It’s been a while, but BioSolar Inc. is finally ready to put its business plan into action.

The company, which makes solar panel components made from plants, was founded five years ago and went public a year later. It has yet to sell a product. Chief Executive David Lee is the only employee at the Santa Clarita headquarters – the only other full-time BioSolar employee is the chief technology officer, Stanley Levy, who lives in Connecticut.

The long gestation period may end soon. Last week the company announced it has hired a South Korean firm to sell its products to Asian manufacturers.

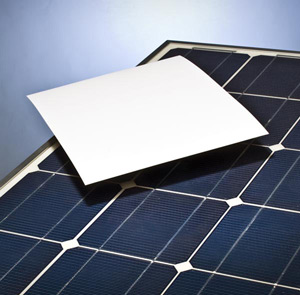

BioSolar makes what’s called backsheet, a protective covering for photovoltaic cells in solar panels. Currently the backsheet market is dominated by DuPont’s Tedlar, a petroleum-based plastic material.

BioSolar’s product, called BioBacksheet, is slightly cheaper than Tedlar, a major selling point. In the last two years, the retail price of solar panels has dropped more than 50 percent, partly because most solar panel manufacturing has migrated to lower-cost Asian countries. That has prompted manufacturers to cut costs as much as possible.

Mark Burger, a clean energy consultant with Kestrel Development in Oak Park, Ill., said competition has become cutthroat in the face of falling prices at retail.

“The price for panels is now a dollar and change per watt capacity so every penny counts,” he said. “BioSolar could be a significant game-changer in the market.”

Burger estimates 900 companies make solar panels worldwide. More than 60 percent of the manufacturers are in Asia, specifically China, Taiwan, Korea and Japan. He said the 10 largest manufacturers control about half the world market.

Lee plans to sell BioBacksheet to small and medium-size manufacturers in Asia who are willing to take a risk on a new product. His sales pitch is that the product will trim costs and differentiate BioSolar’s products as environmentally friendly. Eventually, Lee hopes that once a critical mass of small manufacturers use the product to make solar panels, the large manufacturers will try it.

The manufacturers will then sell them to the end-users – including homebuilders, commercial solar installers and government agencies – in the United States, the largest market in the world. The use of BioBacksheet will help the manufacturers sell their panels as environmentally friendly. BioBacksheet recently received a certification from the U.S. Department of Agriculture that will encourage sales of panels with BioBacksheet to federal agencies and contractors.

Lee has spent the last five years working on his product and business strategy. BioBacksheet will be manufactured by a contractor in Wallingford, Conn.

For the last three years, Lee has worked with ShinHa Inc., a firm in Seongnam, South Korea, on plans to market BioBacksheet in Asia. Lee was born in Korea and came to the United States as a child.

Bruce Winston, an international trade consultant at Makor Group International in Culver City, said that manufacturers in Asia will be willing to try a low-cost material, but the big question is whether consumers and organizations in the United States will buy a product whose durability and effectiveness are still uncertain.

“Even if it’s certified as green, it’s new and they have to prove it in the marketplace,” he explained. “Foreign manufacturers in China and Taiwan are eager to find something new where they can jump on the trend early. But the United States will be much more conservative in trying a new technology.”

Cloudy future

Lee said BioSolar is fulfilling its mission of developing green products to replace petroleum-based components in solar panels.

“The company is more than five years old, but we still have the mindset of a startup,” he told the Business Journal.

The company’s stock trades over the counter with an average 2,200 shares trading per day. The thin volume means that trades as small as a few hundred shares can affect the price. Lee and Levy between them own about 32 percent of outstanding shares.

Tim Keating, chief executive of venture capital firm Keating Capital in Greenwood Village, Colo., said that Lee could face a challenge if Asian manufacturers start to buy his product. The company could face a capital crunch as it tries to expand production to keep up with demand.

“My advice would be to approach institutional investors,” Keating said. “But right now the stock is simply too small to attract institutional interest.”

In August, BioSolar engaged in a 30-1 reverse-stock merger. Lee said it was the first step in his effort for a listing on Nasdaq, but the rest of the plan depends on sales in Asia.

“The first requirement for Nasdaq was to trade in dollars, not in pennies,” he said. “The reverse split accomplished that. The next step is that we need an initial success in sales.”

He expects the company’s first sales next year.