Matech Corp., an L.A. company with a once-promising technology to detect cracks in bridges, has filed for Chapter 7 bankruptcy.

The Nov. 16 filing in U.S. Bankruptcy Court came after Matech defaulted on $6 million in stock debentures, and after several investors and service providers had sued and obtained liens against the company.

The tiny publicly traded company had for years relied on private investors to keep going while trying to commercialize its electrochemical sensor technology to detect cracks in bridges and other metal structures. Over the last decade, the company took in more than $9 million from investors.

But the market didn’t fully materialize, even after a 2007 bridge collapse in Minneapolis focused national attention on the issue of bridge safety. The company never managed to turn a profit as few contracts for the sensor technology were signed.

In recent years, Matech hoped it could win contracts funded through economic stimulus dollars, but those also never came through as state and local governments cut back infrastructure spending because of huge budget deficits.

“There may have been a need for the type of technology that Matech offered, but in the end, the money just wasn’t there to pay for it,” said Casey Hemmatyar, chief executive of Pacific Structural & Forensic Engineers Group Inc. in Ventura, who is familiar with the company’s technology.

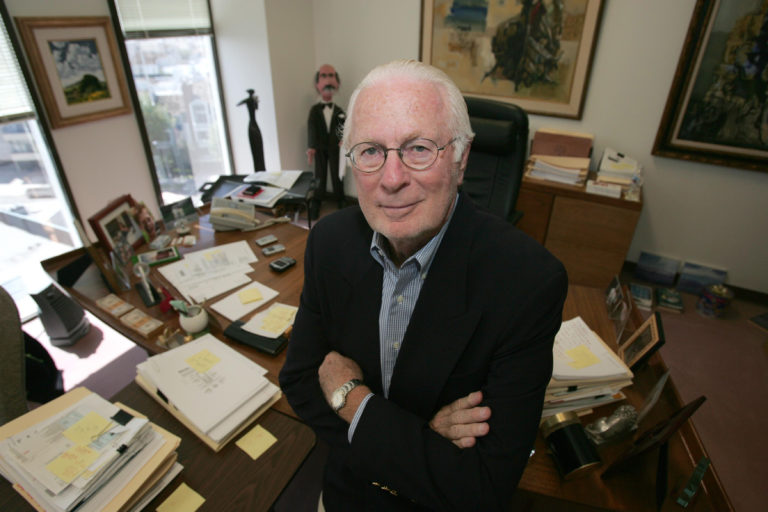

Calls to Matech Chairman Anthony Cataldo and to its bankruptcy attorney, Barry Rothman, were not returned. Company founder and longtime Chief Executive Robert Bernstein, who resigned in March, could not be reached for comment.

Bernstein founded Matech in 1983 as a research and development company focused on developing sensor technology to detect microscopic cracks in metal used in buildings and bridges. At the time, most inspections looking for metal fatigue were visual and microscopic cracks that lead to structure failure could be missed.

But from the beginning, the company had a hard time marketing its technology, which was much more expensive than traditional inspection methods for detecting cracks. Difficulties intensified after the financial collapse in late 2008.

Filings with the Security and Exchange Commission reveal a complex series of private investments in the company stretching out over several years. Some of them resulted in liens and lawsuits as investors and service providers grew impatient with promises of repayment, especially in the last 18 months.

At the center were two major sales of debentures that could be converted into stock. One was for $1.5 million in 2003 to Palisades LLC, an investment entity registered in Capistrano Beach; the other was in 2008 for $1 million to Kreuzfeld Ltd. of Zurich, Switzerland.

Matech had previously reached an agreement with Palisades to extend the debt repayment period to Dec. 31, 2009. But late last year, as the company’s stock price plunged to 17 cents a share from a high of $3.84 a year earlier, Matech did not have the cash or stock available to meet the year-end deadline. By that time, the debt to Palisades and another entity, Corporate Legal Service, had grown to $2.8 million and the Kreuzfeld debt had reached $3 million.

Palisades rebuffed attempts by Matech for an additional debt repayment extension and Matech defaulted on the debentures on Jan 1. On July 9, according to an SEC filing, the company turned over all its assets to Palisades, Corporate Legal Service and Kreuzfeld, effectively ceding control of the company to them.

Meanwhile, Matech agreed in Los Angeles Superior Court in February 2009 to pay investor Stephen Beck $1.75 million in stock, with a cash payment of $100,000 due whenever the company had more than $750,000 cash on hand. That lien remains outstanding.

In addition, Matech in late 2008 agreed in Los Angeles Superior Court to pay one of its consultants, Gem Advisors Inc., $250,000 to settle breach-of-contract claims; as of Sept. 30, 2009, Matech owed Gem $173,500.

Matech had hoped that additional revenue would help repay some of its debts and boost share price so the company could resume a longstanding practice of using stock as a form of payment. In a September 2009 story, the Business Journal reported that the company routinely paid some of its contractors in common stock instead of cash.

But that additional revenue never came in, even though Matech arranged a partnership last year with defense contracting giant Northrop Grumman Corp. to jointly seek bridge repair contracts. In the Business Journal story, Bernstein was quoted as saying Northrop was considering incorporating Matech’s technology into its own bridge Sensor Information Systems program. But no bridge repair contracts materialized and no deal was inked with Northrop to incorporate Matech’s technology.

Bernstein reflected on the company’s problems in the story.

“The two biggest challenges we have are dealing with the fragmented bureaucracy of each state’s transportation department, and now the shortage of funds for infrastructure improvements,” he said.

Matech’s stock is still being traded on the Pink Sheets. It closed Dec. 9 at .0013 cents.