIT Bank N.A. as the county’s largest financial institution with $46 billion in assets. CIT is No. 2 with $41 billion in assets, followed by another Pasadena bank, the East West Bank with $35.8 billion.

No. 4 on the list is Beverly Hills-based

Pacific Western Bank, holding assets valued at $22.2 billion, followed by Chinatown’s

Cathay Bank with $14.3 billion. The five averaged a 7 percent gain in assets year-to-year.

“We’re seeing steady growth among the local banks, which is always a good thing,” said banking consultant Wade Francis, president of Long Beach-based Unicon Financial Services Inc. “However, we have to keep in mind that there are bigger, national banking players in the L.A. region who manage a staggering amount in assets.”

The next benchmark for banks could come with an anticipated federal rate hike in December, Francis said.

“When loan rates increase, in theory, banks should make money,” he said.

Watching the Fed

An increase by the Federal Reserve at its meeting this week could be the third this year – the first two were each hikes of quarter point to the current federal funds rate of 1.25 percent.

Russell Goldsmith, chief executive of City National, said a rate increase would be justified by a strong economy.

“It will not affect City National’s ability to lend,” he said.

Goldsmith has been busy over the last two years overseeing the company’s transition after its $5 billion acquisition by Royal Bank of Canada in November 2015. City National, now a wholly-owned subsidiary of RBC, is commonly referred to as the “Bank to the Stars” for its Hollywood clientele.

While proud of that history, Goldsmith said the entertainment sector represents only 20 percent of their business.

“We have private equity clients, commercial lenders and a whole other host of clientele,” he said.

The company added more than 1,000 employees to its payroll over the past year and expanded into Washington, D.C., Minneapolis and New York.

“Since our merger, we’ve grown and expect continued growth,” he said.

CIT, the second-largest local bank, saw

its parent company, Livingston, N.J.-based CIT Group, announce the sale this month of its reverse mortgage arm Financial Freedom. CIT acquired Financial Freedom when it obtained Pasadena-based OneWest in 2015.

The sale of the reverse mortgage lender includes the sale of mortgage servicing rights and about $900 million of reverse mortgage loans, including other real estate-owned assets. In May, CIT agreed to pay a settlement of $89 million after Financial Freedom was found by the Justice Department to have made reimbursement claims from a government insurance fund it was not entitled to receive.

U.S. Treasury Secretary Steven Mnuchin was one of the founders of OneWest.

List moves

Luther Burbank Savings is no longer

on the list due to its relocation to Santa

Rosa. It was No. 8 last year with $4.7 billion in assets.

No. 16 on the list is downtown’s Royal Business Bank, a subsidiary of RBB Bancorp, which went public this year and raised $86 million in its initial public offering on the Nasdaq. Royal Business Bank jumped one spot higher than its rank last year.

Also moving up on the list is No. 20

CBB Bank based in Koreatown, which was No. 23 last year. The company saw a 20 percent increase in assets with $994 million through June 30 compared with $826 million the year before.

Downtown-based Premier Business Bank rose to No. 26 from No. 31 last year, seeing a 22 percent increase in assets to $559 million from $460 million year-to-year.

Banamex USA is no longer on the list

as the company folded this year. Its parent company Citigroup agreed to pay a settlement of $97.4 million after a long federal investigation into money laundering allegations. Banamex ranked No. 44 last year.